STMicroelectronics Faces Decline, Yet Strategic Growth Initiatives Persist

STMicroelectronics’ shares (STM) have plummeted 33.9% over the past six months, notably trailing the Zacks Computer & Technology sector and the Zacks Semiconductor-General industry, which declined by 17.2% and 28.5%, respectively.

The performance of STM has lagged behind industry competitors like NVIDIA (NVDA), Texas Instruments (TXN), and Amtech Systems (ASYS). During the same period, NVIDIA, Texas Instruments, and Amtech Systems saw their shares decline by 29%, 25.1%, and 22%, respectively.

The pessimism around STM’s stock can largely be traced to a negative forecast for the first quarter of 2025, marked by a substantial year-over-year revenue drop of 22.4% in the fourth quarter of 2024. This downturn is exacerbated by pronounced weaknesses in major end markets, particularly in the automotive and industrial sectors.

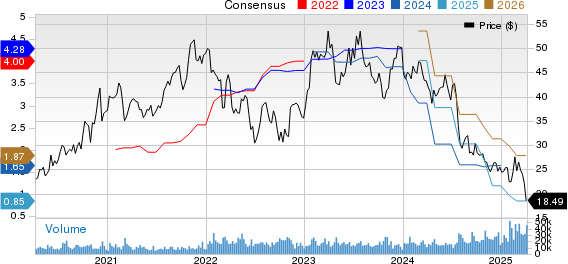

STMicroelectronics N.V. Price and Consensus

STMicroelectronics N.V. price-consensus-chart | STMicroelectronics N.V. Quote

Though recent trends for STM may appear disheartening, the company’s current initiatives, complemented by its advanced microcontroller portfolio and growing investments in Silicon Carbide (SiC) technologies, lay a solid groundwork for long-term success.

Silicon Carbide: A Principal Growth Driver for STM

STMicroelectronics is strategically intensifying its focus on SiC technology. Remarkably, in 2024, STM generated $1.1 billion in revenue from SiC products like high-performance MOSFETs and diodes. This accomplishment results from securing high-value partnerships with automotive and industrial clients, along with a significant collaboration with Ampere.

The Chinese market is emerging as a pivotal growth area for STM’s SiC offerings, bolstered by strong design-in activities and deepening relationships with major automakers. Notably, in 2024, STM outperformed other suppliers by securing more collaborations with leading Chinese carmakers, including a landmark long-term SiC supply agreement with Geely Auto that underscores its robust market presence.

To enhance its production capabilities, STMicroelectronics has announced plans to build a high-volume SiC manufacturing facility in Catania, Italy. This initiative aims to create a fully integrated manufacturing hub, positioning the company to meet increasing demand effectively, thus enhancing operational efficiency and yielding significant annual cost savings by 2027.

Design Wins Enhance STMicroelectronics’ Outlook

Capitalizing on the industry’s trend toward software-defined vehicle architectures and electrification systems, STM has achieved several high-value design wins. This includes efforts focused on consolidating electronic control units (ECUs) into more powerful systems and adopting zonal architectures. A collaboration with Mobileye has already enhanced advanced driver-assistance systems for Level 1 and Level 2 functionalities.

In the industrial domain, STM recorded a wide array of design wins during 2024, spanning applications in data centers, electric vehicle charging stations, renewable energy systems, consumer goods, and factory automation. The company has also introduced products and reference designs catering to high-performance telecom applications and AI server power supplies, demonstrating its commitment to innovation in power and energy management.

Strengthening the STM32 Portfolio for Growth

Advancements in the STM32 microcontroller series showcase STMicroelectronics’ commitment to providing cutting-edge solutions tailored to the diverse demands of its customers. In the fourth quarter, STM announced a new service within the STM32 ecosystem designed to enhance development efficiency and shorten time-to-market for clients, further illustrating its dedication to comprehensive development solutions.

In December 2024, STMicroelectronics launched the STM32N6 series, its most powerful microcontrollers to date, featuring a proprietary neural processing unit that enables advanced machine learning capabilities at the edge. This positioning allows STM to tap into the increasing demand for AI-enabled applications across various sectors effectively.

Moreover, STM’s ongoing partnerships and initiatives within the STM32 series have reinforced its status as a leader in the 32-bit microcontroller market.

Conclusion: STMicroelectronics as a Buying Opportunity

Despite its recent challenges, STMicroelectronics’ strong commitment to product innovation, an expanding STM32 microcontroller portfolio, a strategic focus on SiC, and significant design wins across automotive and industrial markets set it up for potential long-term growth. Given these fundamentals and increasing momentum in high-demand markets, STM could present an appealing buying opportunity for investors interested in the semiconductor sector.

STMicroelectronics currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Chief Research Analyst Highlights “Stock Most Likely to Double”

Our experts have recently identified five stocks with the highest potential for gaining +100% or more in the upcoming months. Among these, Director of Research Sheraz Mian emphasizes one Stock poised for considerable growth.

This top selection comes from one of the most innovative financial firms, already catering to over 50 million clients with an array of advanced solutions, positioning this Stock for significant gains. While not every elite pick can be guaranteed success, this one has the potential to outperform previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which surged by +129.6% in under 9 months.

Free: see our top Stock and four runners-up.

Want the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days today. Click to access this complimentary report.

Texas Instruments Incorporated (TXN): Free Stock Analysis report.

STMicroelectronics N.V. (STM): Free Stock Analysis report.

NVIDIA Corporation (NVDA): Free Stock Analysis report.

Amtech Systems, Inc. (ASYS): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.