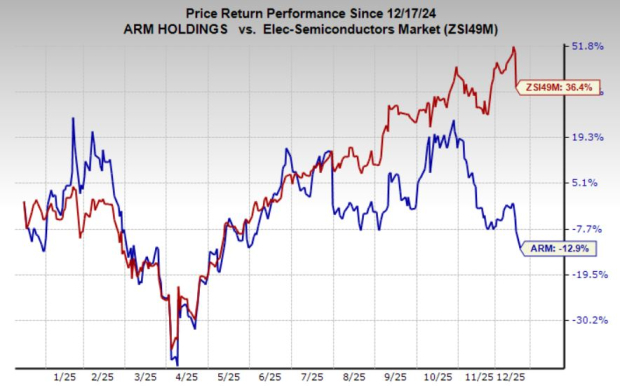

Arm Holdings plc (ARM) has seen a 13% decline in share prices over the past year, contrasting with the 36% growth reported by the industry. The company’s fiscal 2026 earnings are estimated at $1.72, reflecting a 5.5% increase from the previous year, with expected sales growth of 23.5% in the same period. Despite these positive projections, ARM’s stock is currently priced around 60 times forward earnings, significantly higher than the industry average of 37 times.

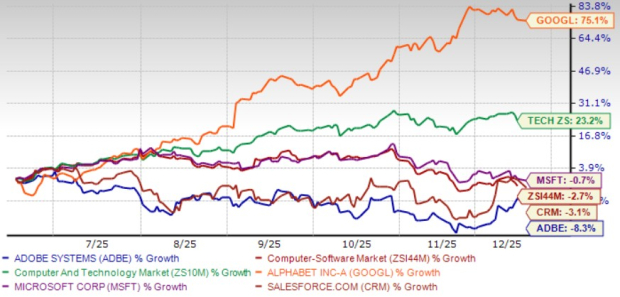

ARM’s competitive advantage stems from a robust dual-sided network effect that connects software developers and hardware manufacturers. This has established ARM as a leading mobile CPU architecture, utilized in nearly every smartphone globally. The ecosystem includes key partnerships with companies like Qualcomm, which builds mobile chips on ARM’s architecture, thereby reinforcing ARM’s market position amidst competition from NVIDIA, particularly in edge computing and AI-driven workloads.

Despite the company’s strong market presence and growth potential, ARM carries a Zacks Rank #3 (Hold), with analysts recommending a watch-and-wait approach for new investors due to elevated valuations in a volatile market environment.