Navitas Semiconductor Sees Significant Growth

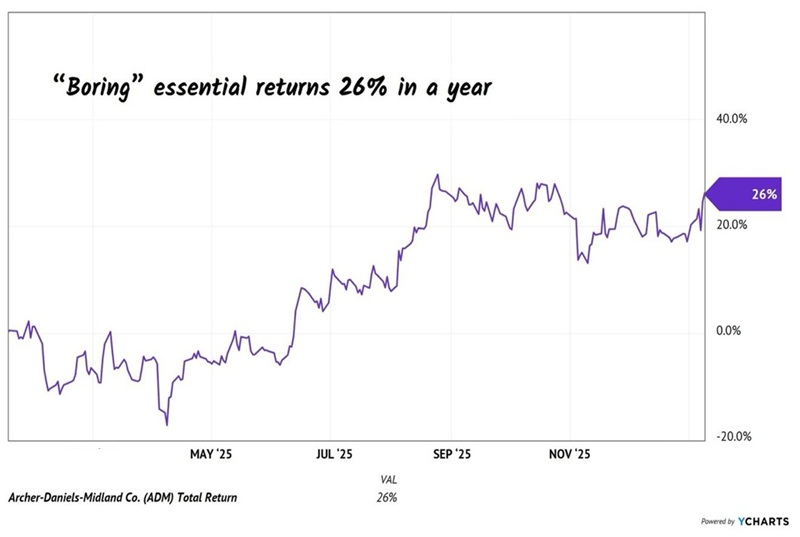

Navitas Semiconductor (NASDAQ: NVTS) has experienced a remarkable 200% increase in its shares over the past year and a 40% rise since January 2023. The midcap tech company specializes in gallium nitride (GaN) and silicon carbide (SiC) power chips and is currently shifting its focus toward data centers and industrial electrification. Despite recent gains, questions linger about whether these increases are sustainable or driven by market speculation.

Financial Metrics and Future Outlook

In Q3 2025, Navitas reported net revenue of just $10 million, with $23 million in expenses. With $150 million in cash reserves, the company is navigating a strategic pivot, deprioritizing lower-power business segments to target higher-power markets. As global demand for data centers is projected to require nearly $7 trillion in investments by 2030, the potential for significant future revenue growth remains. However, with major competitors like Texas Instruments and STMicroelectronics also pursuing GaN technology, the landscape remains competitive.

Key Risks

Investors should note the company’s current lack of profitability and the pressure from increasing operational expenses. While the shift toward GaN and SiC presents lucrative opportunities, the success of Navitas is contingent on sustained demand in emerging sectors like AI data centers and industrial electrification.