Casey’s General Stores Surpasses Earnings Expectations in Q3

Casey’s General Stores CASY experienced a notable surge in its stock during Wednesday’s trading session, following the release of strong earnings for its fiscal third quarter last evening.

The company’s performance stood out amid earnings reports from other significant retailers, including Dick’s Sporting Goods DKS and Kohl’s KSS. Today, Casey’s stock increased by over 6%, reaching above $400 per share.

Q3 Financial Highlights

In the third quarter, Casey’s sales surged 17% year-over-year to $3.9 billion, up from $3.32 billion in the same period last year. Fuel gallons sold saw a 20% increase, contributing to Casey’s growth as a convenience store and gas station operator. The expansion was also supported by a 10% growth in store count compared to the previous year, following last November’s acquisition of Fikes Wholesale, which owned CEFCO convenience stores.

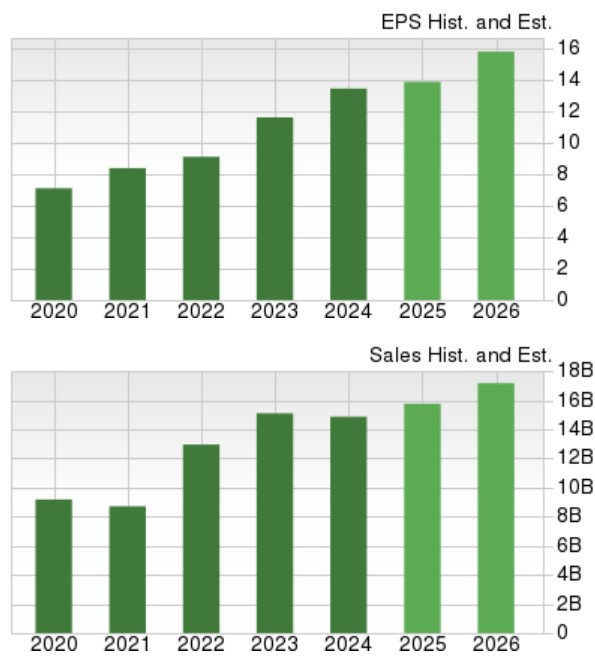

Net income for the third quarter stood at $87 million, equating to $2.33 per share. This figure remained flat compared to the prior quarter but exceeded analysts’ expectations of $1.76 by 32%. Importantly, Casey’s has consistently surpassed the Zacks EPS Consensus for seven consecutive quarters, with an average earnings surprise of 22.71% in its last four quarterly reports.

Image Source: Zacks Investment Research

Ongoing Expansion Efforts

The growth in Casey’s sales was significantly influenced by its prepared food division, renowned for its made-from-scratch pizza. The company operates in 17 states across the Midwest, offering a wide range of products beyond fuel, such as groceries, pet supplies, and automotive products.

As part of its strategic growth plan, Casey’s aims to expand its food business and accelerate the growth of its locations while improving operational efficiency. The company anticipates a full-year fiscal 2025 EBITDA increase of around 11%, even with projected property and equipment purchases of $500 million.

According to Zacks estimates, Casey’s total sales are projected to grow 6% in FY25, with an anticipated increase of 10% in FY26, reaching $17.44 billion. Annual earnings are expected to rise by 3% this year and could jump by 12% in FY26, reaching $15.60 per share.

Image Source: Zacks Investment Research

Performance and Valuation Analysis

Year-to-date, Casey’s stock has risen 2%, outperforming the S&P 500, which is down 5%, and the Nasdaq, which has dropped 9%. Despite recent tariff concerns impacting the markets, it is worth noting that CASY has significantly appreciated over 120% in the last three years, outperforming broader indexes.

Image Source: Zacks Investment Research

Currently, Casey’s stock trades at 24 times forward earnings, which is only slightly above its primary competitor, Murphy USA, trading at 17 times. Additionally, CASY’s price-to-sales ratio is below 1x.

Image Source: Zacks Investment Research

Conclusion

Casey’s operational efficiency presents a positive viewpoint, suggesting the company is effectively leveraging its growth and acquisition strategies. Currently, Casey’s stock holds a Zacks Rank #3 (Hold), though stronger rating adjustments may follow given the likely upward revisions in earnings estimates after the robust Q3 earnings beat.

5 Stocks Forecasted to Double

Each was handpicked by a Zacks expert as the top choice to gain 100% or more in 2024. Although not all picks can succeed, prior recommendations have achieved returns of 143.0%, 175.9%, 498.3%, and 673.0%.

Many of the stocks in this report are currently under the radar of Wall Street, providing an excellent opportunity to invest early.

See These 5 Potential Home Runs Today >>

Casey’s General Stores, Inc. (CASY): Free Stock Analysis Report

Kohl’s Corporation (KSS): Free Stock Analysis Report

DICK’S Sporting Goods, Inc. (DKS): Free Stock Analysis Report

Murphy USA Inc. (MUSA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.