“`html

Snowflake’s Upcoming Earnings Expected to Show Strong Growth

Snowflake (SNOW) is set to report its first-quarter fiscal 2026 results on May 21.

The Zacks Consensus Estimate for revenue is $1 billion, indicating a year-over-year increase of 21.13%.

For earnings, the consensus is 22 cents per share, unchanged over the last 30 days, reflecting a 57.14% growth compared to the previous year.

In the last four quarters, the company has exceeded the Zacks Consensus Estimate in three instances, with an average earnings surprise of 28.04%.

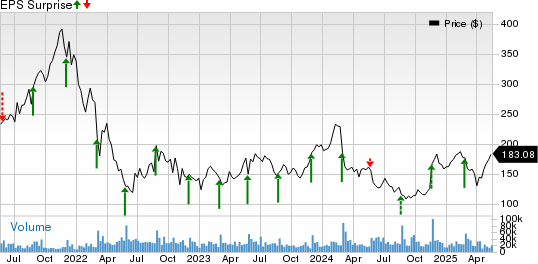

Snowflake Inc. Price and EPS Surprise

Snowflake Inc. price-eps-surprise | Snowflake Inc. Quote

Let’s review how the company has performed before this announcement.

Key Factors for SNOW’s Q1 Earnings

Snowflake’s performance for the first quarter is expected to reflect an expanding customer base and strong partnerships.

The net revenue retention rate, at 126% as of January 31, 2025, demonstrates increasing platform adoption. Additionally, the number of customers contributing over $1 million in trailing 12-month product revenue grew from 455 to 580 within the same period.

As of January 31, 2025, Snowflake had 11,159 customers, up from 9,384 a year earlier. Notably, 745 of these customers were part of the Forbes Global 2000, contributing to 45% of Snowflake’s fiscal 2025 revenues of $3.6 billion, marking a 29% increase from fiscal 2024. This growth trend is anticipated to continue into the current quarter.

For the first quarter of fiscal 2026, Snowflake expects product revenues between $955 million and $960 million, which represents a 21-22% year-over-year growth.

Investments in artificial intelligence (AI) and machine learning (ML), including the launch of Cortex AI and collaboration with OpenAI and Anthropic, are driving customer engagement. More than 4,000 customers are currently utilizing Snowflake’s AI and ML technologies on a weekly basis, likely contributing positively to the upcoming quarter’s performance.

Snowflake Outperforms Sector and Industry

This year, Snowflake’s shares have risen by 18.5%, outperforming the Zacks Computer and Technology sector, which saw a decline of 1.4%, while the Zacks Internet Software industry increased by 7.2%. The robust performance of SNOW can be attributed to its strong product portfolio and growing partner network.

Year-to-Date Performance

Image Source: Zacks Investment Research

Current Valuation of SNOW Stock

Currently, SNOW stock does not appear to offer a bargain, marked by a Value Score of F.

In terms of forward 12-month Price/Sales ratio, SNOW is trading at 12.81X, compared to the Computer & Technology sector’s 6.18X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Expanding Product Portfolio

Notably, Snowflake’s expanding product offerings, such as Apache Iceberg and Hybrid tables, Polaris, and the Cortex Large Language Model, are attracting new customers.

In April 2025, Snowflake improved its AI Data Cloud by integrating core functionalities with Apache Iceberg tables, enhancing query performance, security, and data sharing while supporting open-source initiatives.

In May 2025, the company expanded its AI Data Cloud with tailored solutions for the automotive sector, furthering digital transformation and AI growth.

Strong AI Partnerships Fuel Growth

Significant partnerships, including those with Microsoft (MSFT), Amazon (AMZN), and NVIDIA (NVDA), are likely major contributors to Snowflake’s growth.

In April 2025, Snowflake strengthened its collaboration with Microsoft to integrate OpenAI’s models into Snowflake Cortex AI via the Azure OpenAI Service. This integration aims to empower enterprises in developing AI-centric applications and enhances tools like Microsoft 365 Copilot and Teams.

Together with NVIDIA, Snowflake enables businesses to create tailored AI data applications, enhancing overall AI performance.

Furthermore, its alliance with Amazon Web Services (AWS) has broadened to promote customer-driven innovation and improve industry-specific solutions, effectively serving over 6,000 joint clients, including significant Fortune 500 names.

Should You Buy, Sell, or Hold SNOW Shares?

While Snowflake is reaping benefits from its extensive partner base, growing clientele, and innovative product offerings, challenges like competitive pressures and rising costs remain. The company anticipates tougher year-over-year revenue comparisons for the upcoming quarter due to the effects of a leap year.

Moreover, Snowflake expects a non-GAAP operating margin for fiscal Q1 2026 to be impacted by roughly $15 million due to expenses from its annual sales kickoff event. Concerns regarding valuation levels are also present.

At present, SNOW holds a Zacks Rank #3 (Hold), suggesting that investors may want to wait for a more favorable entry point for the shares.

Conclusion

This analysis reflects the ongoing developments at Snowflake and presents insights for potential investors.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`