Guidance for Investors Amid Current Stock Market Sell-Off

Investors are facing the first significant stock market sell-off of 2025. The uncertainty surrounding when this downturn will end is palpable, as predicting market corrections is notoriously difficult. It is wiser to accept that stock market corrections are a natural part of investing, rather than attempt to forecast their timing.

Embracing Market Corrections: What Should Investors Do?

In light of stock market corrections, another approach is to embrace them. Investors should evaluate their watchlist, assess available cash reserves, and consider acquiring shares that may have seemed overpriced just weeks ago. Current market conditions may provide opportunities to purchase those stocks at reduced prices.

Where to invest $1,000 right now? Our analyst team has identified what they believe are the 10 best stocks to buy at this moment. Learn More »

Two Promising Stocks: Airbnb and Applied Materials

Currently, two stocks worth considering are Airbnb (NASDAQ: ABNB) and Applied Materials (NASDAQ: AMAT). Here’s why holding onto these technology companies may benefit long-term investors.

1. Airbnb: Capitalizing on Global Travel Demand

Airbnb revolutionized the travel industry with its innovative short-term rental platform. Today, it stands as a significant player in the global travel market and is the third-largest online travel agency, following Booking Holdings.

In 2024, customers spent $81.8 billion on the Airbnb platform, representing a 12% increase year-over-year. The company reported $2.6 billion in net income last year.

Despite these strong earnings, the stock is down 22% from its recent highs. Investor concerns stem from potential consumer recessions related to tariffs enacted during the Trump administration and various geopolitical tensions. Delta Air Lines has recently lowered its first-quarter guidance, citing decline in consumer spending on travel, which further fuels worries about Airbnb’s growth.

Nonetheless, Airbnb possesses a resilient platform with 5 million hosting participants. While a slowdown in the travel industry could impact its revenue growth, the long-term outlook remains favorable. With its unique business model that benefits from every transaction, Airbnb is also somewhat insulated from inflationary pressures. If travel spending trends upward long-term, which many believe it will, Airbnb’s revenue is likely to follow suit.

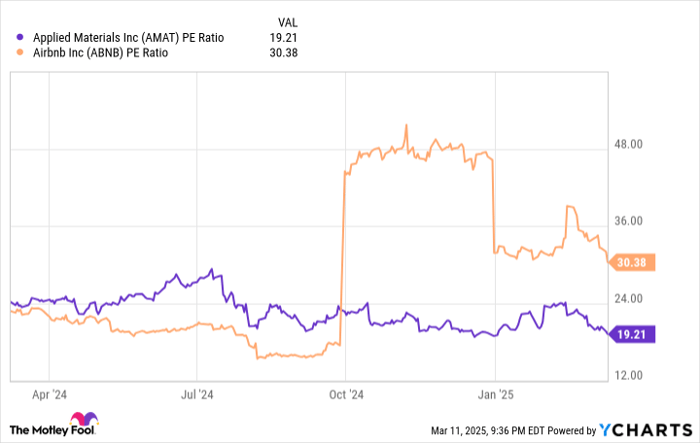

Currently, Airbnb holds a market capitalization of $78 billion and has a price-to-earnings (P/E) ratio of 30 in relation to its 2024 net income; while not considered cheap, the company is reinvesting heavily to enhance its offerings. Eventually, as the market matures, Airbnb’s profit margins could rival those of Booking Holdings. This potential suggests that Airbnb may be increasingly attractive amid the current market drawdown.

Source: YCharts

2. Applied Materials: Key Player in Semiconductor Manufacturing

The modern world relies heavily on computer chips, and Applied Materials is crucial to this industry. The company manufactures and sells machines that help semiconductor producers create advanced computer chips.

These machines enable manufacturers to analyze and design semiconductors at a microscopic level, allowing companies like Nvidia to produce chips with transistors as close as 3 nanometers. Without Applied Materials’ equipment and expertise, the construction of advanced chips for AI and cloud computing would not be feasible.

With decreasing competition in this sector, Applied Materials has experienced significant growth, with revenue hitting $27.6 billion over the past year—an increase of nearly 200% over the last decade. Given the expanding use of chips, particularly relating to AI applications, the demand for Applied Materials’ products is expected to rise in the coming years.

Applied Materials stock is currently trading at a P/E ratio of 19, well below the Nasdaq Composite and S&P 500 averages. Despite the market’s recent downturn, the S&P 500 still has an average P/E of 28, significantly exceeding its historical mean.

As Applied Materials continues to uphold its strong position in the semiconductor field, it offers a sound investment for those looking to hold stocks long-term.

Seize the Opportunity: “Double Down” Stock Recommendations

Feel like you missed your chance to invest in top-performing stocks? It might be time to reconsider.

Our analysts occasionally put out “Double Down” stock recommendations for companies poised for growth. If you fear you’ve already missed out, this could be the prime moment to reinvest. Consider this:

- Nvidia: $1,000 invested in 2009 would be worth $282,016!*

- Apple: $1,000 from 2008 would have grown to $41,869!*

- Netflix: A $1,000 investment in 2004 would now be $482,720!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and opportunities like this may not come around often.

Continue »

*Stock Advisor returns as of March 10, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Airbnb, Applied Materials, Booking Holdings, and Nvidia. The Motley Fool also recommends Delta Air Lines. Please refer to the Motley Fool’s disclosure policy for further information.

The views and opinions expressed herein represent those of the author and do not necessarily reflect those of Nasdaq, Inc.