“`html

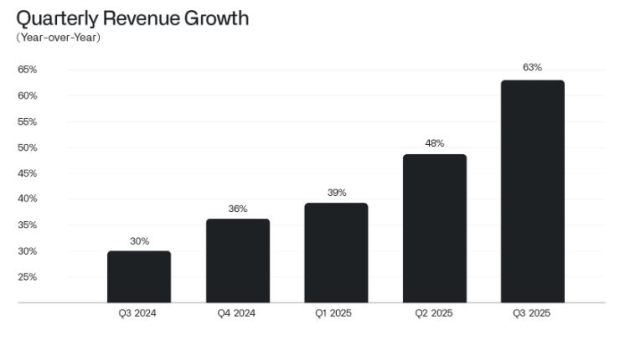

Palantir Technologies Inc. reported third-quarter revenues of $1.18 billion on October 31, 2025, representing a 63% year-over-year and 18% sequential increase. This exceeded the Zacks Consensus Estimate by 8%. The U.S. segment contributed $883 million, accounting for 75% of total revenues. Total contract value bookings reached $2.8 billion, a 151% year-over-year increase, marking the strongest quarter for deal signings.

Palantir achieved an adjusted operating margin of 51%, with GAAP net income of $476 million and earnings per share (EPS) of 18 cents. The company generated $508 million in cash from operations. Looking ahead, it anticipates fourth quarter revenue of $1.329 billion, reflecting 61% year-over-year growth, and has raised full-year revenue guidance to a midpoint of $4.398 billion.

As of the end of Q3, Palantir holds $6.4 billion in cash and equivalents, showcasing strong financial health. Its net dollar retention rate climbed to 134%, while its customer count increased by 45% to 911 clients. Despite record growth, the company’s valuation remains high, prompting a cautious outlook from analysts.

“`