Nvidia’s AI Boom: Analyzing Its Skyrocketing Valuation and Future Potential

Recent developments in artificial intelligence (AI) promise to greatly influence our daily lives. The technology’s capacity to automate tasks and generate creative content can enhance productivity while cutting time and costs.

Nvidia at the Forefront of AI Technology

The company leading this trend is Nvidia (NASDAQ: NVDA). Its graphics processing units (GPUs) are considered the benchmark driving this innovative technology, resulting in a remarkable surge in sales, profits, and, as a result, its stock price.

Since early last year, Nvidia’s stock has soared by 850%. This increase is mirrored by a rise in its valuation, as the company now holds a price-to-earnings (P/E) ratio of 55, significantly higher than the S&P 500 average of 31. Although this might appear steep, a closer examination shows that the stock might not be as overvalued as it initially seems.

Understanding Nvidia’s Valuation in Context

When assessing a stock’s value, it’s crucial not to rely solely on valuation metrics. A stock can be priced at a premium if it demonstrates strong future growth potential, market leadership, and a proven track record of innovation. Nvidia excels in all these aspects, explaining why investors are inclined to pay a premium.

Nvidia forecasts revenues of $37.5 billion for its upcoming fiscal fourth quarter, ending January 28, representing a remarkable year-over-year growth of 70%. The company estimates it holds between 70% and 95% of the advanced AI chip market, limiting opportunities for competitors. Additionally, its Blackwell AI processor stands out as the most powerful AI-centric processor ever produced, highlighting Nvidia’s ongoing innovation.

Despite concerns about its high P/E ratio, a closer look reveals Nvidia’s stock may not be as pricey as believed.

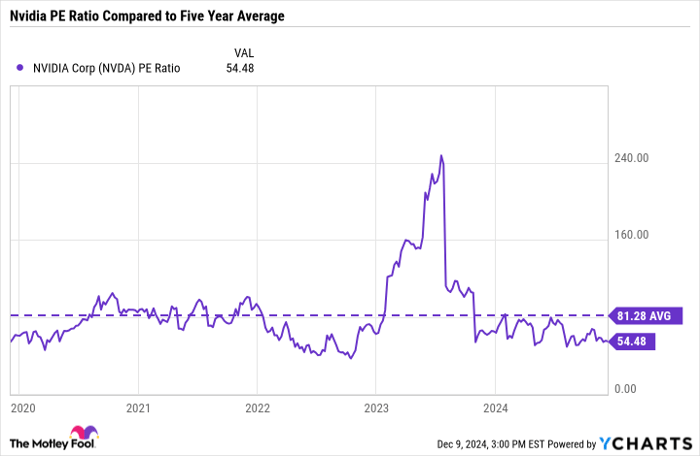

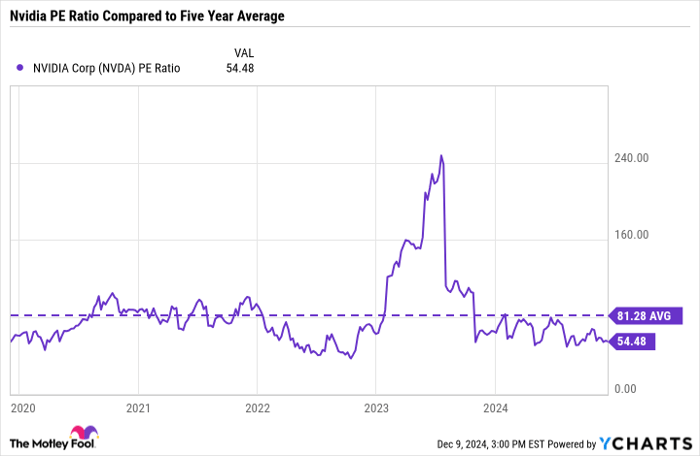

Data by YCharts

The current P/E ratio of 55 might seem elevated, but this is considerably lower than its five-year average of 81. Additionally, at 32 times expected earnings for the upcoming year, Nvidia appears to be attractively priced when factoring in its growth trajectory.

Is Nvidia a Wise Investment Choice?

Before investing in Nvidia, consider the following:

The Motley Fool Stock Advisor analyst team recently identified what they view as the 10 best stocks currently available, and Nvidia did not make the list. The selected stocks are expected to yield significant returns in the coming years.

For some context, if you had invested $1,000 in Nvidia on April 15, 2005, you would have $850,701 today!

Stock Advisor serves as a comprehensive guide for investors, offering strategies for portfolio management, regular analyst updates, and two new stock recommendations each month. This service has delivered over four times the return of the S&P 500 since 2002.

Explore the 10 recommended stocks »

*Stock Advisor returns as of December 9, 2024

Danny Vena owns shares in Nvidia. The Motley Fool also owns shares in and recommends Nvidia. For more details, please see Motley Fool’s disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily represent the views of Nasdaq, Inc.