HP Inc. Faces Challenges: Is It Time to Consider Selling?

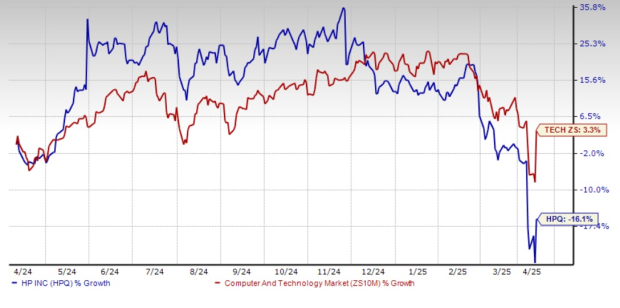

HP Inc. (HPQ) shares have decreased by 16.1% over the past month. This decline is notably below the Zacks Computer and Technology sector’s return of 3.3%. Given this performance, investors may wonder whether now is the time to exit their investment or hold onto HPQ Stock.

HP Inc. Price Performance Overview for One Month

Image Source: Zacks Investment Research

Factors Contributing to HPQ’s Recent Drop

HP’s current slump is part of a broader pullback in the tech sector, largely driven by concerns over rising tariffs and a slowing economy.

The announcement of new U.S. tariffs on April 2 introduced significant uncertainty. These tariffs, which are set to impact hardware imports from China, are likely to increase costs for both suppliers and consumers in the upcoming quarters, potentially decreasing the overall demand for PCs.

Furthermore, these recently announced tariff rates will push component prices higher, which may further diminish demand for PCs and adversely affect HP’s profit margins, especially in the Personal Systems segment.

Despite these challenges, there are signs of optimism.

HP’s PC Shipment Growth in Q1

The global PC market kicked off 2025 with strong momentum, as first-quarter shipments rose by 4.9% year over year, reaching 63.2 million units, according to data from International Data Corporation. This growth stemmed from strategic stockpiling by vendors and buyers to prepare for the new tariffs announced by the U.S. government earlier in April.

All top five vendors—Lenovo (LNVGY), HP, Dell Technologies (DELL), Apple (AAPL), and ASUS—reported year-over-year growth in PC shipments. Apple experienced the highest increase at 14.1%, while Dell posted the smallest rise of 3%. Specifically, Lenovo, HP, and ASUS saw their PC shipments grow by 10.8%, 6.1%, and 11.1%, respectively.

Lenovo leads the market with a share of 24.1%, followed by HP at 20.2%, Dell Technologies at 15.1%, Apple at 8.7%, and ASUS at 6.3%.

Commercial Demand Boosts HP’s Outlook

Rising demand for commercial PCs should help HP navigate the current macroeconomic challenges. A report from the International Data Corporation indicates that commercial PC demand could be driven by two key factors.

First, businesses are expected to upgrade their PCs ahead of the end of Microsoft’s Windows 10 support in October 2025. Second, the increasing interest in PCs with on-device AI capabilities may significantly boost demand for the PC industry.

These factors, along with the enterprise refresh cycle and the growth of AI-enabled devices, can provide some protection for PC manufacturers, even if consumer sentiment weakens due to pricing pressures.

HPQ’s Expanding AI Portfolio

The rapidly growing AI personal computer market presents substantial growth opportunities for several companies. A report from MarketsAndMarkets forecasts a compound annual growth rate (CAGR) of 28.82% for the AI PC market from 2024 to 2030.

To leverage this growth, HPQ has launched a variety of innovative products, such as the HP OmniBook Ultra Flip 14-inch Next-Gen AI PC, HP EliteBook X 14-inch Next-Gen AI PC, Z by HP Gen AI Lab, HP OmniBook X AI PC, HP EliteBook Ultra AI PC, HP OmniBook Ultra laptop, and HP OmniStudio PC over the past year.

Additionally, HP is enhancing its Printer business with groundbreaking AI technology. Recently, HP unveiled HP Print AI, the first intelligent print technology that utilizes AI to improve home printing experiences. To further enrich its Printing business, HP is increasing investments in A3 multifunction printers aimed at disrupting the traditional $55 billion A3 copier market.

Conclusion: Consider Holding HPQ for the Time Being

While the overall tech sector experiences a downturn, HPQ demonstrates resilience through robust PC shipment growth and a commitment to AI-driven innovation. Although tariff pressures may affect margins, strong commercial demand and HPQ’s proactive initiatives position the company well for future recovery. For long-term investors, maintaining a position in HPQ Stock could be a wise decision as the company adapts to shifting market conditions.

HPQ currently holds a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The 7 Best Stocks for the Next 30 Days

Recently released: Experts have narrowed down 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They consider these tickers “Most Likely for Early Price Increases.”

Since 1988, this complete list has outperformed the market more than twice, averaging a gain of +23.9% per year. So, it’s advisable to pay close attention to these seven selections.

Want the latest recommendations from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days. Click to receive this report for free.

Apple Inc. (AAPL): Free Stock Analysis report

HP Inc. (HPQ): Free Stock Analysis report

Dell Technologies Inc. (DELL): Free Stock Analysis report

Lenovo Group Ltd. (LNVGY): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.