NVIDIA and Palantir: Comparing Shares Amid Market Trends

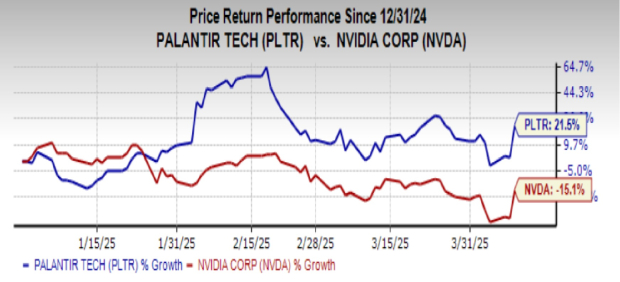

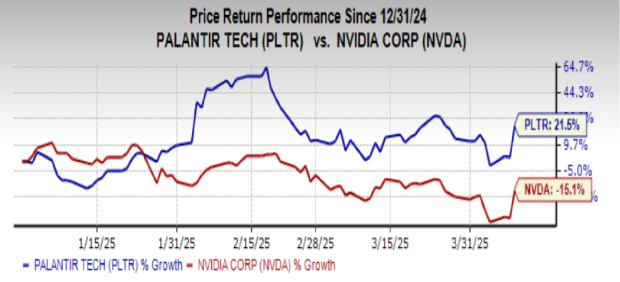

Artificial intelligence (AI) has boosted semiconductor giant NVIDIA Corporation (NVDA) and data-analytics leader Palantir Technologies Inc. (PLTR) to become favorites on Wall Street, with significant fluctuations in their stock prices this year. While NVIDIA has seen a 15.1% decline in shares, Palantir has gained 21.5%. This raises the question: does Palantir possess greater growth potential? Let’s delve into the details.

Image Source: Zacks Investment Research

Factors Supporting NVIDIA’s Future Growth

NVIDIA holds over 80% of the expanding graphics processing unit (GPU) market, which solidifies its competitive advantage. The demand for NVIDIA’s CUDA software platform significantly outpaces that of Advanced Micro Devices, Inc. (AMD) and its ROCm platform. This shift is likely to persist due to the complexities involved with infrastructure transitions.

A strong appetite for both new and older NVIDIA chips continues to drive sales. The latest Blackwell chips, with their enhanced AI interfaces, attract interest from top tech companies, while the older Hopper chips remain popular for their quality over rivals like Intel Corporation (INTC).

Spending on AI data centers is on the rise, further benefiting NVIDIA. Major cloud providers are projected to invest nearly $250 billion in AI infrastructure, significantly increasing their GPU purchases to accommodate the surging demand for AI tasks.

Currently, Microsoft Corporation (MSFT), an important customer of NVIDIA, has slowed down some data center initiatives. However, competitors such as Amazon.com, Inc. (AMZN) and Alphabet Inc. (GOOGL) are stepping up to take the lead, ensuring continued demand for NVIDIA products.

Reasons to Consider Palantir’s Growth Potential

Palantir’s Artificial Intelligence Platform (AIP) has gained traction due to its ability to automate tasks that exceed human capabilities. It assists clients in processing complex data through generative AI, which is proving invaluable in decision-making processes.

Research firms like International Data Corp. and Forrester Research have lauded AIP, contributing to a 43% increase in Palantir’s customer base in the last quarter. Moreover, Palantir’s expansion into private sector markets from its traditional government client base is driving revenue growth.

In the fourth quarter, Palantir’s revenues surged by 36%, and predictions indicate a 31% year-over-year increase for the current fiscal period. The company’s remaining performance obligations also surpassed current growth projections, suggesting substantial future growth.

Can Palantir Surpass NVIDIA? Should You Invest in PLTR Stock?

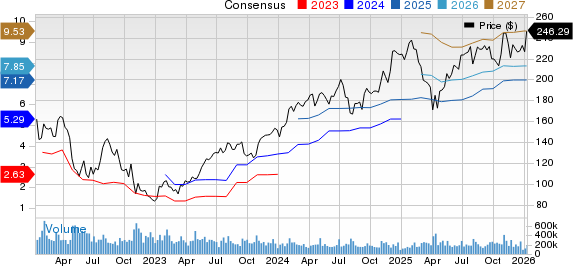

NVIDIA’s dominance in the GPU market, relentless demand for its chips, and the escalating investments in AI infrastructure are likely to support its stock’s long-term upward trajectory.

Additionally, NVIDIA has a price/earnings-to-growth (PEG) ratio of 0.85, indicating the stock is undervalued. Analysts have accordingly raised NVIDIA’s average short-term price target by 82.9%, increasing from $96.30 to $176.15.

Image Source: Zacks Investment Research

Conversely, Palantir faces challenges as its primary customer, the government, is cutting software budgets amidst financial uncertainty. The Trump administration is implementing an 8% annual budget reduction for the next five years, which could hinder Palantir’s expansion prospects.

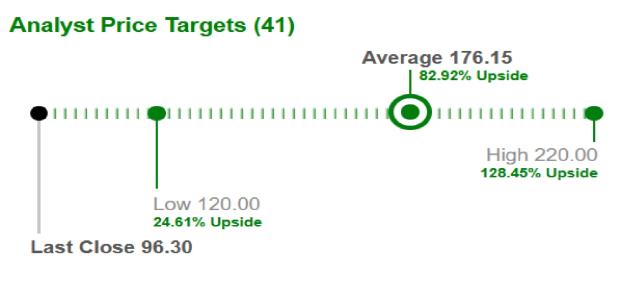

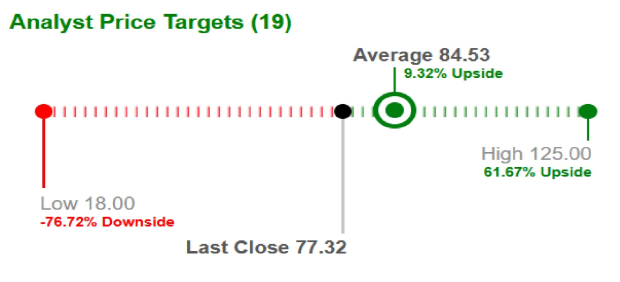

Adding to concerns, Palantir is currently trading at a high forward price-to-earnings (P/E) ratio of 165.49. This valuation is steep given that earnings are projected to grow only 37% by 2025, setting high expectations that may not be met. Analysts are therefore cautious, adjusting Palantir’s average short-term price target up by only 9.3%, moving from $77.32 to $84.53.

Image Source: Zacks Investment Research

Given the current uncertainties, potential investors may want to avoid Palantir stock for the time being. However, existing shareholders could consider holding their investments, as the increase in customer numbers due to AIP signifies positive momentum for the company.

Currently, Palantir holds a Zacks Rank #3 (Hold), while NVIDIA boasts a Zacks Rank #2 (Buy). You can view a complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Experts have just published a list of 7 elite stocks from the current roster of 220 Zacks Rank #1 Strong Buys. They believe these stocks are “Most Likely for Early Price Pops.”

Since 1988, this complete list has outperformed the market more than twice over, with an average annual gain of +23.9%. Investing attention in these seven stocks could prove beneficial.

For the latest recommendations from Zacks Investment Research, you can download the report titled 7 Best Stocks for the Next 30 Days.

For rigorous analysis, follow reports on:

- Amazon.com, Inc. (AMZN)

- Intel Corporation (INTC)

- Advanced Micro Devices, Inc. (AMD)

- Microsoft Corporation (MSFT)

- NVIDIA Corporation (NVDA)

- Alphabet Inc. (GOOGL)

- Palantir Technologies Inc. (PLTR)

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.