Apple Shares Struggle Amid Competition and Tariff Challenges

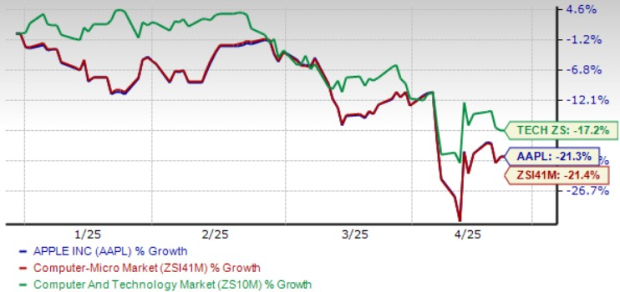

Apple (AAPL) shares have seen a 21.3% decline year-to-date (YTD), falling behind the Zacks Computer & Technology sector’s decline of 17.1%. The company’s stock price has faced pressure from U.S. President Donald Trump’s tariffs on trade partners such as China, Mexico, and Canada. Following the April 2 announcement regarding tariffs, Apple shares dropped 11.2% by April 9, although they have since seen a recovery of 3.4% as of now.

China remains a critical market for Apple due to the concentration of manufacturing there. Increased tariffs have negatively impacted Apple’s supply chain in the country. Fortunately for Apple, the Trump administration exempted electronic goods like smartphones and computers from reciprocal tariffs, which provided some relief.

Demand for the iPhone in China has been sluggish, with increasing competition from rivals like Huawei and Xiaomi contributing to this trend. In fact, Greater China sales fell by 11.1% year-over-year in the first quarter of fiscal 2025, highlighting the challenges Apple faces in the region.

Apple Stock YTD Performance

Image Source: Zacks Investment Research

Will Apple’s Services Sector Enhance Its Growth?

Although the iPhone remains Apple’s flagship product, the Services segment has emerged as a key growth driver. For the first fiscal quarter, Services revenues increased by 14% year-over-year, with projections for the March-end quarter (second-quarter fiscal 2025) indicating low double-digit growth.

Currently, Apple boasts over 1 billion paid subscribers across its Services portfolio, more than double its count from four years ago. The expansion of offerings in Apple TV+, Apple Music, and Apple Arcade, along with the growing popularity of Apple Pay, has spurred subscriber growth.

However, Apple TV+ faces significant content competition from established players like Netflix (NFLX), Amazon (AMZN), and Disney (DIS). Recent popular shows from Apple TV+, such as Severance and Ted Lasso, are limited compared to the extensive libraries of its competitors. This content gap contributes to profitability challenges, with reports indicating Apple TV+ has lost over $1 billion. As of 2024, the platform had an estimated 45 million subscribers.

Data from JustWatch, as reported by 9TO5Mac, shows that Apple TV+ market share in the United States increased from 7% in Q4 2024 to 8% in Q1 2025. In comparison, Amazon Prime Video leads with 21% market share, followed closely by Netflix at 20%, Max at 13%, and Disney+ at 12%.

How Will Apple Intelligence Affect iPhone Sales?

Despite a slight decline in iPhone sales—down 0.8% year-over-year to $69.14 billion in the first quarter of fiscal 2025—sales improved for the iPhone 16 in regions where Apple Intelligence features were available. The launch of these features commenced in U.S. English and has since expanded to additional countries.

The rollout of Apple Intelligence has been enhanced with updates in iOS 18.4, iPadOS 18.4, and macOS Sequoia 15.4, bringing support for various languages such as French, German, Italian, and more. This feature is now accessible across nearly all regions globally, including users in the European Union.

AAPL Earnings Estimates Show Downward Trend

Over the past 30 days, the Zacks Consensus Estimate for Apple’s fiscal 2025 earnings has fallen by 1.1% to $7.18 per share, suggesting a 6.37% growth compared to fiscal 2024.

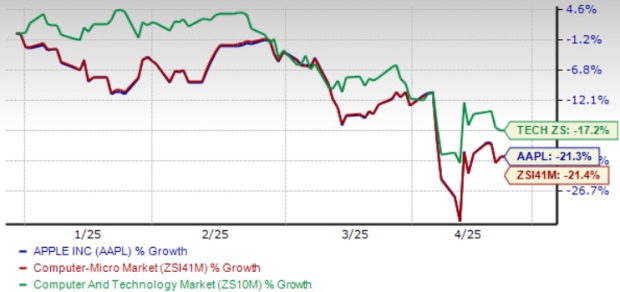

Apple Inc. Stock Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Apple has exceeded the Zacks Consensus Estimate in all four of its most recent quarters, with an average earnings surprise of 4.39%. (Check the latest EPS estimates and surprises on Zacks earnings Calendar.)

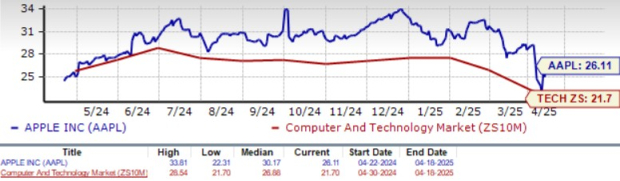

Is Apple Stock Overvalued?

Currently, AAPL stock shows signs of being overvalued, indicated by a Value Score of D. The stock is trading at a forward 12-month P/E ratio of 27.85X, which is higher than the sector average of 23.92X, suggesting a stretched valuation.

Price/Earnings Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

AAPL shares are currently trading below both the 50-day and 200-day moving averages, which reflects a prevailing bearish trend.

Apple Trades Below 50-day & 200-day SMAs

Image Source: Zacks Investment Research

Conclusion

While Apple’s Services segment has emerged as a significant revenue driver, the underperformance of Apple Intelligence poses challenges for its hardware sales (iPhone, iPad, and Mac). This situation raises doubts about whether Apple’s current valuation reflects its near-term growth potential.

Presently, AAPL holds a Zacks Rank #3 (Hold), suggesting that potential investors may want to wait for a more favorable entry point in the stock. You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Research Chief Identifies “Stock Most Likely to Double”

Our experts have recently revealed five stocks with the highest potential for growth, with Zacks’ Director of Research Sheraz Mian highlighting one stock expected to soar.

This particular stock is part of a rapidly expanding financial firm with over 50 million customers and diverse innovative solutions. It holds promise for significant gains ahead. While not all our top picks achieve success, this one could significantly outpace prior Zacks’ predictions, similar to Nano-X Imaging, which surged by +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Runners-Up.

Stay updated with Zacks Investment Research for the latest stock recommendations. Download our report on the 7 Best Stocks for the Next 30 Days for free by clicking here.

Amazon.com, Inc. (AMZN): Free Stock Analysis report.

Apple Inc. (AAPL): Free Stock Analysis report.

Netflix, Inc. (NFLX): Free Stock Analysis report.

The Walt Disney Company (DIS): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.