Amazon Stock: An Opportunity Amid Market Volatility

What’s more appealing than a discount from Amazon (NASDAQ: AMZN)? How about a dip in the company’s stock price?

Recently, Amazon has faced challenges in the market, with shares declining nearly 30% from their recent highs.

Where to invest $1,000 now? Our analyst team has just released a list of the 10 best stocks to consider for your portfolio. Continue »

Here are three compelling reasons why investors might view this dip as a buying opportunity.

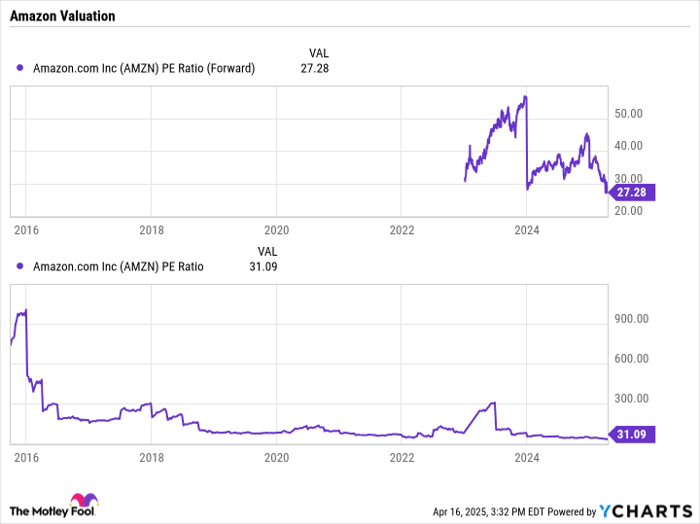

Amazon Stock Valuation at a Historical Low

Amazon is not only down from its highs but is also trading at one of its cheapest valuations in years. The stock has a trailing price-to-earnings (P/E) ratio of 31 and a forward P/E of 27.

To put this into context, over the past decade, Amazon has maintained an average trailing P/E of 137, with a three-year average close to 84. Some fluctuations are attributed to aggressive investment periods, which occasionally lead to negative earnings. Historically, when earnings have been positive, the trailing P/E often surpassed 50 times.

AMZN PE Ratio (Forward) data by YCharts.

Although tariffs introduce some uncertainty and may impact short-term results, this presents a rare chance to acquire Amazon stock at such a low valuation. Investors should keep their focus on the long-term potential rather than being distracted by temporary market fluctuations.

Amazon’s History of Thriving After Investment Cycles

Amazon has a track record of robust investment aimed at expanding its operations. This approach has evolved the company from a humble online bookseller to the world’s largest e-commerce and logistics entity.

This strategy also led to Amazon pioneering the infrastructure-as-a-service model, establishing its dominance in the cloud computing sector.

Historically, during these significant investment phases, both investors and analysts have often scrutinized Amazon’s spending. Nonetheless, this strategy has consistently proven beneficial for both the company and its shareholders over time, despite occasional profit hits short-term. Analysts at Goldman Sachs noted in 2017 that past capital expenditure increases often preceded strong stock performance.

Currently, Amazon is channeling substantial investments into artificial intelligence (AI) and the requisite data centers to support AI operations. By 2025, Amazon plans to allocate $100 billion towards AI infrastructure to accommodate rising demand for AI applications. In the prior year, the company invested $83 billion in capital expenditures, with $27.8 billion in the last quarter alone.

In its annual letter to shareholders, Amazon termed AI “a once-in-a-lifetime reinvention of everything we know,” indicating that customer and shareholder benefits stem from its substantial investments. Additionally, Amazon emphasized the long-term value and attractive free cash flow and return on invested capital (ROIC) from these resources.

Image source: Getty Images.

Two Market-Leading Segments to Drive Growth

Investing in Amazon provides exposure to two market-leading business segments. The company retains its status as the largest e-commerce and logistics provider globally. This segment continues to show steady revenue growth in the low double digits while benefiting from strong operating leverage. Consequently, combined operating income for North America and international segments surged 74% last quarter.

This boost is largely attributed to enhanced efficiencies from AI and a growing advertising business. For instance, AI optimizes delivery routes and uses robotic systems to identify damaged goods pre-shipment, reducing return costs. AI applications also assist in maintaining stock levels of popular products and flagging items commonly returned, informing customers beforehand.

Moreover, Amazon’s advertising services experienced an 18% revenue increase to $17.3 billion last quarter, benefitting from tools like Amazon Marketing Cloud that help advertisers analyze data for improved marketing strategies. As a result, Amazon has solidified its position as the third-largest digital advertiser globally.

However, Amazon’s most profitable segment remains its Amazon Web Services (AWS), the quickest expanding branch, which reported a 19% revenue increase last quarter due to customer adoption of AI workloads on its platform. Growth is also fueled by offerings such as Bedrock and SageMaker, which enable clients to create their AI models and applications. Bedrock supplies foundational models, whereas SageMaker provides a comprehensive solution.

Furthermore, through its Annapurna Labs subsidiary, Amazon has developed custom AI chips that outperform traditional graphics processing units (GPUs) while consuming less power, enhancing cost efficiency.

Despite potential short-term disruptions from tariffs, these two leading business segments position Amazon as a strong long-term investment.

Is Now the Right Time to Invest $1,000 in Amazon?

Before purchasing shares in Amazon, consider the following:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks for investor consideration—and Amazon was not among them. These recommended stocks have the potential to deliver significant returns in the coming years.

For instance, if you had invested $1,000 in Netflix when it made the list on December 17, 2004, your investment would now be worth $524,747!* Similarly, a $1,000 investment in Nvidia on April 15, 2005, would now equal $622,041!*

It’s essential to mention that Stock Advisor boasts a total average return of 792%—significantly outperforming 153% for the S&P 500. Join Stock Advisor for access to the latest top 10 stock picks.

See the 10 stocks »

*Stock Advisor returns as of April 14, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Geoffrey Seiler holds no positions in any of the mentioned stocks. The Motley Fool has investments in and recommends Amazon and Goldman Sachs Group. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.