NIKE and Target Stocks Struggle Amid Market Challenges

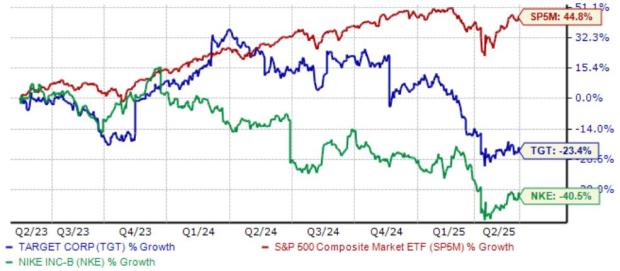

NIKE (NKE) and Target (TGT) have significantly underperformed the S&P 500 in recent years, causing investors to question if these stocks are now a buy at lower prices.

Nike Sees Relief

NIKE has faced challenges due to weak quarterly results and declining demand for its products. Initial tariff announcements from China early this year significantly impacted its stock performance.

However, shares have rebounded by 9% over the past month, outperforming the S&P 500, following a recent de-escalation announcement regarding tariffs.

While this 90-day tariff de-escalation marks a potential step toward a lasting resolution, uncertainty still looms. Most apparel companies, including NIKE, experienced sharp declines in their earnings outlooks due to heavy manufacturing exposure to tariffs.

The earnings outlook for NIKE’s current fiscal year is improving slightly, but investors may want to hold off until more clarity on tariffs emerges for a more stable EPS forecast.

Target Struggles

Target’s stock has plunged nearly 30% in 2025, underperforming both the S&P 500 and peers in the retail sector. Recent quarterly results have added to the pressure, particularly due to weak sales linked to its discretionary inventory.

Unlike Walmart, Target’s product mix is less focused on grocery items. It thrived during the pandemic when discretionary spending was high, but that trend has reversed.

Weak inventory management has contributed significantly to Target’s decline. The latest quarterly results showed comparable store sales dropped 5.7% year-over-year, further indicating muted sales growth.

Bottom Line

Both NIKE and Target have faced considerable pressure and are far from their all-time highs. Their struggles stem largely from disappointing quarterly results and mismatches in product assortments.

Investors may be wise to wait for additional clarity on tariffs and whether either company can rekindle consumer interest before making investment decisions.