Okta Sees Significant Growth Driven by Strong Demand for Identity Solutions

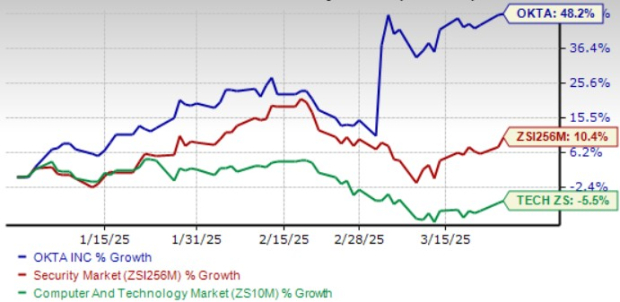

Okta (OKTA) shares have increased by 48.2% year to date (YTD), primarily due to the company’s robust product offering. Notably, more than 20% of bookings for the fourth quarter of fiscal 2025 came from new products such as Okta Identity Governance, Privileged Access, Device Access, Fine Grain Authorization, Identity Security Posture Management, and Identity Threat Protection powered by Okta AI.

Impressive Customer Growth and Financial Metrics

The strength of OKTA’s portfolio is reflected in its ability to attract new clients, leading to a healthy growth rate. At the end of the fourth quarter of fiscal 2025, Okta reported having 19,650 customers and $4.215 billion in remaining performance obligations, indicating strong prospects for subscription revenue. The number of customers with over $100 thousand in Annual Contract Value (ACV) increased by 7% year-over-year, reaching 4,800.

The Total Contract Value (TCV) from the top 25 deals in the fourth quarter exceeded $320 million, and Okta added an additional 25 customers contributing more than $1 million in ACV during the quarter.

Okta’s Stock Performance

Image Source: Zacks Investment Research

Rising Demand for Identity Solutions

Okta’s offerings, including Okta AI—a suite of advanced, AI-driven capabilities—enable organizations to create improved user experiences while enhancing protection against cyber threats. The Okta Platform and Auth0 Platform function efficiently across public clouds, on-premises systems, and hybrid environments.

Utilizing Okta Workforce Identity, businesses can secure and manage their employees, contractors, and partners. The Customer Identity solution allows organizations to enable and oversee the identities of their customers. Additional key offerings within Okta’s platform include Identity Governance, Privileged Access, Device Access, Identity Security Posture Management, and Identity Threat Protection with Okta AI. Specifically, Okta Identity Governance has gained traction with over 1,300 customers and $100 million in ACV.

The company is capturing market share in cybersecurity against major players like Microsoft (MSFT), International Business Machines (IBM), and CyberArk (CYBR). Furthermore, Gartner’s reports indicate that OKTA is rated higher than its competitors in all use cases for Access Management. Notably, OKTA has received recognition as a Gartner Peer Insights Customers’ Choice for Access Management for six consecutive years.

Strong Partnerships Enhance Okta’s Future

Okta’s diverse and expansive partner ecosystem includes major firms such as Amazon Web Services (AWS), CrowdStrike, Google, LexisNexis Risk Solutions, Microsoft, Netskope, Palo Alto Networks, Plaid, Proofpoint, Salesforce, ServiceNow, VMware, Workday, Yubico, and Zscaler. The company has achieved over 7,000 integrations with various cloud, mobile, and web applications, as well as IT infrastructure providers as of January 31, 2025.

In the fourth quarter of fiscal 2025, OKTA surpassed $1 billion in aggregate TCV through its collaboration with AWS. Revenue generated from the AWS marketplace surged by over 80% in fiscal 2025.

Outlook for Q1 and Fiscal Year 2026

Looking ahead to the first quarter of fiscal 2026, Okta anticipates revenues between $678 million and $680 million, demonstrating a year-over-year growth of 10%. The company expects a non-GAAP operating margin of around 25% and non-GAAP earnings ranging from 76 cents to 77 cents per share.

For the entirety of fiscal 2026, OKTA forecasts revenues between $2.85 billion and $2.86 billion, signifying a growth rate of 9-10% compared to the previous fiscal year. Similar to the first quarter, a non-GAAP operating margin of 25% is projected, with non-GAAP earnings estimates between $3.15 and $3.20 per share.

Additionally, the company expects a free cash flow margin of 26% for fiscal 2026.

Positive Trends in Earnings Estimates

Over the past 30 days, the Zacks Consensus Estimate for Okta’s fiscal 2026 earnings has risen by 8.6% to $3.16 per share, reflecting a growth of 12.46% from the earnings reported in fiscal 2025. Meanwhile, the first-quarter fiscal 2026 Zacks Consensus Estimate for OKTA’s earnings has increased by 10.1% to 76 cents per share, indicating year-over-year growth of 16.92%.

Furthermore, Okta has surpassed the Zacks Consensus Estimate for a consecutive four quarters, with an average earnings surprise of 15.7%.

Okta, Inc. Price and Consensus

Okta, Inc. price-consensus-chart | Okta, Inc. Quote

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Why Okta Stock is a Buy

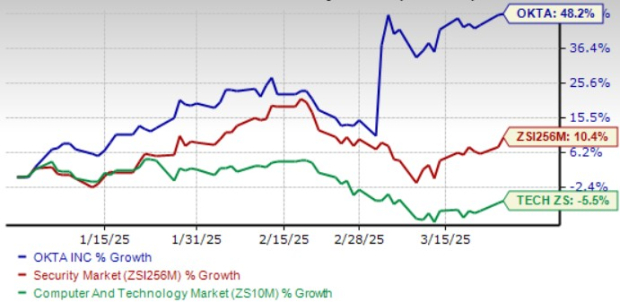

Given its growth potential and expansive market, Okta presents an appealing investment opportunity, reflected by its current premium valuation, as indicated by a Value Score of F. On the forward Price/Sales ratio, OKTA trades at 7X, compared to the broader sector’s 5.88X, showcasing a notable premium.

Price/Sales F12M

Image Source: Zacks Investment Research

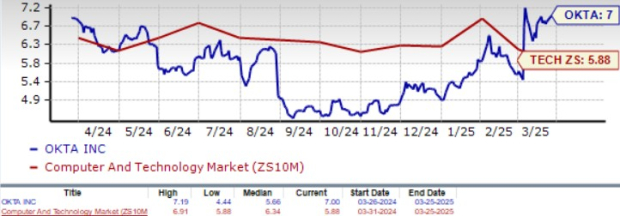

The stock is currently trading above its 50-day and 200-day moving averages, suggesting a bullish trend.

OKTA Stock Trades Above Key Moving Averages

Image Source: Zacks Investment Research

Currently, Okta holds a Zacks Rank #2 (Buy) and a Growth Score of A, indicating a favorable investment profile, according to Zacks Proprietary methodology. For further insight, you can see the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Zacks Highlights Top Semiconductor Stock

It’s important to note that this highlighted semiconductor stock is considerably smaller than NVIDIA, which has gained over 800% since our recommendation. NVIDIA remains strong, but our new top chip stock offers significant growth potential.

With significant earnings growth and an expanding customer base, this stock is positioned to capitalize on the growing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to increase from $452 billion in 2021 to $803 billion by 2028.

Want to see this stock? Click for free access >>

For the latest recommendations from Zacks Investment Research, download our report on the 7 Best Stocks for the Next 30 Days by clicking here.

Microsoft Corporation (MSFT): Free Stock Analysis report

International Business Machines Corporation (IBM): Free Stock Analysis report

CyberArk Software Ltd. (CYBR): Free Stock Analysis report

Okta, Inc. (OKTA): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.