“`html

Nvidia’s Stock Performance: What Investors Should Know

Nvidia (NVDA) has emerged as one of the most searched stocks recently. Understanding the key factors affecting the Stock can provide insights into its future performance.

In the past month, shares of this graphics chip manufacturer focused on gaming and artificial intelligence have increased by +5.2%, outperforming the Zacks S&P 500 composite, which rose +3.8%. Within this same timeframe, the broader Zacks Semiconductor – General industry gained 2%. The vital question that remains: What direction will the Stock take next?

Impact of Earnings Estimates on Stock Performance

While news releases or rumors about a company’s changing business prospects can cause immediate fluctuations in its Stock price, fundamental factors ultimately drive long-term buy-and-hold decisions.

At Zacks, we prioritize the changes in earnings projections above all else. This is because the present value of future earnings largely determines a company’s fair value. Our analysis focuses on how sell-side analysts adjust their earnings estimates based on the latest business trends. An increase in earnings estimates tends to raise the fair value of a Stock, prompting investors to buy when the market price is lower than this fair value. Studies show a strong link between earnings estimate revisions and subsequent stock price movements.

For the current quarter, Nvidia is projected to report earnings of $0.88 per share, reflecting a +44.3% increase from the same quarter last year. However, the Zacks Consensus Estimate has decreased by -3.3% in the past 30 days.

For the current fiscal year, analysts expect a consensus earnings of $4.29, up +43.5% from the previous year. This estimate also dropped by -2.1% in the last month.

Looking at the next fiscal year, the consensus estimate rises to $5.44, which indicates a +26.8% increase from what Nvidia is expected to report a year ago. This estimate has seen a slight reduction of -0.7% over the past month.

With a strong performance history, our proprietary Stock rating tool, the Zacks Rank, offers a useful perspective on Nvidia’s near-term price potential by effectively utilizing earnings estimate revisions. The recent changes in consensus estimates have positioned Nvidia at a Zacks Rank #3 (Hold).

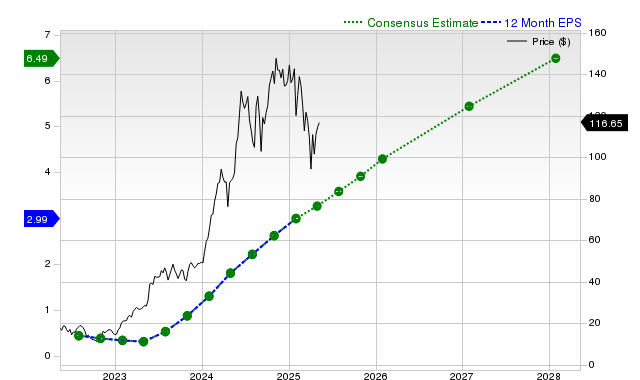

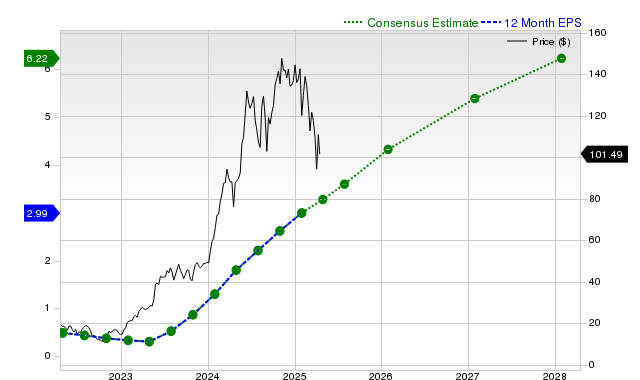

The chart below illustrates the evolution of the company’s forward 12-month consensus EPS estimate:

12-Month EPS

Revenue Growth Projections

A company’s earnings growth serves as a strong indicator of its financial health. However, sustainable earnings growth usually hinges on revenue growth. Understanding a company’s revenue potential is therefore essential.

For Nvidia, the projected sales estimate for the current quarter stands at $42.71 billion, marking a +64% increase year-over-year. For the current and next fiscal years, estimates of $194.17 billion and $240.53 billion suggest growth rates of +48.8% and +23.9%, respectively.

Recent Earnings Results and Surprise Metrics

Nvidia’s last reported quarter saw revenues of $39.33 billion, which translates to a +77.9% increase year-over-year, with an EPS of $0.89 compared to $0.52 a year prior.

When compared to the Zacks Consensus Estimate of $37.72 billion, Nvidia’s reported revenues reflected a positive surprise of +4.26%. The EPS surprise was +5.95%.

The company successfully beat consensus EPS estimates in each of the last four quarters and exceeded revenue estimates in the same period.

Valuation Considerations

Investment decisions must account for a Stock‘s valuation. Accurately assessing whether a Stock‘s price reflects the intrinsic value of the underlying business is crucial for predicting future performance.

It is important to compare the current value of valuation multiples—like price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF)—to historical values for a fair assessment. Additionally, comparing Nvidia with its peers can also provide a valuable perspective on its Stock price.

According to the Zacks Style Scores system, Nvidia holds a D rating in the Value category, indicating it is trading at a premium compared to its peers.

Conclusion

The information discussed may help assess whether Nvidia deserves attention amid market activity. However, its Zacks Rank #3 suggests that it may perform in line with broader market trends in the near term.

Additional Insights

The semiconductor market is on a growth trajectory, projected to expand from $452 billion in 2021 to $803 billion by 2028. This positions Nvidia favorably, alongside potential emerging chip stocks.

Please note that the views and opinions presented herein do not necessarily reflect those of Nasdaq, Inc.

“`