Palantir Technologies: Is This AI Stock Still Worth Your Investment in 2025?

Palantir (NASDAQ: PLTR) has quickly emerged as a top artificial intelligence (AI) stock pick for many investors. The stock has more than quadrupled in 2024 and has a huge following.

But with all that success comes an obvious question: Is Palantir still a top AI pick for 2025? The author believes the business is primed to succeed in the coming year, but there are also some high expectations baked into the stock price.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Room for Growth in Palantir’s Market

Palantir develops AI software that helps clients access the latest information for decision-making. Initially focused on the government sector, the company has since expanded into the private sector.

A standout product is its Artificial Intelligence Platform (AIP), which enables companies to integrate generative AI models into their workflows. This integration marks a significant advancement in workplace efficiency, potentially reducing errors.

The increasing demand for AIP has led to impressive growth for Palantir, with revenue increasing 30% year over year to $726 million in Q3. Notably, the U.S. commercial sector was the strongest contributor, with revenue soaring 54% to $179 million. Considering that the U.S. commercial customer count stands at 321, there is significant potential for expansion.

If Palantir can expand its U.S. commercial customer base and extend that growth to government and international clients, it may just be starting a substantial upward trend. However, there are important factors to consider.

Is the Stock Overvalued Compared to the Business?

One reason for Palantir’s small U.S. client list is its high software costs. By annualizing the U.S. Q3 revenue and dividing it by the number of customers, we find that revenue per client was $2.23 million. This suggests that most clients are likely spending at least $1 million per year with Palantir.

This price point limits the potential customer base as not every company has the budget. Moreover, businesses with this level of funding may already possess the resources to develop Palantir’s solutions internally. Thus, the expectation that many thousands of businesses will adopt Palantir’s software in the next decade warrants reconsideration.

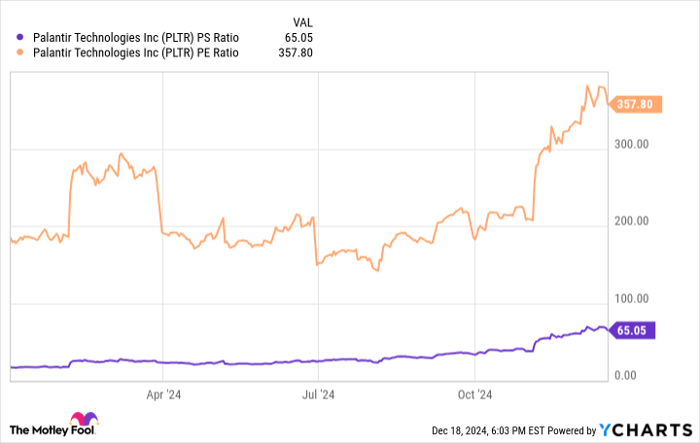

Currently, Palantir’s stock trades at a staggering 65 times sales and 358 times earnings!

PLTR PS Ratio data by YCharts

In contrast, popular AI stock Nvidia (NASDAQ: NVDA) trades at 51 times earnings and 28 times sales, while growing at a significantly faster rate.

To match Nvidia’s current valuation, Palantir would need to achieve substantial growth. Assuming the following:

- 30% profit margin (up from 20%)

- 40% company-wide revenue growth

It would take over four years for Palantir’s stock price to reach the same valuation as Nvidia’s, under these conditions (excluding the effects of stock-based compensation). That implies four years of stagnant stock prices while maintaining higher growth rates.

These projections seem unlikely, especially given the constraints posed by product pricing. Therefore, it may be wise for investors to consider alternative AI stocks for 2025, as others may present more attractive options without excessive expectations factored into their valuations.

Is Investing in Palantir Technologies Smart Right Now?

Before you invest in Palantir Technologies, note this:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks for investors to consider, and Palantir Technologies wasn’t among them. The selected stocks have the potential to generate significant returns in the coming years.

For instance, when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $800,876!*

Stock Advisor offers an easy-to-follow strategy for investors, including portfolio-building guidance, analyst updates, and two new stock picks each month. Since its inception, the Stock Advisor service has delivered over four times the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.