Broadcom’s Stock Decline Presents Investment Opportunities

Broadcom (AVGO) shares have fallen 11.4% over the past month. This decline is attributed to the broader sell-off in technology stocks, driven by increasing recession fears following U.S. President Donald Trump’s decision to impose tariffs on major trading partners including China, Mexico, and Canada. This action heightens the risk of a trade war, which has implications for Broadcom, given that approximately 20% of its net revenues were generated from shipments to China (including Hong Kong) in fiscal 2024.

Despite this dip in stock price, many view it as a prime opportunity for investors to purchase AVGO. The company’s innovative portfolio, diverse partner relationships, robust VMware business, and strong balance sheet, along with significant free cash flow generation, position Broadcom favorably for growth-oriented investors. Let’s explore these factors further.

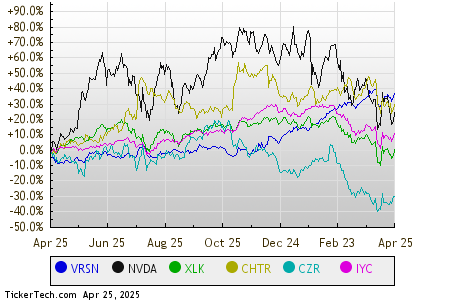

Overview of AVGO Stock Performance

Image Source: Zacks Investment Research

Broadcom’s Strong Portfolio Enhances Future Prospects

The strong demand for Broadcom’s application-specific integrated chips (ASICs), particularly those supporting AI and machine learning applications, is fuelling its top-line growth. Notable users of Broadcom’s ASICs include Alphabet (GOOGL) and Meta Platforms (META). Custom AI accelerators (XPUs), a type of ASIC, are essential for training Generative Artificial Intelligence (GenAI) models and require intricate integration of computing, memory, and I/O capabilities to ensure performance with lower power consumption and costs.

AVGO’s innovative portfolio serves as a key growth driver. The company is pioneering the next-generation 3-nanometer XPUs, being the first to market in this process node, and plans to start volume shipments to hyperscale customers in the latter half of fiscal 2025. Additionally, Broadcom intends to develop the industry’s first 2-nanometer AI XPU, using 3.5D packaging and aiming for clusters of 500,000 accelerators for hyperscale clients.

In the AI sector, AVGO sees vast opportunities as its three major hyperscaler customers are also developing their own XPUs. By 2027, each of these clients plans to deploy 1 million XPU clusters across a single fabric. The serviceable addressable market for XPUs and networking is projected to be between $60 billion and $90 billion in fiscal 2027. Recently, Broadcom has expanded its customer base with four new hyperscalers, treating them as partners.

Broadcom’s rich partner ecosystem—including NVIDIA, Arista Networks, Alphabet, Dell Technologies (DELL), Meta Platform, Juniper, and Supermicro—plays a crucial role in driving AI revenue. For the upcoming second quarter of fiscal 2025, AVGO anticipates AI revenues to increase by 44% year-over-year to $4.4 billion, while semiconductor revenues are expected to rise by 17% year-over-year to $14.9 billion.

Security Portfolio Growth Supports Broadcom

Broadcom is focused on delivering AI-powered, proactive security solutions to combat evolving cyber threats. In March 2025, AVGO launched updates to VMware vDefend that enhance security planning, lifecycle management, and scalability for VMware Cloud Foundation. New tools—like the Security Segmentation Assessment report, optimized micro-segmentation, and advanced Network Detection and Response—are designed to improve threat prevention and operational efficiency.

Recently, AVGO unveiled Incident Prediction, an extension of the Adaptive Protection security feature within Symantec Endpoint Security Complete (SES-C). SES-C is an integrated endpoint security platform providing cloud-based protection with AI-driven security management, all operating through a single agent and console architecture.

Broadcom also enjoys a strong balance sheet, supported by significant free cash flow generation. As of February 2, 2025, the company held $9.31 billion in cash and equivalents, alongside $6.11 billion in operational cash flow. Free cash flow was recorded at $6.01 billion, representing 40% of total revenue at the end of the first quarter of fiscal 2025.

This solid financial health allows AVGO to consistently pay dividends and repurchase stock. Earlier this month, Broadcom’s board authorized a new share repurchase program, allowing for the buyback of up to $10 billion of its common Stock through December 31, 2025.

Upward Trend in AVGO’s Earnings Estimates

The Zacks Consensus Estimate for AVGO’s fiscal 2025 earnings stands at $6.60 per share, reflecting a 0.6% increase in the last month and indicating anticipated growth of 35.52% year-over-year.

Broadcom Inc. Stock Price and Consensus

Broadcom Price Consensus Chart | Broadcom Quote

The consensus estimate for the fiscal second quarter earnings is projected at $1.57 per share, slightly up by $0.01 over the previous month, continuing an upward trend with a year-over-year growth of 42.73%.

AVGO has consistently surpassed the Zacks Consensus Estimate in the previous four quarters, showcasing an average surprise of 3.44%. You can find the latest EPS estimates and surprises on Zacks’ earnings Calendar.

AVGO Shares Trade at a Premium

Currently, AVGO shares are valued at a high premium, reflected by its Value Score of F, indicating that the stock may be overvalued at this stage.

In terms of forward 12-month Price/Sales ratio, AVGO trades at 11.65X compared to the sector’s 5.06X.

Price/Sales Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

Conclusion

Broadcom’s growing AI portfolio, bolstered by a strong partner network, suggests promising top-line growth potential. These factors support the current premium valuation of the stock.

Broadcom holds a Zacks Rank #1 (Strong Buy) and a Growth Score of B, indicating a favorable mix that presents a compelling investment opportunity according to Zacks’ proprietary methodology. Investors can see the complete list of Zacks #1 Rank stocks here.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys, categorizing these as “Most Likely for Early Price Pops.”

Since 1988, this list has consistently outperformed the market, averaging a gain of +23.9% per year. Investors should give these carefully selected stocks prompt attention.

see them now >>

Looking for the latest recommendations from Zacks Investment Research? Today, you can download the report on 7 Best Stocks for the Next 30 Days. Click here for your free report.

Dell Technologies Inc. (DELL): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.