Texas Instruments Experiences Significant Share Decline Amid Market Challenges

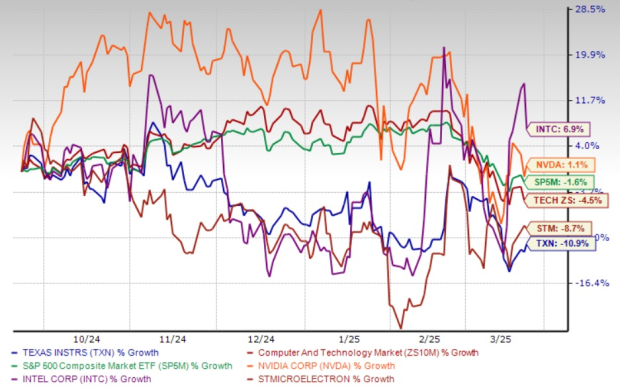

Texas Instruments (TXN), a leader in the integrated circuits market encompassing analog, mixed-signal, and digital signal processing, has faced a notable decline in its share value, dropping 10.9% over the past six months.

During this period, TXN stocks have lagged behind the Zacks Computer and Technology sector, as well as the S&P 500 index, which fell by 4.5% and 1.6%, respectively. Furthermore, TXN stocks have underperformed compared to industry competitors such as NVIDIA (NVDA), STMicroelectronics (STM), and Intel (INTC).

Market Performance Over the Last Six Months

Image Source: Zacks Investment Research

Causes of TXN’s Share Decline

The challenges contributing to TXN’s decline stem from weaknesses in its industrial, automotive, and enterprise systems markets. Notably, the industrial and automotive sectors constitute about 70% of Texas Instruments’ revenue and saw only modest sequential decline in the fourth quarter of 2024.

Additionally, the Embedded Processing segment, which has historically accounted for over 15% of TXN’s total revenue, is now experiencing a downturn due to industry cyclicality, leading to reduced sales figures.

Moreover, profit margins in the Embedded Processing segment are under strain as TXN expands its Lehi, Utah facility with a second fabrication operation, LFAB2. This growth initiative has resulted in underutilization across the entire Lehi factory, which primarily services Embedded Processing products.

Investors have also expressed concern about the U.S. government’s approach to China, as rising geopolitical tensions could negatively affect Texas Instruments, which relies on China for approximately 20% of its 2024 revenues. Potential trade restrictions may further complicate TXN’s future performance.

Despite these challenges, Texas Instruments is not without strategies to foster recovery.

TXN’s Recovery Strategy: Fostering Growth Amidst Adversity

In response to stagnant conditions in the industrial and automotive markets, TXN is focused on building its inventory to a robust $4.5 billion. This positioning allows the company to swiftly satisfy customer demand once market conditions improve, thus avoiding abrupt production increases.

Additionally, TXN has recently secured $1.6 billion in CHIPS Act funding from the U.S. government, which will fund new 300mm wafer fabrication facilities in Texas and Utah. This initiative aims to reinforce TXN’s role as a reliable supplier of analog and embedded chips.

Texas Instruments has also ventured into the edge AI sector with the introduction of the TMS320F28P55x Series, which features an integrated Neural Processing Unit. As the edge AI market is projected to grow significantly, TXN will have new opportunities for expansion. A Fortune Business report predicts the global edge AI market will reach $269.82 billion by 2032, with a compound annual growth rate (CAGR) of 33.3% from 2024 to 2032.

The Zacks Consensus Estimate for TXN’s revenues in 2025 is projected at $17.1 billion, reflecting a year-over-year increase of 9%. The earnings consensus is set at $5.35 per share, indicating a projected rise of 2.9% year-over-year.

Notably, Texas Instruments has exceeded Zacks Consensus Estimate expectations in the last four quarters, achieving an average surprise of 8.9%.

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Conclusion: Hold TXN Stocks for the Time Being

Though Texas Instruments is currently facing pressures across its industrial, automotive, and enterprise systems segments, the company is strategically maintaining strong inventory levels and expanding manufacturing capabilities. As the cyclical downturn recedes, TXN is expected to bounce back effectively.

The recent $1.6 billion CHIPS Act funding and its entry into the edge AI market present positive developments for Texas Instruments, giving it a Zacks Rank #3 (Hold). Given these considerations, we advise investors to retain their holdings of TXN stocks for the time being. You can see the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Highlights #1 Semiconductor Stock

Our top chip stock has shown substantial growth potential, estimated at only 1/9,000th the size of NVIDIA, which has surged over 800% since our recommendation. While NVIDIA remains a strong option, we anticipate significant growth for this new top contender.

With robust earnings growth and an expanding customer base, this company is well-positioned to satisfy the burgeoning demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. Global semiconductor manufacturing is expected to rise from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days for free. Click to access this report.

Intel Corporation (INTC): Free Stock Analysis report

Texas Instruments Incorporated (TXN): Free Stock Analysis report

STMicroelectronics N.V. (STM): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.