NVIDIA’s Explosive Growth: What Investors Need to Know in 2024

NVIDIA Corporation (NVDA) has shown extraordinary performance in 2024, with its stock price soaring nearly 180% year-to-date. This surge places NVIDIA as a leader in the semiconductor industry, significantly outpacing the Zacks Semiconductor – General industry’s gain of 127.5% and the Technology Select Sector SPDR Fund (XLK) ETF’s increase of 22.6%.

Year-to-Date Price Performance Overview

Image Source: Zacks Investment Research

With a market capitalization of $3.395 trillion, NVIDIA ranks as the second most valuable public company in the United States, trailing only Apple Inc. (AAPL) at $3.622 trillion. It has joined the elite group of companies valued over $3 trillion, alongside Microsoft Corporation (MSFT). As NVIDIA’s impressive growth continues, many wonder: Is there still potential for further expansion, or has it reached its peak?

NVIDIA’s Unstoppable Growth Driven by AI Innovations

NVIDIA’s sharp ascent can be attributed to its leadership in artificial intelligence (AI), especially in generative AI. As more businesses adopt these technologies to enhance productivity, the demand for NVIDIA’s powerful graphic processing units (GPUs), which enable such advancements, has exploded.

According to Fortune Business Insights, the global generative AI market is expected to soar to $967.6 billion by 2032, growing at a spectacular compound annual growth rate (CAGR) of 39.6% beginning in 2024. This rapid growth signifies that NVIDIA’s GPUs are vital for companies starting their AI journeys.

NVIDIA’s advanced technology offers unparalleled computational strength, which allows complex AI models to handle extensive calculations. Generative AI is gaining traction in many fields, including healthcare, automotive, and manufacturing, positioning NVIDIA to be a key player in this market for years to come.

Expanding Influence Across Various Sectors

NVIDIA’s impact reaches well beyond AI. Its GPUs are crucial to progress in sectors such as automotive, healthcare, and manufacturing. In the automotive industry, NVIDIA’s technology is instrumental in the creation of autonomous vehicles, a sector expected to grow rapidly over the next decade. In healthcare, NVIDIA’s GPUs are transforming medical diagnostics, improving imaging techniques, and enhancing patient care. This diverse applicability underscores NVIDIA’s resilience and adaptability in the tech sector.

Furthermore, NVIDIA’s strong data center solutions are increasingly in demand as firms invest in cloud and edge computing. This division is poised to significantly elevate NVIDIA’s revenues, as businesses accelerate their digital transitions, reinforcing NVIDIA’s long-term growth prospects.

Financial Performance Showcases Stability and Strength

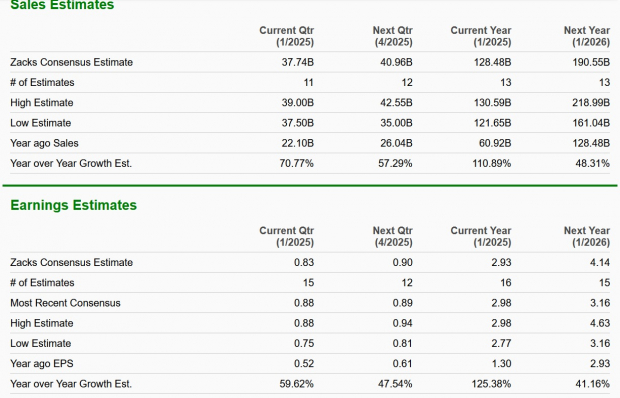

NVIDIA’s recent financial results highlight its market dominance. During the third quarter of fiscal 2025, NVIDIA achieved an astounding 94% year-over-year revenue growth, alongside a 103% rise in non-GAAP earnings per share (EPS). For the fourth quarter, executives forecast revenue to jump to $37.5 billion, compared to $22.1 billion in the same quarter last year.

The Zacks Consensus Estimate for NVIDIA’s revenues and earnings for fiscal years 2025 and 2026 indicates sustained growth, reflecting high confidence in the company’s leadership in multiple sectors, including gaming, automotive, and professional visualization.

Image Source: Zacks Investment Research

NVIDIA’s financial strength is further demonstrated by its strong balance sheet. As of October 27, 2024, it held $38.4 billion in cash, up from $34.8 billion on July 28. In the first three quarters of fiscal 2025, NVIDIA generated $47.5 billion in operating cash flow and $45.2 billion in free cash flow.

This robust financial position not only facilitates ongoing innovation but also acts as a buffer against market fluctuations, ensuring that NVIDIA can seize emerging opportunities.

Valuation Remains Attractive Despite Growth

Even with its impressive gains, NVIDIA’s valuation appears favorable. The stock is trading at a trailing 12-month price-to-earnings (P/E) ratio of 35.15, less than the Zacks Semiconductor – General industry average of 37.83. This indicates that the stock is currently trading at a relative discount, presenting potential upside for investors.

Image Source: Zacks Investment Research

NVIDIA: Key Takeaways

NVIDIA’s striking 180% surge year-to-date is commendable, but its growth potential seems far from exhausted. The company’s dominance in AI, wide-ranging applications, and strong financial performance firmly establish it as a cornerstone of the semiconductor and technology sectors.

For investors interested in the AI revolution and beyond, NVIDIA offers a compelling opportunity. Its promising long-term prospects and attractive valuation make it a worthwhile investment for those eager to embrace technological advancements.

Currently, NVIDIA holds a Zacks Rank #2 (Buy) and boasts a VGM Score of B. Research indicates that stocks with a VGM Score of A or B, paired with a Zacks Rank #1 (Strong Buy) or #2, provide the best investment opportunities. At present, NVDA stock stands out as an appealing investment option. You can see the complete list of today’s Zacks #1 Rank stocks here.

Special Offer: Access All Zacks Buys and Sells for Just $1

No gimmicks.

Years ago, we surprised our members by offering 30-day access to all our picks for just $1. There are no strings attached.

Thousands have taken advantage of this offer, while many others thought there must be a catch. Yes, we do have a reason: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Interested in the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today. Click to access this free report.

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.