Nvidia: Current Market Opportunities Amid AI Growth and Challenges

Nvidia (NASDAQ: NVDA) has experienced significant growth over the past two years. Recently, however, it has presented investors with a unique buying opportunity, one that many may not have anticipated. The company, a leader in artificial intelligence (AI) chips, is on a trajectory as the AI market is projected to expand into the trillions by the end of the decade. Such trends should support further gains in Nvidia’s stock price.

Market Challenges Impacting Nvidia

Despite the positive outlook, general economic concerns have loomed large. President Trump’s proposed tariffs on imports have cast a shadow over Nvidia, leading to overall market anxiety. Furthermore, export restrictions that recently halted Nvidia’s chip sales to China intensified investor worries. Consequently, Nvidia’s stock saw a decline of up to 29% from the beginning of the year to its lowest point last month. Although it has begun to rebound, its current price remains quite attractive in relation to future earnings estimates.

As investors consider whether to purchase Nvidia shares, a significant moment is approaching on May 28—its quarterly earnings report. This event typically offers crucial updates and insights into Nvidia’s future, especially in light of ongoing tariff concerns affecting electronics and chip exports.

Image source: Getty Images.

Nvidia’s Sales and Profitability Insights

Nvidia has consistently impressed investors with its impressive earnings growth and strategic updates. The company has achieved double- or triple-digit revenue growth quarter after quarter, setting new revenue records each time. Its profitability remains robust, with gross margins consistently exceeding 70%. Even during the costly product launch for the Blackwell architecture and chip, Nvidia maintained these strong margins.

Looking ahead, Nvidia remains committed to innovation, planning to release updates on its chip and architecture annually. The Blackwell Ultra is set to debut in the latter half of this year, with the Vera Rubin architecture planned for the same period next year. This focus should help Nvidia maintain its leadership in the AI sector.

Proactive Measures Amid Export Restrictions

Regarding the situation in China, Nvidia aims to build a research and development center in Shanghai. This initiative seeks to customize designs for Chinese customers while adhering to U.S. export controls, demonstrating Nvidia’s proactive approach in navigating current challenges.

As for the upcoming earnings report, Nvidia has a history of exceeding analysts’ expectations. Following the strong launch of Blackwell, which generated $11 billion in revenue in its first quarter, investor sentiment remains positive. While Nvidia anticipates a $5.5 billion charge related to U.S. export restrictions, this factor is likely already factored into current market sentiment.

However, potential risks from tariffs and export challenges remain. Setbacks in negotiations between the U.S. and China or weaker-than-expected economic indicators may impact Nvidia’s stock performance. The company’s reliance on the financial stability of other major tech firms, especially for AI investments, is critical.

Nvidia’s Current Valuation

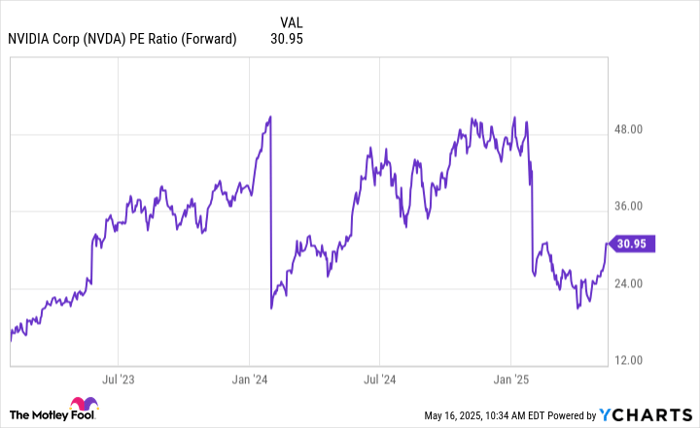

With all factors considered, should you invest in Nvidia before May 28? Currently, Nvidia trades at 30 times forward earnings estimates, a slight increase compared to a few weeks back but still lower than its peaks last year and early this year, indicating reasonable current pricing.

NVDA PE Ratio (Forward) data by YCharts

Positive earnings news could drive the stock price higher, although significant valuation changes are less likely to push it into overvalued territory immediately. Despite potential near-term growth risks, Nvidia’s long-term prospects appear strong.

Thus, Nvidia presents a buying opportunity. Whether you purchase now or wait until after May 28, the outcome for long-term investors is unlikely to vary significantly. With the AI sector continually evolving, Nvidia’s stock could provide substantial returns over time.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.