AppLovin Rebounds as Digital Ad Market Shows Signs of Recovery

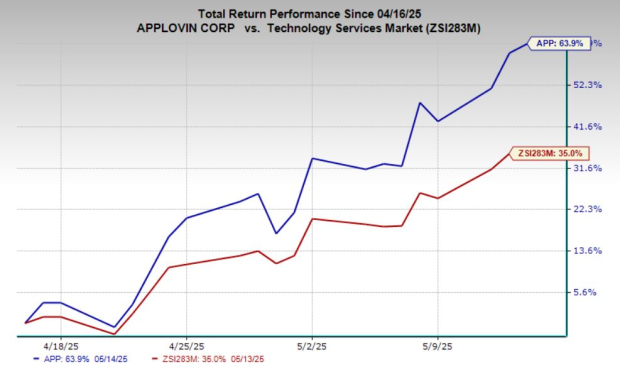

AppLovin Corporation (APP) has experienced a significant decline of 26% in its stock price over the last three months, outpacing the industry’s decline of 15%. Competitors, particularly in the mobile advertising sector, have also encountered challenges. For instance, shares of Alphabet (GOOGL) dropped 11%, while Meta Platforms (META) fell by 10% during this period, indicating broader weaknesses across the digital ad landscape.

Despite this downturn, APP has shown a remarkable recovery, surging 64% in the past month. Alphabet has rebounded with an 8% gain, and Meta Platforms has rallied 31% in the same timeframe. As major players like Alphabet and Meta regain their footing, their performance could signal a potential improvement in market conditions for digital ad firms. This analysis will discuss whether APP now presents a compelling investment opportunity.

Image Source: Zacks Investment Research

Strategic Transition to a High-Margin Business Model

AppLovin is in the process of transforming itself into a pure-play advertising platform, placing emphasis on high-growth and high-margin sectors. A pivotal aspect of this transition was the $900 million divestiture of its gaming unit to Tripledot Studios. This strategic move enables APP to focus more on its ad technology, aligning with its goal of catering to a global digital advertising market comprising over 10 million businesses. The company is investing in automation to develop advanced tools that will enhance customer efficiency and maximize ad performance.

Solid Financial Performance Highlights Growth Trajectory

AppLovin’s latest earnings report underscores the company’s strong financial health and growth potential. The firm continues to capitalize on its AXON 2.0 technology and strategic expansion within the gaming and in-app advertising arenas. In the first quarter of 2025, revenues increased by 40% year over year, fueled by strong market demand. Furthermore, adjusted EBITDA rose by 83% year over year, reflecting enhanced operational efficiency. Notably, net income soared 144% compared to the previous year, indicating APP’s capability to convert revenue growth into substantial profit. For the full year 2024, revenues grew by 43% year over year, while adjusted EBITDA surged by 81%, showcasing AppLovin’s ability to take advantage of market opportunities while maintaining operational effectiveness.

Analysts Forecast Strong Earnings and Revenue Growth for APP

The Zacks Consensus Estimate for second-quarter 2025 earnings stands at $2.01 per share, representing an impressive 125.8% increase from the same quarter last year. Additionally, earnings for the full years 2025 and 2026 are projected to grow by 85.2% and 41.9%, respectively, compared to their preceding years.

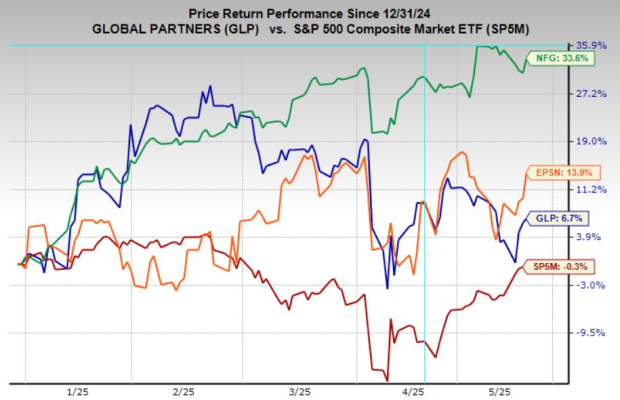

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for second-quarter 2025 revenues is $1.45 billion, reflecting an impressive 33.9% increase from the prior-year quarter. Moreover, earnings for the full years 2025 and 2026 are anticipated to grow by 24.3% and 19.7%, respectively, compared to prior years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Investment Recommendation for APP

AppLovin (APP) stands out as an appealing investment opportunity due to its robust financial performance and promising growth prospects. Recent results and strategic initiatives highlight its potential for sustained success in the gaming and software sectors. With its strong fundamentals, innovative technology, and strategic growth plans, AppLovin is positioning itself as a leader in the industry. Given its solid financial outlook and rising analyst confidence, a “Buy” rating for APP Stock is recommended to leverage its favorable growth trajectory.

APP currently holds a Zacks Rank #1 (Strong Buy).

Five Stocks with Doubling Potential

Each was carefully selected by a Zacks expert as the top choice for gaining +100% or more in 2024. While not all picks can succeed, previous recommendations have seen increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks in this report are currently under the radar of Wall Street, presenting a unique opportunity to invest early.

Discover these five potential home runs today.

AppLovin Corporation (APP): Free Stock Analysis.

Alphabet Inc. (GOOGL): Free Stock Analysis.

Meta Platforms, Inc. (META): Free Stock Analysis.

The views and opinions expressed herein are those of the author and do not necessarily reflect the positions of Nasdaq, Inc.