“`html

Baidu’s Stock Performance: Analysis Amid AI Innovations and Challenges

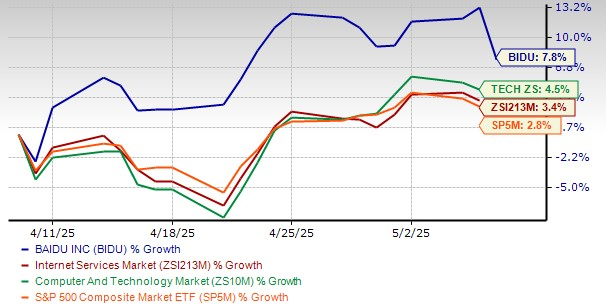

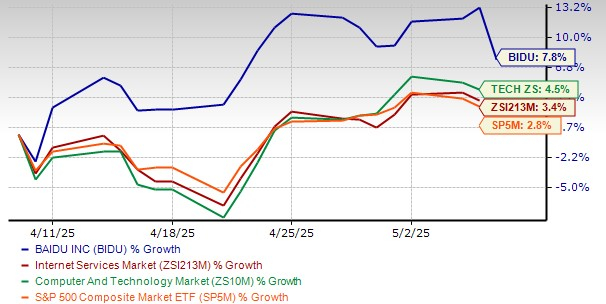

Baidu, Inc. (BIDU) shares have seen a 7.8% increase over the past month, outperforming the Zacks Internet – Services industry’s 3.4% gain and the Zacks Computer and Technology sector’s 4.5% rise. Nonetheless, BIDU remains approximately 25.4% below its 52-week high of $116.25, compared to a low of $74.71. Year-to-date, the stock has only risen by 3%, contrasting sharply with the industry’s 11.8% decline.

As the scrutiny regarding the potential delisting of Chinese stocks from U.S. markets intensifies, investors must ponder: does Baidu offer an appealing entry point, or do looming challenges lie ahead? Is this the right time to consider investing in Baidu’s AI initiatives?

BIDU Share Price Performance

Image Source: Zacks Investment Research

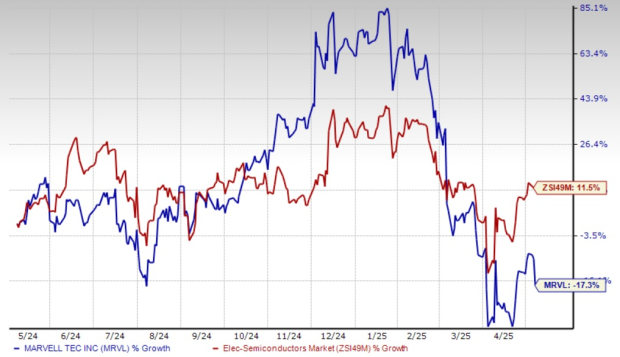

Technical Indicators for Baidu

Baidu shares are trading below both the 50-day and 200-day moving averages, signaling a bearish trend for the stock.

Image Source: Zacks Investment Research

Innovations in AI: Translation for Animal Communication

In a notable move, Baidu has filed a patent for an AI-based system aimed at translating animal vocalizations into human language, particularly focusing on pets such as cats. This technology will analyze sounds, behaviors, and physiological signals to ascertain an animal’s emotional state and convey it in comprehensible terms. Though currently in the research phase, this aligns with Baidu’s strategic push in the AI domain, following developments like the Ernie 4.5 Turbo model.

Expanding AI Product Offerings

In April 2025, Baidu launched the ERNIE 4.5 Turbo model at its developer conference, marking a significant leap in AI technology. This model generates diverse content including text, images, audio, and video, thus broadening its application range in fields such as content creation and customer service. To enhance accessibility, Baidu is offering ERNIE 4.5 Turbo at just 20% of the cost of ERNIE 4.5 and about 0.2% of GPT-4.5 rates. Additionally, the introduction of ERNIE X1 Turbo—designed for tasks requiring advanced reasoning—has positioned Baidu ahead of competitors like DeepSeek’s R1, while maintaining lower costs.

Baidu’s leadership in AI sectors, including ERNIE Bot for generative AI and autonomous driving, may yield significant returns as these technologies mature. The company is rapidly monetizing AI cloud services, capitalizing on growing enterprise and government demand for AI solutions. Despite a mature search business, Baidu holds a dominant share in China’s ad market, and a rebound in the economy or advertising could rejuvenate its revenue streams.

Growth of Apollo Go Robotaxi Business

Baidu’s Apollo Go, an autonomous ride-hailing service, reported over 1.1 million rides in Q4 2024, reflecting a 36% year-over-year growth. As of January 2025, total public rides exceeded 9 million, with Apollo Go becoming the first service authorized to conduct robotaxi testing in Hong Kong in November 2024. Since February 2025, operations have transitioned to fully driverless in China.

The company employs an asset-light growth strategy, collaborating with local fleet operators and mobility providers to facilitate the expansion of Apollo Go, enhancing ride volumes and operational efficiency while paving the way for broader international growth.

AI Cloud Revenue Growth and Infrastructure

Baidu’s AI Cloud revenue surged by 26% year-over-year in Q4 2024, contributing to a 17% increase for the full year. Notably, revenue from generative AI nearly tripled in 2024, signaling strong demand for the ERNIE model and robust AI infrastructure. Baidu serves a diverse customer base across various sectors including Internet services, automotive, manufacturing, energy, and finance, with increasing adoption among mid-tier businesses. By leveraging the Tianfeng MaaS platform, Baidu enables clients to seamlessly integrate AI into their operations, projecting continued revenue growth and improving non-GAAP operating margins through 2025.

Sound Financial Position

As of the end of 2024, Baidu reported a solid net cash position of approximately RMB 170.5 billion alongside free cash flow of RMB 13.1 billion. Enhanced operational efficiency is indicated by decreasing personnel expenses and stable overall operating costs. Baidu maintains a disciplined capital allocation strategy, focusing on high-return investments in AI, cloud services, and autonomous driving. In 2024, the company repurchased over $1 billion in shares as part of a broader $5 billion buyback program slated for completion by December 2025. Management has expressed dedication to increasing buybacks, affirming confidence in the company’s long-term outlook.

Challenges Ahead for Baidu

Despite potential, Baidu faces several headwinds. The stagnation in its core business remains a concern, particularly as search advertising evolves into a mature sector. Fierce competition from entities like ByteDance, diverting advertising revenue to its TikTok/Douyin platforms, and Tencent’s growing ad ecosystem pose challenges. In Q4, Baidu’s online marketing revenue fell by 7%, and overall revenue decreased by 3% in 2024.

Additionally, the competitive landscape in AI and cloud services includes major players like Alibaba (BABA) and Tencent (TCEHY) as well as emerging startups, all vying for market share in China’s AI sector. Alibaba Cloud leads in offering extensive enterprise services backed by significant AI-focused investments. Tencent Cloud leverages its position in gaming and social media to deliver AI services tailored to user behavior and engagement.

Although the risks of delisting Chinese stocks from U.S. markets are being discussed, no immediate measures appear imminent at this time.

“`# Baidu (BIDU) Stock Analysis: Valuation and Earnings Insights

Evaluating Baidu’s Current Stock Valuation

Baidu (BIDU) is currently trading at a discount compared to its industry peers and historical metrics. Its forward 12-month price-to-earnings (P/E) ratio is lower than its five-year average, indicating potential undervaluation. The stock has earned a Value Score of A, suggesting attractiveness in the current market. This positioning contrasts sharply with other major players; for instance, Alibaba has a forward P/E of 11.1, while Tencent’s is 15.93.

Price/Earnings (F12M)

Image Source: Zacks Investment Research

Positive Analyst Revisions for Baidu’s Earnings

Analyst sentiment around Baidu is shifting positively, as reflected in recent earnings estimates. Over the last 60 days, the Zacks Consensus Estimate for BIDU’s 2025 earnings per share has climbed from $9.59 to $10.08. This upward trend signals growing confidence in the company’s financial outlook.

Image Source: Zacks Investment Research

Investment Strategy for Baidu Stock

For long-term investors, Baidu presents a compelling hold option. The company boasts a strong innovation pipeline and solid financial foundation, despite trading significantly below its 52-week high. Recent performance shows BIDU gained 7.8% over the past month, outpacing industry and sector averages. This reflects emerging investor confidence, particularly as its AI initiatives gain momentum.

Baidu’s advancements include the launch of its ERNIE 4.5 Turbo and the logic-driven ERNIE X1 Turbo, as well as developments in pet communication AI and the Apollo Go robotaxi service. These innovations are expected to drive long-term revenue growth. The company reported a near tripling in generative AI revenue for 2024, along with a 26% year-over-year rise in AI cloud growth, indicating strong enterprise demand.

While challenges like delisting fears and competition from Alibaba and Tencent linger, Baidu appears resilient. The likelihood of immediate delisting seems low, and the company continues to benefit from a loyal user base and an expanding monetization strategy. Furthermore, BIDU’s current valuation reflects a significant discount compared to its peers, supported by improving EPS projections, which enhances earnings visibility.

In summary, Baidu’s favorable valuation, rising traction in AI, and stable financial footing offer investors a balanced risk-reward proposition within the dynamic Chinese tech environment. As it stands, BIDU holds a Zacks Rank of #3 (Hold).

Investment Insights: Top 7 Stocks to Watch

Experts have identified seven elite stocks deemed “Most Likely for Early Price Pops” from a list of Zacks Rank #1 Strong Buys. Historically, these selections have consistently outperformed the market, averaging a +23.9% gain per year since 1988.

For the latest expert recommendations and insights, investors are encouraged to stay informed about emerging opportunities.

Baidu, Inc. (BIDU): Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

The content and analysis reflect the author’s views and are not indicative of any endorsement by Nasdaq, Inc.