Robinhood Markets, Inc. (HOOD) experienced a 12.8% surge in its stock price on Monday after announcing new cryptocurrency offerings for users in the European Union and the United States. This follows a remarkable increase of over 300% in shares over the past year.

The company is expanding its services by adding more than 200 U.S. stocks and ETF tokens, including Apple Inc. (AAPL) and NVIDIA Corporation (NVDA), to its platform in the EU. Robinhood is also set to introduce crypto perpetual futures if approved by the CFTC, and it has launched crypto staking for U.S. users, aiming to compete with exchanges like Coinbase Global, Inc. (COIN).

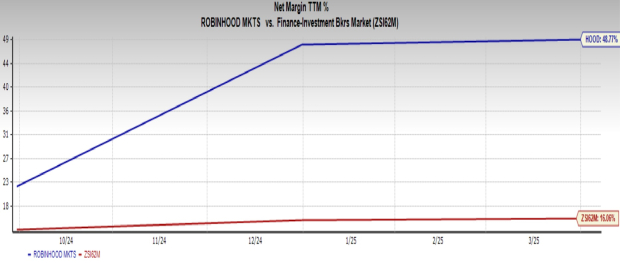

In the first quarter, Robinhood reported revenues of $927 million, reflecting a 50% year-over-year increase, while earnings per share reached 37 cents, a 106% increase from the previous year. The current price-to-earnings (P/E) ratio stands at 76.12, significantly higher than the industry’s 15.44, indicating caution for potential new buyers.