Nvidia’s Stock Performance and Future Split Possibilities Analyzed

Nearly a year ago, Nvidia (NASDAQ: NVDA) executed a 10-for-1 stock split. This marked the sixth split in the company’s history since it became public in 1999. Following this action, shares climbed to an all-time closing high about six months later.

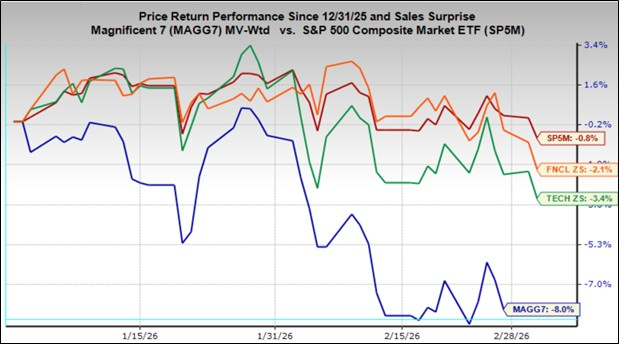

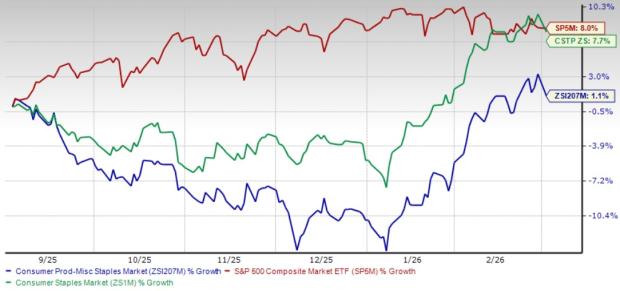

However, shares have since fallen, paralleling a general downturn in the Nasdaq Composite index, which briefly hit bear market territory in early April, dropping over 20% from recent peaks. Despite this, Nvidia’s stock has shown resilience, making a comeback recently. While the broader stock market struggles may persist, it is expected to eventually recover. Nvidia remains a leader in areas like artificial intelligence (AI), gaming, robotics, driver assistance, and self-driving technology.

Understanding Stock Splits

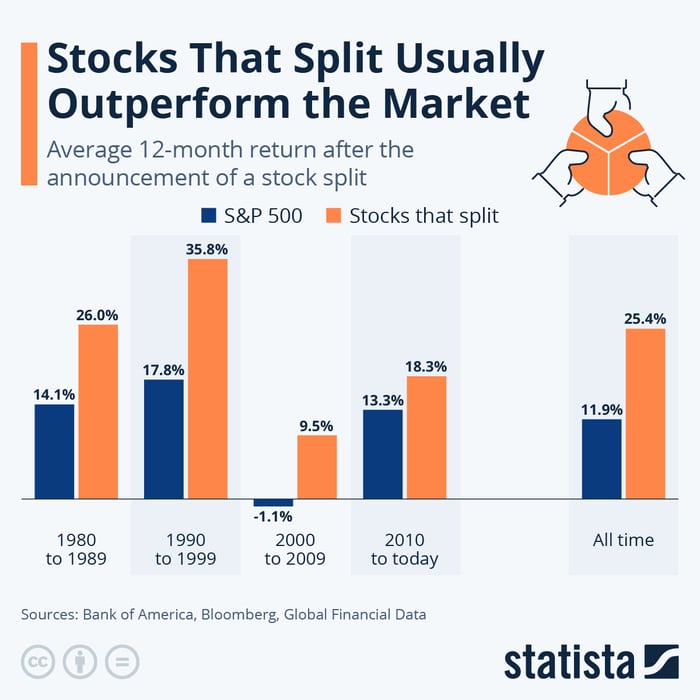

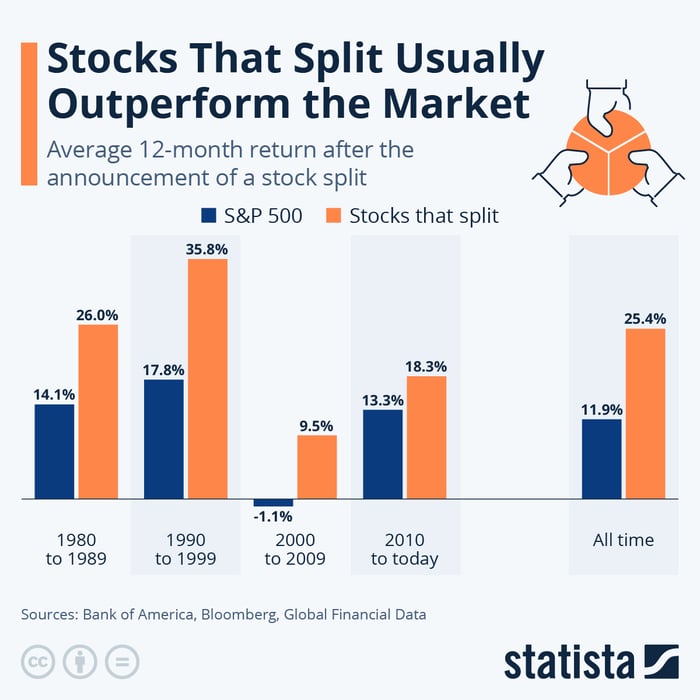

Nvidia’s business model is likely what attracts investors to its shares. Speculation exists around a possible future stock split, with historical data suggesting that owning shares before a split can yield positive returns.

Image source: Statista.

Companies typically split their stock to enhance liquidity by making shares more affordable for a broader range of investors. As share prices decrease, retail investors often increase their trading activity, attracted by the lower prices. Though many brokerages offer fractional shares, most investors may not be aware of this option, making lower share prices more appealing.

Furthermore, firms tend to announce stock splits when their stock prices have shown an upward trend. A split can boost investor confidence, signaling potential for continued strong performance. Stocks may also be added to significant indexes, particularly those that utilize price-weighted calculations. Additionally, companies may consider employee purchase plans, as lower-priced shares can encourage more participation.

Nvidia’s Growth Outlook

While stock splits do not directly alter a company’s market capitalization, they can positively influence investor perception and market activity. Nvidia’s management may look past short-term fluctuations to focus on promising future developments, which could lead them to consider another stock split.

Investors are particularly focused on Nvidia’s growing data center revenue, which was the primary driver of revenue growth for the fiscal year ending January 26, 2025. Although this segment dominates, the other three divisions have also seen revenue increases annually over the past two years. Nvidia’s gaming segment, worth over $10 billion, only constituted about 9% of sales last year, leading some investors to overlook other avenues for growth.

Notably, Nvidia’s automotive and robotics segments present significant growth potential. These areas are starting from lower bases compared to data centers and could soon erupt in expansion. Automakers are integrating advanced driver assistance systems and could soon market fully autonomous vehicles. Similarly, robotics technology could transition from industrial applications to mobile, humanoid forms, further boosting efficiency.

Is a Stock Split on the Horizon?

While the potential for another stock split is intriguing, investors would be wise to focus on Nvidia’s fundamental growth prospects. Historical data indicates that split announcements can lead to impressive returns, but the underlying business fundamentals also support a bullish outlook for Nvidia.

Nvidia’s management may decide to delay any split announcement until market conditions stabilize. Regardless, owning the stock presents an opportunity to invest in a rapidly growing company while also positioning for any future split announcements.

Conclusion

In summary, Nvidia’s strong market presence across various segments makes it a compelling investment now and in the future.

Howard Smith has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views expressed here reflect those of the author and do not necessarily represent Nasdaq, Inc.