Pitney Bowes Navigates Market Challenges with Strategic Growth Moves

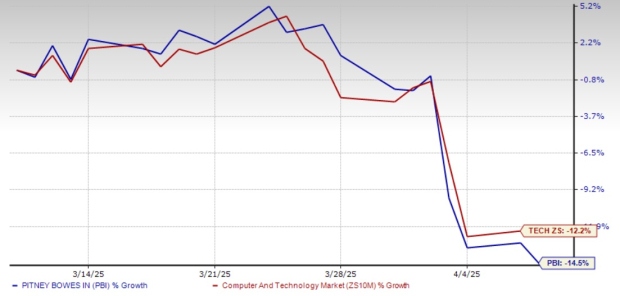

Pitney Bowes (PBI) shares have dropped 14.5% over the past month, underperforming the Zacks Computer and Technology sector, which fell by 12.2%. This decline in PBI’s stock price is largely due to broader market pressures.

A recent sell-off in technology stocks, spurred by concerns about rising trade tensions and slowing economic growth, has adversely impacted the sector. However, given Pitney Bowes’ strong fundamentals, the apprehension among investors appears exaggerated.

Recent Performance of Pitney Bowes

Image Source: Zacks Investment Research

Leveraging a Strong Customer Base for Growth

Pitney Bowes serves a diverse customer base, including over 90% of Fortune 500 companies, underscoring its market leadership. Relationships with industry leaders like Amazon (AMZN), eBay (EBAY), and Salesforce (CRM) enhance its standing in the global logistics and technology markets.

For example, PBI offers cross-border e-commerce logistics to eBay in the U.S. and U.K. This partnership evolved from being a participant in eBay’s Global Shipping Program to becoming a key logistics provider via eBay International Shipping.

Furthermore, PBI collaborates with Amazon Web Services as part of its Solution Provider Network, ensuring seamless integration with advanced technologies. Additionally, through Salesforce’s Shipping API Partner Program, Pitney Bowes has utilized Salesforce’s cloud platform and mapping technologies to help underwriters better assess risk factors.

These partnerships not only broaden PBI’s revenue sources but also position the company for sustainable growth. The Zacks Consensus Estimate anticipates that Pitney Bowes’ earnings per share for 2025 will reach $1.21, representing a 47.6% year-over-year increase.

Divesting GEC Business to Focus on Growth

In response to ongoing challenges in its Global Ecommerce (GEC) segment, Pitney Bowes has divested this business, which had underperformed despite prior investments such as the acquisitions of Borderfree in 2015 and Newgistics in 2017. The GEC segment initially saw growth during the pandemic, but post-pandemic declines in package volumes and aggressive competitor pricing impacted its profitability.

Recognizing the GEC segment as a liability, Pitney Bowes completed the divestiture, incurring one-time exit costs of $165 million, of which $120 million has already been paid in 2024. This strategic move allows PBI to concentrate on more profitable ventures, enhancing its profit margins and creating a leaner operational structure.

Moreover, the company is actively working on reducing debt and enhancing its financial strength. During the fourth-quarter earnings call, PBI announced that it repaid $275 million in Oaktree notes with internally generated cash. Additionally, it decreased offshore cash holdings by $90 million, improving liquidity.

Conclusion: A Strategic Buy Opportunity for Investors

Pitney Bowes is undergoing positive changes through strategic realignment and cost-cutting measures. The divestiture of the GEC business, along with financial discipline and solid partnerships, positions the company for enduring profitability. Considering these factors, we recommend that investors consider buying Pitney Bowes, currently rated Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Stocks Poised for Potential Doubling

Each of these stocks has been handpicked by a Zacks expert as the top choice to potentially gain +100% or more by 2024. Although past selections vary in success, prior recommendations have surged +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report have remained below Wall Street’s radar, offering an attractive chance for early investment.

Today, explore these 5 potential home runs >>

Want the latest suggestions from Zacks Investment Research? You can presently download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Amazon.com, Inc. (AMZN): Free stock analysis report.

Salesforce Inc. (CRM): Free stock analysis report.

eBay Inc. (EBAY): Free stock analysis report.

Pitney Bowes Inc. (PBI): Free stock analysis report.

This article originally appeared in Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.