Semtech Faces Challenges but Innovates to Regain Market Confidence

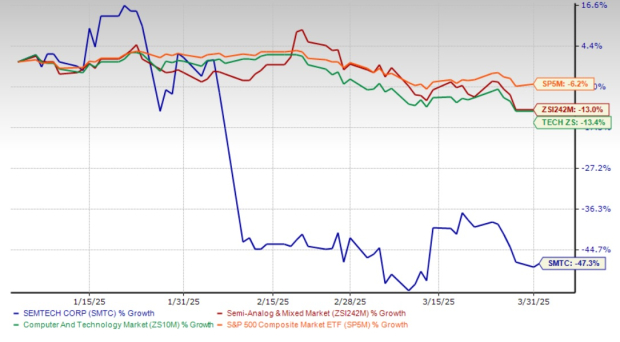

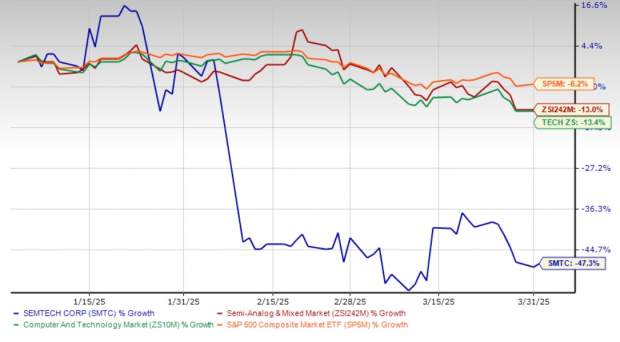

Semtech (SMTC) has seen its shares drop by 47.3% in the last three months, which is significantly below the decline of 13% for the Zacks Semiconductor – Analog and Mixed industry, a 13.4% decrease in the Zacks Computer and Technology sector, and a 6.2% fall in the S&P 500 index during the same period.

Three-Month Performance Overview

Image Source: Zacks Investment Research

The company’s recent performance highlights difficulties primarily linked to its CopperEdge business. SMTC’s CopperEdge signal integrity solutions are vital components embedded in active copper cables, essential for connecting GPUs, CPUs, switches, storage units, and other server rack components, thereby facilitating effective data transmission.

According to a regulatory filing from February 2025, a key customer of Semtech’s CopperEdge solutions is undergoing architectural changes in its server racks. This shift has resulted in sales projections for CopperEdge products to fall under the previously estimated $50 million for fiscal 2026.

This news prompted several lawsuits against the company over allegations of violating securities laws, which has further shaken investor confidence in the stock. Nevertheless, these short-term setbacks are counterbalanced by Semtech’s robust financials supported by its innovative offerings.

Innovation in Signal Integrity Enhances Semtech’s Prospects

In response to issues such as thermal management and high costs prevalent in AI and machine learning tasks, Semtech has introduced the 1.6T Octal Small Form-factor Pluggable (OSFP) Active Copper Cable. This new solution utilizes Amphenol’s APH OSFP interconnects, providing design and integration flexibility for data center operators.

The 1.6T OSFP Active Copper Cable combines Semtech’s CopperEdge 224G per lane linear equalizer integrated circuits with Amphenol’s advanced cable technology. This latest interconnect solution is reported to consume 90% less power than traditional digital signal processing options while offering significantly lower latency.

The introduction of the 1.6T OSFP Active Copper Cable may help steer the CopperEdge business back on track. Additionally, Semtech’s other offerings, including LoRa technology and LoRaWAN standards, are witnessing strong demand among industrial customers. These growing trends could positively influence both Semtech’s revenue and profits.

Optimism regarding the company’s financial prospects is reflected in the Zacks Consensus Estimates for fiscal years 2026 and 2027, projecting revenue growth of 15.9% and 10.6%, respectively. Earnings per share (EPS) is expected to increase by 96.6% in fiscal 2026 and by 27.4% in fiscal 2027.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Strength from Collaborative Partnerships

To bolster innovation, SMTC co-founded the LoRa Alliance, partnering with companies in the IoT connectivity and infrastructure sector. Key members of the LoRa Alliance, such as Netmore, MultiTech, and Acklio, are collaborating to standardize LoRaWAN technology for broader adoption across various industries.

Furthermore, Semtech engages with major corporations like Amazon (AMZN), where they have teamed up to integrate the LoRaWAN protocol into Amazon Web Services’ IoT Core and managed cloud services. This collaboration with one of the top public cloud service providers enhances Semtech’s market presence.

Additionally, partnering with Amdocs enables Semtech to tap into the private cellular networks market for enterprises, diversifying its business opportunities and potential revenue streams.

Conclusion: Hold Semtech Stock for Stability

Semtech is currently addressing the struggles in its CopperEdge sector by launching advanced OSFP Active Copper Cables designed to alleviate cost, latency, and thermal challenges. These steps are expected to encourage key customers to revisit their usage of Semtech’s products. In parallel, robust demand for its LoRaWAN solutions from IoT and industrial sectors is likely to support the recovery of SMTC stock.

Taking into account these factors, we recommend that investors retain this Zacks Rank #3 (Hold) stock for the time being. You can see the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Poised to Potentially Double

Each stock has been handpicked by a Zacks expert, aimed at gaining +100% or more in 2024. While not every selection may succeed, previous recommendations have reported gains of +143.0%, +175.9%, +498.3%, and +673.0%.

The stocks highlighted in this report are largely under the radar of Wall Street, presenting a prime opportunity to invest early.

Check out these 5 potential home runs >>

Interested in Zacks Investment Research’s latest recommendations? Download our report: 7 Best Stocks for the Next 30 Days, click here.

Amazon.com, Inc. (AMZN): Free stock analysis report

Amphenol Corporation (APH): Free stock analysis report

Amdocs Limited (DOX): Free stock analysis report

Semtech Corporation (SMTC): Free stock analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.