QUALCOMM (QCOM) Faces Challenges While Guarding Its Semiconductor Empire

San Diego, California-based QUALCOMM Incorporated (QCOM) stands out as a leading technology company known for its advancements in wireless and telecommunications. With a market cap of $177.2 billion, Qualcomm plays a vital role in creating semiconductor solutions and communication technologies that impact mobile, automotive, and IoT sectors.

A Large-Cap Stock with a Competitive Edge

Qualcomm is classified as a “large-cap stock,” given its market cap far exceeds the $10 billion threshold. The chip maker capitalizes on its expertise in wireless technology, broad patent portfolio, and a dual revenue model consisting of chip sales and licensing, which helps it stay competitive in a fast-paced industry.

Driving Connectivity in a High-Tech World

Known for its mobile chipsets and leadership in 5G technology, QCOM aids in advancing connectivity for smartphones, IoT devices, automotive systems, and various industrial uses. The company’s extensive global reach and alliances with major tech firms strengthen its foothold in the improving semiconductor and telecommunications sectors.

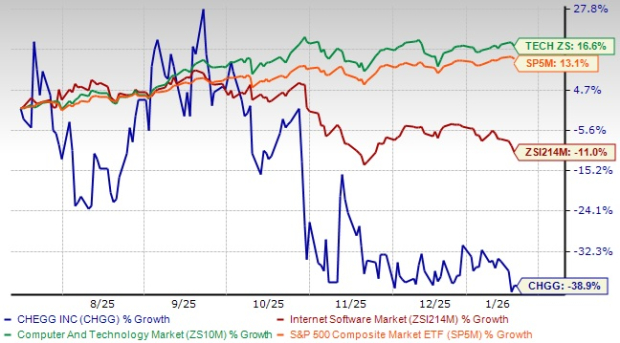

Stock Performance: A Mixed Bag

Despite its strengths, QCOM shares are currently trading 30.8% below their 52-week high of $230.63, reached on June 18. Over the last three months, QCOM stock has seen slight gains, notably trailing behind the Dow Jones Industrial Average’s ($DOWI) 10.7% rise in the same period.

Year-to-date, Qualcomm shares have increased by 10.3%, and there has been a 22.7% gain over the last 52 weeks. For context, the $DOWI has risen by 18.5% in 2024 and 23.8% year-over-year.

Market Signals Indicating Caution

Reflecting a bearish price trend, QCOM has been trading below its 50-day moving average since mid-November and under its 200-day moving average since early November.

On November 29, QCOM shares rose more than 2% after Bloomberg reported that new U.S. restrictions on chip technology sales to China were not as severe as previously expected.

Market Reactions to Diversification Plans

On November 20, QCOM shares fell 6.2% following the announcement to broaden its focus beyond smartphones by 2030 during its IoT and Automotive Diversification Investor Day. This decision made investors uneasy due to concerns over potential short-term revenue impacts, especially with Apple potentially moving away from Qualcomm chips by 2027.

Comparative Performance: Broadcom Outshines

Broadcom Inc. (AVGO), a competitor, has performed impressively, with gains of 98.7% over the last 52 weeks and 60.8% in 2024, highlighting Qualcomm’s recent struggles compared to the competitive landscape.

Analyst Outlook

Analysts maintain a moderate optimism for QCOM’s future, giving the stock a consensus rating of “Moderate Buy” based on insights from 31 analysts. The average price target stands at $207.92, presenting an upside of 30.3% compared to current trading levels.

On the date of publication,

Kritika Sarmah

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are exclusively for informational purposes. For more details, please view the Barchart Disclosure Policy

here.

The views and opinions expressed herein represent those of the author and do not necessarily reflect those of Nasdaq, Inc.