The erratic performance of Brazilian fintech firm StoneCo (NASDAQ: STNE) continues to attract both excitement and skepticism from investors. While the stock has surged by an impressive 75% since the commencement of 2023, it remains a far cry from its peak in early 2021 when it touched the heavens before crashing dramatically.

StoneCo is treading a path of redemption marked by six consecutive quarters of profit as it grapples with past challenges. The fintech’s ascendancy was shackled by credit issues in recent years, leading to a sudden nosedive in its fortunes. Nonetheless, a sense of renewed optimism looms over StoneCo as investors speculate on its potential for a remarkable turnaround.

The Rise of Brazil’s Fintech Star

StoneCo has emerged as a key player in Brazil’s financial technology sector, serving small- and medium-sized enterprises with a wide array of financial services. Boasting a suite of offerings ranging from payment solutions to e-commerce gateways, the company has often drawn striking parallels to Block‘s Square product.

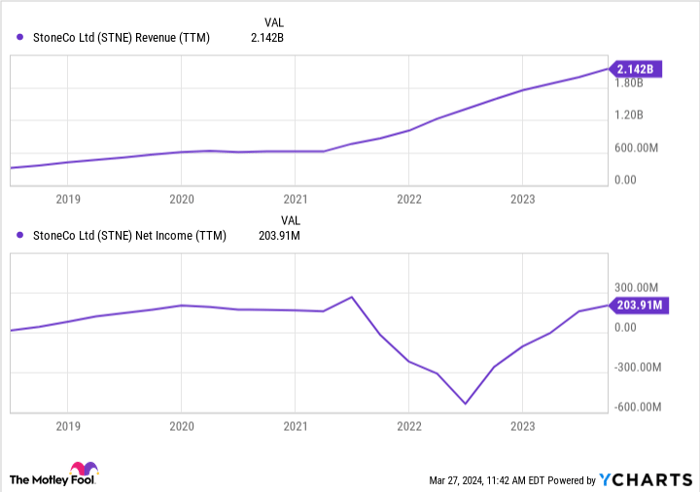

The cornerstone of StoneCo’s revenue streams lies in its electronic payment-processing solutions, which encompass processing transactions from numerous payment methods and earning fees from subscription services. The financial metrics of the company underscore its impressive growth trajectory, with a 28% compound annual growth rate in total payment volume (TPV) over the past four years.

Despite its tumultuous journey, StoneCo has navigated the choppy waters successfully. The company witnessed robust growth in its client base and total payment volume in the previous year, culminating in a transition from a substantial net loss to a commendable net profit.

Riding the Rollercoaster: The Dilemma of Credit Performance

StoneCo’s ambitious foray into lending activities in recent years brought both promise and peril. A rapid expansion in loans backfired amidst challenging economic conditions in Brazil, characterized by high interest rates and a sluggish recovery post-pandemic.

The fintech’s woes were compounded by reliance on flawed data from Brazil’s national registry, leading to massive losses, plummeting stock prices, and a credibility crisis. Undeterred by setbacks, StoneCo has rekindled its credit aspirations with a tempered approach this time, focusing on prudent underwriting and portfolio management.

STNE Revenue (TTM) data by YCharts.

Navigating Risks in the Fintech Landscape

As StoneCo charts a course towards sustained growth, it must confront lingering risks that threaten to undermine its progress. The churn in senior management and a rise in non-performing loans pose formidable challenges that demand vigilant monitoring and strategic intervention.

However, amidst the tempest of uncertainties, StoneCo stands to benefit from the optimistic economic outlook for Brazil in 2024. The favorable macroeconomic landscape, characterized by declining interest rates and robust consumer spending, bodes well for the fintech’s future prospects.

Image source: Getty Images.

Unveiling StoneCo’s Investment Appeal

According to industry projections, Brazil’s digital payments market is slated for significant growth, providing a fertile ground for StoneCo’s expansion. With ambitious targets for transaction value and net income, StoneCo is poised for a dynamic resurgence in the financial landscape.

Despite past setbacks, StoneCo shines as a beacon of revival in the fintech realm. Investors eyeing enduring growth prospects in an emerging market context may find StoneCo an enticing investment option, albeit one that comes with risks characteristic of growth stocks.

Should StoneCo be a part of your portfolio? Only time will reveal the true extent of its potential.

As the investment landscape evolves, StoneCo’s narrative of resilience and growth continues to intrigue market observers. The stage is set for a compelling journey as StoneCo navigates complexities and strives to carve a niche in Brazil’s financial technology ecosystem.

Accompanying StoneCo on this tumultuous yet exhilarating voyage promises insights into both the perils and promises of fintech investment, underscoring the transformative power of strategic resilience in an ever-evolving market scenario.

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Block and StoneCo. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.