Warren Buffett to Step Down as CEO of Berkshire Hathaway

Warren Buffett, at age 94, has announced he will step down as chief executive of Berkshire Hathaway BRK.B. He will transfer leadership to Greg Abel, currently the vice chairman overseeing non-insurance operations, including Berkshire Hathaway Energy. Buffett will continue to serve as chairman of the board to maintain strategic continuity within the company.

The announcement came over the weekend, which was anticipated given Buffett’s advanced age and his long tenure at the helm since 1965. However, shares of BRK.B fell 5% this week after reaching a 52-week high of $542 last Friday and missing Q1 expectations released on Saturday.

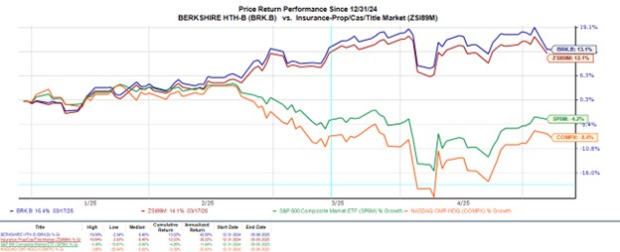

Despite this dip, Berkshire Hathaway has provided a solid hedge against broader market volatility, maintaining a year-to-date increase of 13%, similar to its peers in the Zacks Insurance-Property and Casualty Industry.

Image Source: Zacks Investment Research

About Greg Abel

Greg Abel has served as vice chairman of non-insurance operations since 2018 and joined Berkshire in 1999. He will assume the CEO role in early 2026. After Berkshire’s acquisition of his former company, MidAmerican Energy Holdings, he took charge of Berkshire Hathaway Energy, marking Buffett’s initial major foray into the energy sector.

Buffett has reassured shareholders about Abel’s readiness, labeling him a tremendous asset to the company. He emphasized Abel’s capability to uphold Berkshire’s distinctive culture through effective leadership and solid business judgment.

Berkshire’s Q1 Results

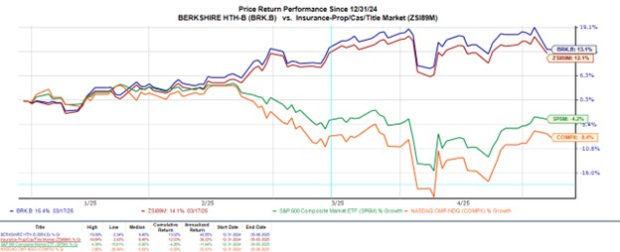

In Q1, Berkshire’s sales were reported at $89.72 billion, a reduction from $89.86 billion in the previous year, and below the projected $92.2 billion. Earnings per share (EPS) stood at $4.47, down from $5.19 year-over-year and missing expectations of $4.81.

The decline in earnings was attributed to uncertainty stemming from President Trump’s tariffs and other geopolitical risks. Additionally, insurance underwriting profit plummeted 48%, falling from $2.6 billion in Q1 2024 to $1.34 billion, with Geico Insurance facing challenges from Southern California wildfires.

Image Source: Zacks Investment Research

Berkshire’s Cash Position

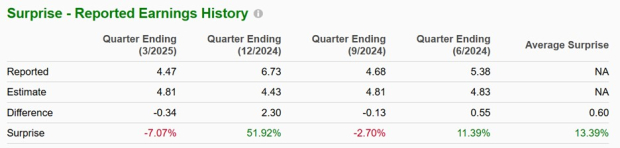

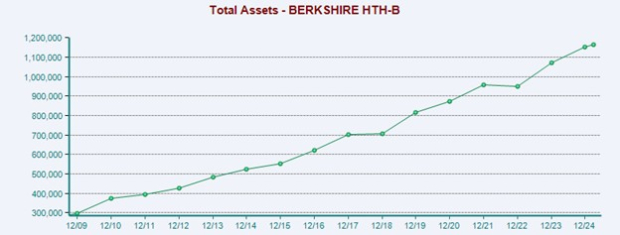

Berkshire’s substantial cash reserves, exceeding $42 billion in cash holdings as of the end of Q1, have drawn investors even amidst tariff concerns. The company reported a total of $347.7 billion in cash reserves, including short-term investments like U.S. Treasury Bills. Its total assets amounted to $1.16 trillion, significantly overshooting total liabilities of $507.79 billion.

Image Source: Zacks Investment Research

Berkshire’s Future Outlook

Berkshire Hathaway typically avoids providing forward-looking projections. However, the company indicated that ongoing macroeconomic and geopolitical events could impact future operating results.

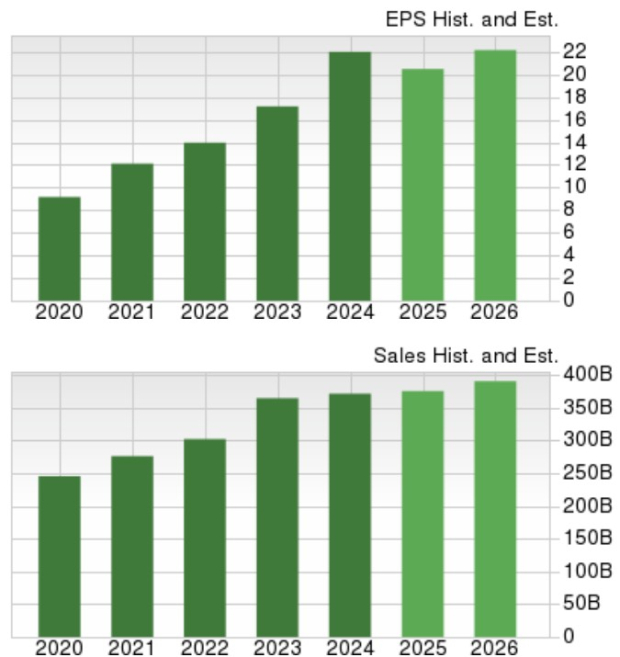

According to Zacks estimates, Berkshire’s total sales are projected to increase by 1% in fiscal 2025, followed by an additional 4% growth in FY26, reaching $390.43 billion. Annual earnings are expected to decline by 7% in the current year but are forecasted to recover and rise by 8% in FY26 to $22.16 per share.

Image Source: Zacks Investment Research

Berkshire’s P/E Valuation

Currently, BRK.B shares trade at around $516, reflecting a price-to-earnings (P/E) ratio of 25X forward earnings. This stands in stark contrast to the industry average of 11.9X, which includes prominent firms like The Progressive Corporation PGR and Allstate ALL.

Berkshire’s diversification distinguishes it from many insurance peers, as BRK.B trades near its decade-long median and is above the S&P 500’s current average P/E of 21.5X.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Currently, Berkshire ranks a Zacks Rank #3 (Hold). Some investors may be seeking a more significant pullback in BRK.B, as Buffett has consistently maintained that Berkshire Hathaway is best suited for long-term holders who understand its business model and avoid speculative trading.

“`html

Berkshire Hathaway’s Resilience Amid Tariff Concerns and Cash Position

Berkshire Hathaway Inc. (BRK.B) demonstrates potential resilience as investors weigh opportunities to buy shares following recent selloffs. The company’s significant cash reserves could help maintain its stock value despite ongoing tariff concerns in the market. Regardless of the fluctuations, Berkshire’s diverse portfolio remains compelling for investors seeking stability.

5 Stocks Poised for Remarkable Growth

A recent analysis has identified five stocks selected by a Zacks expert as top candidates, each expected to potentially double in value by 2024. Past recommendations have seen remarkable gains of +143.0%, +175.9%, +498.3%, and even +673.0%.

Notably, many of the stocks included in this report are currently off the radar for major Wall Street analysts, creating a unique opportunity for early investments.

Explore These 5 Potential Home Runs >>

For ongoing insights, you may be interested in downloading the report on the “7 Best Stocks for the Next 30 Days.” This free resource offers additional recommendations to consider.

Berkshire Hathaway Inc. (BRK.B) – Stock Analysis Report

The Allstate Corporation (ALL) – Stock Analysis Report

The Progressive Corporation (PGR) – Stock Analysis Report

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`