Nasdaq Faces Correction: Is Nvidia a Smart Buy?

The tech-heavy Nasdaq Composite index is struggling in 2025, recently slipping into correction territory. This decline follows impressive gains in 2023 and 2024, largely driven by trends in artificial intelligence (AI). Economic factors, such as the trade war-induced tariff implications, a drop in consumer confidence in February, and a lackluster jobs report, have prompted investors to take profits in high-flying tech stocks. The Nasdaq Composite has fell over 13% since reaching its peak on December 16, 2024.

Understanding Stock Market Corrections

A stock market correction occurs when a major index declines by 10% to 20%. As of now, the Nasdaq is firmly within this range, and several leading names in the tech sector have also experienced significant losses. The duration of this correction remains uncertain, but it can present buying opportunities for seasoned investors seeking to acquire quality stocks at reduced prices.

Nvidia: A Strong Contender During the Current Correction

Currently, Nvidia (NASDAQ: NVDA) appears to be an appealing investment. Its valuation is attractive, it is experiencing robust growth, and it remains a leader in its industry. The current valuation of Nvidia may represent a strategic long-term investment opportunity given the expansive markets it influences.

Nvidia’s Value Compared to 2022

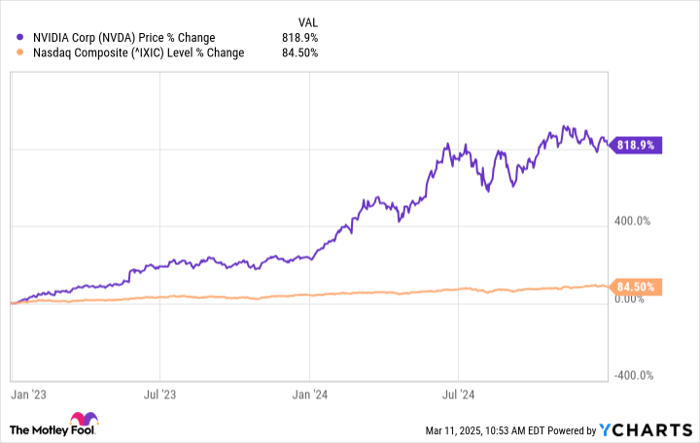

In 2022, Nvidia’s stock fell dramatically, losing about 50% of its value. However, investors who purchased shares at that time benefitted from significant gains over the following two years. Nvidia’s stock surged by an impressive 820% in 2023 and 2024, primarily driven by remarkable growth in its revenue and earnings.

NVDA data by YCharts

Notably, Nvidia’s stock is currently trading at 24 times forward earnings estimates, lower than its forward multiple of 34 at the end of 2022. Importantly, Nvidia’s growth rate has also picked up significantly. For fiscal 2023, it recorded flat revenue growth and a 25% drop in adjusted earnings. In contrast, fiscal 2025 has seen revenue soar by 114% and adjusted earnings increase by 130%.

This makes Nvidia a safer investment option today compared to 2022, thanks to its strong growth trajectory coupled with a more attractive valuation.

A Promising Growth Future for Nvidia

Nvidia operates across various markets that should support its long-term growth. The AI chip market alone is projected to surpass $500 billion in annual revenue by 2033, driven by applications in autonomous vehicles and edge computing devices, among others.

Currently, Nvidia captures approximately 92% of the AI chip market, positioning its data center revenue for sustained growth, even with potential competition. The company’s technological advancements suggest it may retain its leading status in this sector.

In the previous quarter, Nvidia reported sales of $11 billion for its latest generation of Blackwell AI processors, nearing the $12.6 billion revenue generated by rival AMD in the data center market last year. Consequently, Nvidia is positioned to capture a significant share of the burgeoning AI chip revenue opportunity in the years ahead.

Beyond AI, Nvidia’s professional visualization and automotive sectors also present substantial growth potential. For instance, the company expects its automotive revenue to triple in the current fiscal year to approximately $5 billion, following a prior year increase of 55%.

Nvidia’s extensive partner ecosystem, including major automakers like Hyundai and Toyota, as well as ride-sharing companies like Uber, enhances its ability to seize growth trends in the automotive market. These entities leverage Nvidia’s hardware and software solutions to develop autonomous vehicles and robotaxis.

Moreover, Nvidia’s enterprise software revenue doubled last year due to increasing demand for its AI offerings, adding to its growth prospects in various segments. Given these favorable conditions, it is plausible that Nvidia will recover strongly from the current correction and deliver meaningful long-term gains for investors.

Is Now the Right Time to Invest in Nvidia?

Before purchasing stock in Nvidia, consider the following:

The Motley Fool Stock Advisor team recently selected what they consider the 10 best stocks for investors, and Nvidia was not included. The stocks on this list could yield substantial returns in the upcoming years.

If you had invested $1,000 in Nvidia when it was on the list on April 15, 2005, it would now be worth $655,630!

Stock Advisor provides clear, actionable guidance for investors, with insights on portfolio building, regular analyst updates, and new stock picks each month. Since 2002, the performance of the Stock Advisor has significantly outperformed the S&P 500.

*Stock Advisor returns as of March 10, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Uber Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.