PDD’s Recent Performance and Growth Drivers

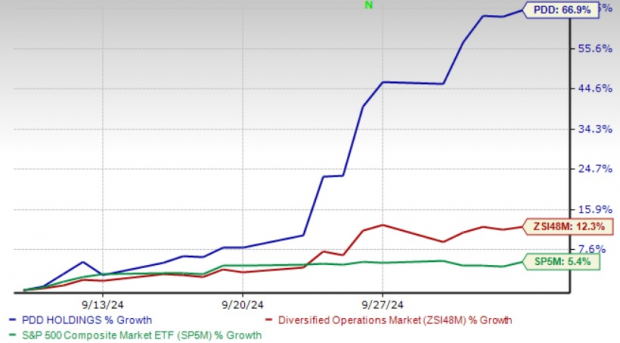

Shares of PDD Holdings surged by an impressive 66.9% in the past month, surpassing industry and S&P 500 returns. The company’s success is attributed to recent stimulus actions by the People’s Bank of China to boost the country’s economy.

PDD shines in e-commerce with its robust Pinduoduo platform, particularly in agriculture. Its innovative approach to digital inclusion for smallholder farmers adds to its appeal.

Evaluation and Promising Opportunities for PDD

PDD Holdings offers a potential opportunity for investors with a forward P/E ratio of 11.94X, lower than industry averages, hinting at promise in the stock.

Pinduoduo’s expanding product range from agriculture to electronics and furniture is fueling its e-commerce growth. The company’s focus on enhancing user engagement, brand partnerships, and supply chain efficiency is commendable.

Concerns and Competition Impacting PDD’s Earnings

While PDD maintains strong momentum, challenges lie in the uncertain economic landscape and competitive pressure from global giants like Amazon, eBay, and Alibaba. This has led to reduced earnings estimates for PDD Holdings.

Geopolitical tensions and market volatility further add to the uncertainties surrounding the stock.

Final Thoughts on PDD

PDD Holdings’ flourishing e-commerce model and agricultural focus present an appealing investment option. However, investors must consider the competitive landscape and macroeconomic challenges before diving in.

For now, maintaining a cautious approach towards PDD stock might be wise, considering the short-term hurdles despite its long-term growth potential.

PDD Holdings currently holds a Zacks Rank #3 (Hold), indicating a mixed sentiment surrounding its future performance.

A Bright Future for Infrastructure Stocks in the U.S.

The upcoming surge in U.S. infrastructure development is set to create vast opportunities for growth and investment. Zacks offers insights into potential stocks poised for significant gains in this arena.

Discover potential investment opportunities. Download Zacks’ Free Report on Profiting from Infrastructure Spending Today.

For more insights and investment recommendations, check out Zacks Investment Research’s latest analysis on top-performing stocks such as Amazon, eBay, Alibaba, and PDD Holdings.