Okta’s Steady Growth and Strong Performance Signal Future Success

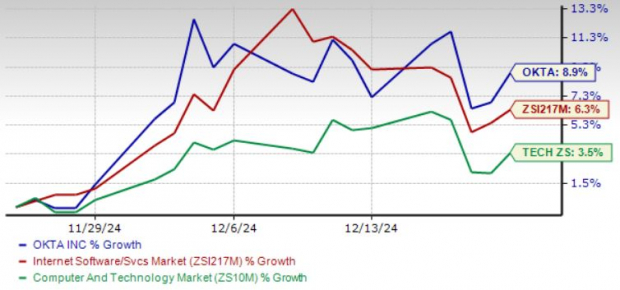

Okta (OKTA) shares have climbed 8.9% over the past month, significantly outpacing the broader Zacks Computer & Technology sector’s return of 3.5% and the Zacks Internet Software and Services industry’s gain of 6.3%.

The company showcases a robust portfolio, with rising demand for products such as Okta identity governance and Okta privileged access, even in a tough economic climate. The strong uptake of its Identity Threat Protection solution has contributed to the growing customer base, a vital factor for those looking at long-term investment potential.

As of the end of the third quarter of fiscal 2025, Okta boasts 19,450 customers and $2.062 billion in current remaining performance obligations, signaling optimistic future revenue growth from subscriptions. Customers generating over $100K in Annual Contract Value (ACV) increased by 8% year over year, reaching 4,705.

Okta Excels Against Its Peers This Month

Image Source: Zacks Investment Research

Innovative Solutions Propel Okta Forward

The innovative solutions offered by OKTA are expected to attract more clients and boost revenue. The integration of Okta AI across the Workforce Identity Cloud and Customer Identity Cloud allows organizations to leverage AI for enhanced user experiences and protection against cyber threats.

Predictions indicate OKTA’s revenues will grow at a compound annual growth rate (CAGR) of 26% from fiscal 2022 to fiscal 2025.

In September, Okta improved the capabilities of Auth0 and the Okta Customer Identity Cloud. These enhancements provide developers with better scalability, security, and customization options.

The Auth0 Free Plan has been enhanced to support 25,000 monthly active users (MAUs), along with features like passwordless options, unlimited social and Okta connections, and custom domain support. Paid plans now offer enterprise-grade identity security, multi-factor authentication, and improved log retention, among other features.

Okta is gaining traction in the cybersecurity sector against competitors like Microsoft (MSFT), International Business Machines (IBM), and CyberArk (CYBR).

Gartner has positioned Okta favorably compared to Microsoft and CyberArk across various use cases in its Critical Capabilities for Access Management. Furthermore, Okta has received the highest ranking in Gartner’s Magic Quadrant for Ability to Execute for three consecutive years.

Growing Demand for Identity Solutions Fuels Okta’s Success

Recent global security breaches highlight the increasing importance of cybersecurity firms like OKTA.

According to IDC, the global security market is projected to grow at double-digit rates over the next five years, reaching $200 billion by 2028. Notably, Identity and Access Management (IAM), which Okta specializes in, is expected to experience significant growth, with a CAGR in the teens or higher from 2024 to 2028.

The strong demand for secure remote access and enhanced protections, driven by ongoing digital transformations in enterprises, positions Okta well for the future.

In October, Okta introduced new Workforce Identity Cloud features aimed at addressing unmanaged SaaS service accounts, governance risks, and identity verification challenges.

New tools within Okta Privileged Access, such as Secure SaaS Service Accounts, are designed to protect non-federated SaaS accounts by offering functions like credential rotation and audit trails.

The Governance Analyzer tool assists managers and approvers by providing essential insights to make swift, informed decisions regarding authorization.

Strong Outlook for Q4 and Fiscal 2025

For the fourth quarter of fiscal 2025, Okta anticipates revenues between $667 million and $669 million, translating to a year-over-year growth rate of 10-11%.

Additionally, the company expects non-GAAP earnings for the fourth quarter to fall between 73 cents and 74 cents per share.

For fiscal 2025, Okta projects revenues between $2.595 billion and $2.597 billion, an increase from its previous guidance, indicating 15% growth compared to fiscal 2024.

The estimated non-GAAP earnings for fiscal 2025 are expected to range between $2.75 and $2.76 per share, reflecting an increase from prior guidance. Free cash flow margins are now estimated to be around 25% for this period.

Positive Earnings Trend for OKTA

For the upcoming fourth quarter of fiscal 2025, the Zacks Consensus Estimate for Okta’s earnings has risen by 9% to 73 cents per share over the last month, indicating a year-over-year growth of 15.87%.

Okta has successfully exceeded the Zacks Consensus Estimate in the past four quarters, with an average surprise of 19.87%.

Okta, Inc. Price and Consensus

Okta, Inc. price-consensus-chart | Okta, Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The consensus for revenue stands at $668.8 million, which implies a 10.55% increase from the same quarter last year.

Looking at fiscal 2025, the Zacks Consensus Estimate for Okta’s earnings has gone up by 5.7% to $2.76 per share in the past month, suggesting a remarkable growth of 72.5% compared to fiscal 2024.

Projected revenue for fiscal 2025 is estimated at $2.60 billion, indicating a 14.75% increase from the previous year.

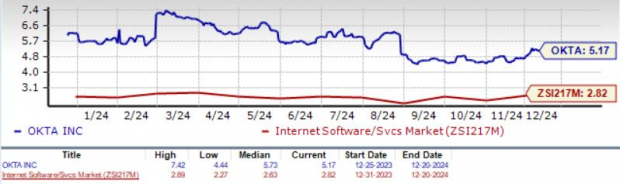

Valuation Insights for OKTA

Currently, Okta shares are trading at a premium, indicated by a Value Score of F.

The forward 12-month Price/Sales (P/S) ratio for OKTA is at 5.17X, notably higher than the Zacks Internet Software Services industry’s ratio of 2.82X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

In Summary

With strong growth potential and a large market to tap into, Okta represents an interesting investment opportunity at this time.

Okta holds a Zacks Rank #2 (Buy) and a Growth Score of A, representing a favorable combination for investors. For those interested, you can view the complete list of Zacks #1 Rank (Strong Buy) stocks.

Zacks Unveils Top 10 Stocks for 2025

Curious about our 10 prime picks for 2025?

Historical performance suggests they could excel.

Since 2012, the Zacks Top 10 Stocks have impressively gained +2,112.6%, more than quadrupling the S&P 500’s +475.6%. Now, our Director of Research, Sheraz Mian, is reviewing 4,400 companies to select 10 outstanding stocks to buy and hold in 2025. Be among the first to get in on these stocks, available January 2.

Want the latest recommendations from Zacks Investment Research? You can download 5 Stocks Set to Double to access this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

Okta, Inc. (OKTA): Free Stock Analysis Report

For the original article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.