AMD Stock Struggles Despite Potential for Future Growth

Advanced Micro Devices (NASDAQ: AMD) has faced significant challenges over the past year. Investor optimism surrounding AMD’s potential to gain market share from Nvidia in the critical data center market has not materialized. Additionally, much of AMD’s other business segments have underperformed, contributing to a decline in the stock over the last twelve months.

Since reaching its peak last March, AMD’s shares have dropped more than 50%, while most other stocks have gained value. In contrast, investing in Nvidia would have yielded a return of over 50% in the same timeframe. This stark difference in performance prompts the question: could AMD be on the verge of a turnaround? After all, a drop of 50% may present a compelling opportunity for those looking to capitalize on a potential recovery.

AMD’s Struggles in the Data Center Sector

Unlike Nvidia, which focuses primarily on graphics processing units (GPUs), AMD offers a wider range of products. Despite having comparable offerings to Nvidia, AMD has consistently underperformed in the data center market, where it was expected to capture market share as the industry shifted from AI training to inference. Unfortunately, that expected market takeover has not occurred.

In AMD’s fiscal fourth quarter, which ended on December 28, data center revenue increased by 69% year-over-year to $3.86 billion. While this figure seems impressive, it pales in comparison to Nvidia’s performance, which saw its data center revenue soar 93% to $35.6 billion during its fiscal Q4 (ended January 26)—nearly tenfold that of AMD.

This discrepancy highlights a flaw in AMD’s investment thesis and has significantly impacted the stock‘s trajectory. The performance of AMD’s other segments has not provided much relief either.

Client revenue, which includes all CPUs and GPUs manufactured for laptops and PCs sold to consumers, was a positive note, growing by 58% year over year. However, this is a competitive market, and profits are limited due to commoditization; there isn’t much differentiation that leads to significant price premiums.

The remainder of AMD’s results showed disappointing outcomes. Gaming revenue, which encompasses GPUs for PC and gaming consoles, declined by 59%, and embedded processors saw a drop of 13%.

Overall, AMD experienced a year-over-year revenue growth of 24%. While this isn’t inherently poor, it fell short of expectations, leading to an unfavorable perception among Wall Street analysts.

Valuation Analysis: Is Now the Time to Invest in AMD?

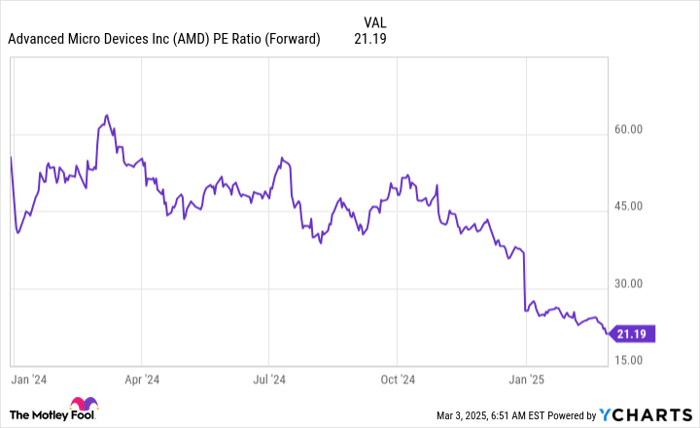

AMD has experienced some unique one-time charges in the past year, which complicate the analysis of its trailing price-to-earnings (P/E) ratio. For a clearer picture, using the forward P/E ratio is more insightful, as it excludes these unpredictable charges. This approach demonstrates that AMD’s valuation has significantly declined over the year.

AMD PE Ratio (Forward) data by YCharts

With a forward P/E ratio of 21.2, AMD appears to be attractively priced. In comparison, the broader market, as represented by the S&P 500, has a forward P/E ratio of 21.6. Thus, AMD is valued similarly to the market average.

Market analysts project revenue growth of 23% for 2025 and 21% for 2026, indicating significant potential for AMD to outperform the broader market while still trading at a discount. This difference presents a compelling buying opportunity for investors. Although AMD may not surpass Nvidia, it still possesses robust fundamentals.

Excluding the comparison to Nvidia, there is enough value in AMD’s business model that it could be a strong investment choice. Recovery throughout 2025 could lead to a more favorable valuation that reflects its growth potential.

Seize This Opportunity for Potential Gains

Do you ever feel like you missed out on investing in the most successful companies? Here’s your chance.

Occasionally, our team of analysts issues a “Double Down” Stock recommendation for companies they believe are positioned for substantial growth. If you think you might have already missed your opportunity to invest, now is the time to act.

The following examples illustrate the potential for significant gains:

- Nvidia: an investment of $1,000 when our team doubled down in 2009 would now be worth $286,710!*

- Apple: if you had invested $1,000 when we doubled down in 2008, it would now be valued at $44,617!*

- Netflix: if you invested $1,000 at the time we doubled down in 2004, it would have grown to $488,792!*

Currently, we are issuing “Double Down” alerts for three promising companies; this opportunity might not come around again soon.

Continue »

*Stock Advisor returns as of March 3, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.