When it comes to determining whether to buy, sell, or hold a stock, the input of Wall Street analysts is often sought. Reports in the media about rating changes by these analysts, who are employed by brokerage firms, can exert significant influence on the price of a stock. But should investors take these recommendations at face value?

Analyzing Nvidia’s Brokerage Recommendations

Before we delve into the reliability of brokerage recommendations and how to interpret them effectively, let’s first examine the viewpoints of Wall Street heavyweights regarding Nvidia (NVDA).

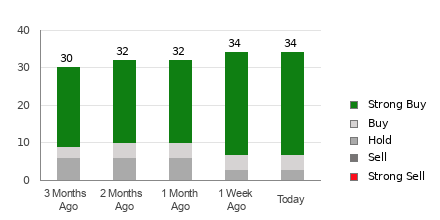

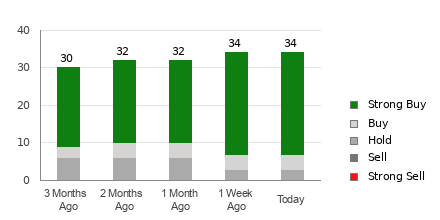

As of now, Nvidia holds an average brokerage recommendation (ABR) of 1.23, assessed on a scale of 1 to 5 (ranging from Strong Buy to Strong Sell). This figure is derived from the actual recommendations (such as Buy, Hold, Sell, etc.) given by 37 brokerage firms. An ABR of 1.23 roughly aligns with a rating between Strong Buy and Buy.

Out of the 37 recommendations factoring into the current ABR, 31 are Strong Buy and three are Buy. Collectively, Strong Buy and Buy constitute 83.8% and 8.1% of all recommendations, respectively.

Interpreting Brokerage Recommendation Trends for NVDA

While the overall ABR suggests buying Nvidia, it’s prudent for investors to not solely base their investment decisions on this information. Numerous studies have indicated that brokerage recommendations have limited success in guiding investors towards stocks with the highest potential for price appreciation.

Why is this the case, you ask? Well, the analysts at brokerage firms often exhibit a strong positive bias in rating a stock due to their vested interest in the companies they cover. Our own research shows that for every “Strong Sell” recommendation, brokerage firms dole out five “Strong Buy” recommendations.

Essentially, their interests aren’t always aligned with those of retail investors, and their ratings rarely offer a reliable indication of a stock’s potential price trajectory. As such, the most effective use of this information may be to validate your own research or an indicator that has demonstrated a high degree of accuracy in forecasting a stock’s price movement.

The Zacks Rank vs. ABR

Zacks Rank, our in-house stock rating tool with a remarkably audited track record, classifies stocks into five categories, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This serves as a reliable gauge of a stock’s performance in the near future. Hence, using the ABR to validate the Zacks Rank could be a prudent method for making an informed investment decision.

It’s important to note that, despite both being displayed on a scale of 1-5, the Zacks Rank and ABR are fundamentally distinct measures. The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (e.g., 1.28). On the other hand, the Zacks Rank is a quantitative model that allows investors to leverage the power of earnings estimate revisions and is displayed in whole numbers from 1 to 5.

Brokerage analysts have historically been overly optimistic in their recommendations. Their ratings tend to be more favorable than what their research would support, primarily due to the vested interest of their employers, and as a result, they mislead investors far more frequently than they guide them.

However, earnings estimate revisions are at the heart of the Zacks Rank, and empirical evidence demonstrates a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

Moreover, the Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts offer current-year earnings estimates, ensuring a balanced representation across the five ranks.

There’s also a crucial disparity between the ABR and Zacks Rank in terms of timeliness. The ABR might not always be up-to-date, while the Zacks Rank swiftly reflects the actions of brokerage analysts as they adjust their earnings estimates to mirror shifting business trends, making it consistently timely in predicting future stock prices.

Considering an Investment in NVDA?

In regards to earnings estimate revisions for Nvidia, the Zacks Consensus Estimate for the current year has risen by 0.1% over the past month to $12.31. The increasing optimism among analysts about the company’s earnings prospects, reflected in their strong consensus in revising EPS estimates upwards, could be a valid catalyst for a surge in the stock’s value in the near term.

The magnitude of the recent shift in the consensus estimate, alongside three other factors linked to earnings estimates, has positioned Nvidia at a Zacks Rank #2 (Buy). You can view the comprehensive list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Hence, Nvidia’s equivalent ABR of Buy may serve as a valuable guide for investors.

Zacks Names “Single Best Pick to Double”

Out of a multitude of stocks, 5 Zacks experts have each selected a favorite with the potential to surge by over 100% in the coming months. From these choices, Director of Research Sheraz Mian specifically identifies one stock as having the most explosive upside of all.

This involves a relatively lesser-known chemical company that has witnessed a 65% increase over the past year, yet remains considerably undervalued. With relentless demand, soaring 2022 earnings forecasts, and $1.5 billion allocated for share repurchases, retail investors could capitalize at any moment.

This company could rival or even surpass other recent Zacks’ Stocks Set to Double, such as the Boston Beer Company, which skyrocketed by +143.0% in just over 9 months, and Nvidia, which surged by +175.9% in a year.

Free: See Our Top Stock and 4 Runners Up

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.