Dell Technologies: A Deep Dive into Recent Performance and Future Prospects

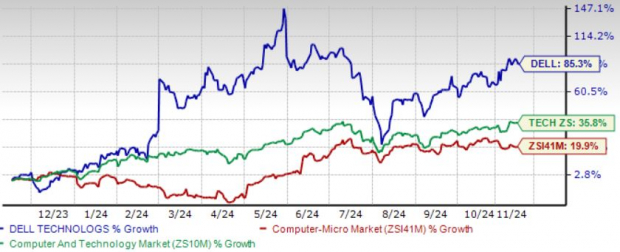

Dell Technologies DELL shares have experienced an 8.1% decrease in the past six months, mainly due to a shrinking gross margin and declining consumer PC shipments. However, this may create a potential buying opportunity for investors, as the company’s AI portfolio continues to grow. Over the past year, DELL shares have increased significantly by 85.3%, surpassing the 35.8% return of the broader Zacks Computer & Technology sector.

Strong demand for AI servers, fueled by ongoing digital transformation and rising interest in generative AI applications, has acted as a major driver for the company’s success. The introduction of the Dell AI Factory has played a crucial role in this, merging Dell Technologies’ solutions with an array of partners like NVIDIA NVDA, Meta Platforms META, Microsoft MSFT, and Hugging Face.

Year-to-Date Performance Review

Image Source: Zacks Investment Research

DELL’s collaboration with NVIDIA has been instrumental in shaping the Dell AI Factory. This partnership combines Dell’s offerings with NVIDIA’s AI Enterprise software and Tensor Core GPUs, boosting computing capacity while streamlining the development of AI applications, leading to quicker implementation.

Driving Growth with Cutting-Edge AI Solutions

Dell’s advanced air and liquid-cooled AI servers, alongside optimized networking and storage solutions, are fueling revenue growth. In the second quarter of fiscal 2025, orders hit $3.2 billion, largely thanks to Tier-2 cloud service providers. Furthermore, Dell shipped $3.1 billion worth of AI servers during this quarter, leaving a robust backlog of $3.8 billion at the end of the period.

The demand for AI servers is expanding significantly within Tier-2 cloud service providers and enterprise customers. Dell Technologies is optimistic about achieving strong growth in the latter half of fiscal 2025, driven by solid AI demand.

With partners like AMD, NVDA, META, MSFT, and Intel, DELL is well-positioned to capture a larger share of the market. Notably, the Dell PowerEdge XE9712 utilizes NVIDIA GB200 NVL72 technology, targeting expansive AI GPU clusters for advanced language model training and real-time inference. Additionally, the Dell PowerEdge M7725 features direct-to-chip liquid cooling with a 5th generation AMD EPYC-based system tailored for high-performance computing.

As part of the Dell AI Factory initiative, Dell’s GenAI Solutions with Intel offer rigorously engineered platforms designed for effortless AI integration. Their solutions support diverse GenAI applications, such as digital assistants and content generation.

Furthermore, DELL is collaborating with NVIDIA on AI implementations at the telecom network edge, utilizing the PowerEdge XR8000 server with NVIDIA L4 Tensor Core GPUs to enhance computing power and facilitate quicker application development.

Optimistic Outlook for the Second Half of Fiscal 2025

Looking ahead, Dell Technologies anticipates that the AI hardware and services market will reach $174 billion by 2027, growing at a compound annual growth rate (CAGR) of over 22% from 2023 to 2027. To support these AI endeavors, the company is investing in engineering capabilities, particularly in data center design and networking.

For fiscal 2025, Dell forecasts revenues between $95.5 billion and $98.5 billion, representing a year-over-year growth of about 10% based on a midpoint estimate of $97 billion. The Infrastructure Solutions Group is projected to grow by 30%, driven by AI initiatives.

Meanwhile, earnings are expected to be around $7.80 per share (+/- 25 cents), reflecting a 9% year-over-year increase at the midpoint.

Rising Earnings Estimates Signal Positive Momentum

The Zacks Consensus Estimate for Dell’s fiscal 2025 earnings stands at $7.85 per share, a slight increase over the past two months, indicating a 10.1% growth from the previous year. Revenue estimates also reflect a positive trajectory, pegged at $97.27 billion for year-over-year growth of 10%.

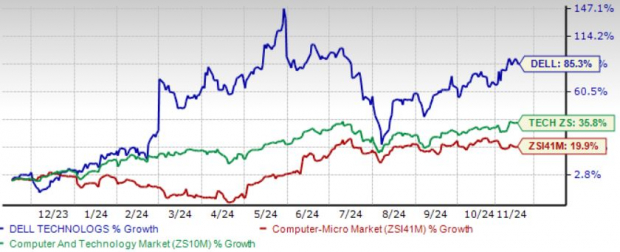

Dell Technologies Inc. Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

DELL has consistently surpassed the Zacks Consensus Estimate over the last four quarters, with an average surprise of 16.32%.

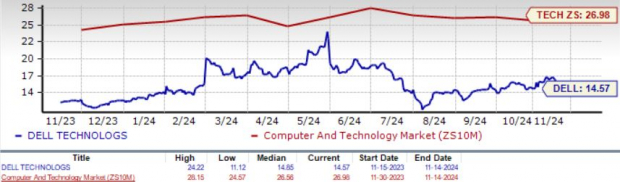

Valuation Appears Attractive

Dell Technologies shares currently present a favorable value opportunity, as indicated by a Value Score of A. With a forward 12-month P/E ratio of 14.57X, DELL stock is trading significantly below the sector average of 26.98X.

P/E Ratio Overview for DELL

Image Source: Zacks Investment Research

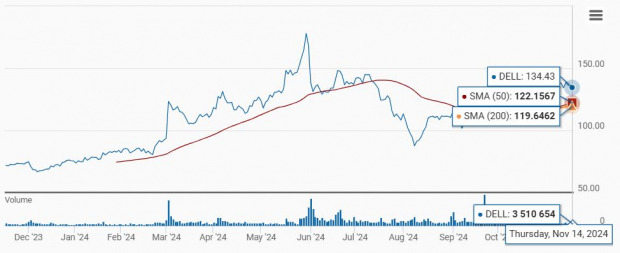

Additionally, DELL shares are trading above their 50-day moving average, which is a sign of a bullish trend.

DELL Shares Above Key Moving Averages

Image Source: Zacks Investment Research

In Summary

Dell’s robust AI strategy and growing partnership network present compelling reasons for investors to consider the stock. With a Zacks Rank of #2 (Buy), the recommendation is for investors to begin accumulating shares at this time.

Must-See: Solar Stocks with Major Growth Potential

The solar sector is poised for growth as technological advancements and economic shifts steer society away from fossil fuels to support the AI revolution. Analysts predict that solar energy will drive 80% of renewable energy expansion, presenting substantial opportunities for smart investors.

To discover Zacks’ top solar stock picks and maximize potential returns, take advantage of this free analysis.

For those interested in the latest stock recommendations from Zacks Investment Research, today is your chance to download “5 Stocks Set to Double” at no cost.

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To access the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.