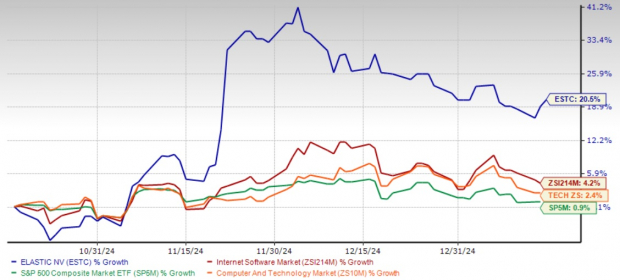

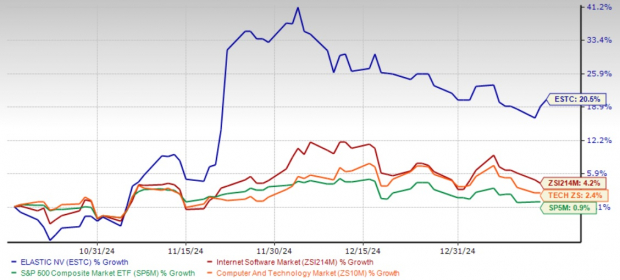

Elastic’s Stock Surges 20.5% as Investors Rally Behind AI Innovations

Elastic (ESTC) shares have seen a remarkable growth of 20.5% over the last three months, significantly outpacing the Zacks Computer and Technology sector, the Zacks Internet – Software industry, and the S&P 500 index, which appreciated by 2.4%, 4.2%, and 0.9%, respectively.

This impressive performance demonstrates growing investor confidence in Elastic’s role in the data analytics market, particularly for its cutting-edge and secure artificial intelligence (AI)-powered search solutions. With this upward trend, potential investors may be asking: Is ESTC stock still a viable buy?

AI-Driven Success Fuels Elastic’s Growth

Elastic’s search AI platform is gaining traction for various applications, such as semantic search, chatbot integration, and retrieval-augmented generation. These capabilities allow businesses to address immediate challenges, contributing to the company securing substantial contracts.

Elastic’s Price Performance Over Three Months

Image Source: Zacks Investment Research

Elastic has enhanced its platform with features such as hybrid search, binary quantization for vector databases, AutoOps for managing clusters, and OpenTelemetry integration. Furthermore, the company has formed partnerships with Microsoft (MSFT), Amazon (AMZN), NVIDIA, and Alphabet (GOOGL) to broaden its market reach.

The Elastic platform is accessible through major cloud service providers including Amazon Web Services, Google Cloud Platform, and Microsoft Azure. This allows customers to deploy the Elastic platform in hybrid, public, private, and multi-cloud settings.

Simplified Migration Boosts Elastic’s Appeal

The availability of the Elastic search AI platform has improved customer accessibility. To further ease the transition, Elastic has launched an Express migration program alongside AI-driven automatic import features, making it easier for businesses to integrate their critical data. In addition, the platform is supported by an AI-based SIEM solution that enhances threat detection and incident response.

These advancements make switching from competitors more straightforward, which bodes well for Elastic’s expanding customer base and revenue potential. The Zacks Consensus Estimate predicts that Elastic’s revenues for fiscal years 2025 and 2026 will grow by 15% and 13.6%, respectively. Earnings estimates for the same years are expected at $1.19 and $1.71, indicating year-over-year growth of 43.7% and 13.3%.

Notably, Elastic has exceeded the Zacks Consensus Estimate in each of the last four quarters, demonstrating an average earnings surprise of 30.5%.

Track the latest EPS estimates and surprises on the Zacks Earnings Calendar.

Conclusion: Consider Buying Elastic Now

The enhancements to Elastic’s search AI platform, partnerships with key vendors, and reduced hurdles for adoption through migration programs have strengthened its customer base.

Given these positive trends, it is advisable to consider adding Elastic to your portfolio. Currently, ESTC holds a Zacks Rank #2 (Buy). For more insights, you can explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Identifies Top Semiconductor Stock

Despite being only 1/9,000th the size of NVIDIA—which has soared over +800% since our recommendation—this new top chip stock shows tremendous potential for growth.

With robust earnings growth and an expanding customer base, it is well-positioned to meet the soaring demands in Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is projected to skyrocket from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Elastic N.V. (ESTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.