“`html

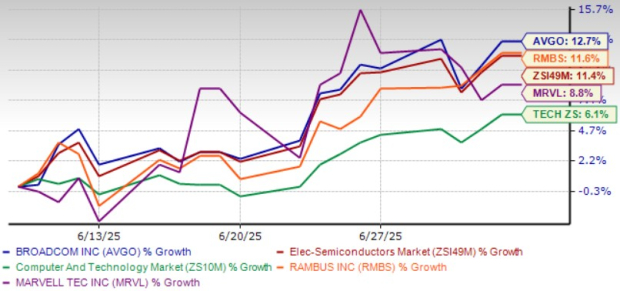

Broadcom Inc. (AVGO) shares increased by 12.7% over the past month, surpassing the Zacks Electronics Semiconductors industry’s growth of 11.4% and the Zacks Computer and Technology sector’s 6.1% increase. As of the second quarter of fiscal 2025, Broadcom’s revenues from custom AI accelerators (XPUs) grew double digits year-over-year, driven by strong demand from major clients like Alphabet and Meta Platforms. For the third quarter of fiscal 2025, Broadcom is forecasting revenue of $15.8 billion, indicating 21% year-over-year growth.

Broadcom’s AI networking revenues saw a remarkable 170% increase year-over-year, making up 40% of its AI revenues. Despite strong overall performance, the company anticipates sluggish growth in its server storage, wireless, and industrial businesses, with gross margin expected to decline by approximately 130 basis points in the upcoming quarter.

As of May 4, 2025, Broadcom held cash and cash equivalents of $9.47 billion and generated $6.41 billion in free cash flow, accounting for 43% of its revenue. The company has reduced its debt by $1.6 billion, with total gross principal debt now at $67.8 billion.

“`