Ford Motor Company (NYSE: F) announced on December 15, 2025, it expects a $19.5 billion impact due to the cancellation of its F-150 Lightning electric vehicle. This decision is aligned with a broader repositioning of its electric vehicle program and will adversely affect the company’s earnings through Q4 FY2025, all of FY2026, and $5.5 billion into FY2027.

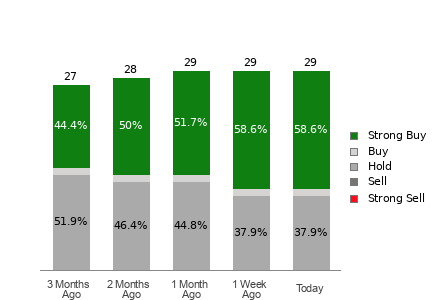

In addition to the EV issues, Ford is grappling with significant warranty costs, having spent $2.8 billion in the first half of 2025. The company also leads the U.S. in auto recalls, representing 35% of all recalls this year. The National Highway Traffic Safety Administration recently announced a recall of approximately 273,000 Ford vehicles due to a parking malfunction. With a trailing P/E ratio of 11.4 and forward P/E of 9.4, Ford’s valuation is low compared to the S&P 500’s P/E of 31.2, suggesting ongoing earnings challenges for the manufacturer. Analysts recommend avoiding Ford shares while they remain under $15.