Super Micro Computer Faces Significant Stock Decline Amidst Controversies

Super Micro Computer (NASDAQ: SMCI) experienced a severe drop in its stock value during Thursday’s trading, closing down 11%.

Cisco’s AI Market Moves Pressure Supermicro

The decline in Supermicro’s stock was largely influenced by recent announcements from Cisco regarding its entry into the artificial intelligence (AI) server market. This follows a prior decrease of 6.3% after the company disclosed to the Securities and Exchange Commission (SEC) that it could not meet the deadline for its quarterly 10-Q report.

Over the past month, Supermicro’s shares have plummeted by 62%, and year-to-date, they are down 36.5%. Compared to its peak in March, the stock has fallen a staggering 85%.

Is There Value in Supermicro Stock After Sharp Declines?

Initially benefiting from a surge in AI demand at the start of 2024, Supermicro’s stock has now seen a significant decline in valuation. Despite the stock’s drop, its strong sales and earnings growth could suggest it is undervalued when assessed through traditional metrics.

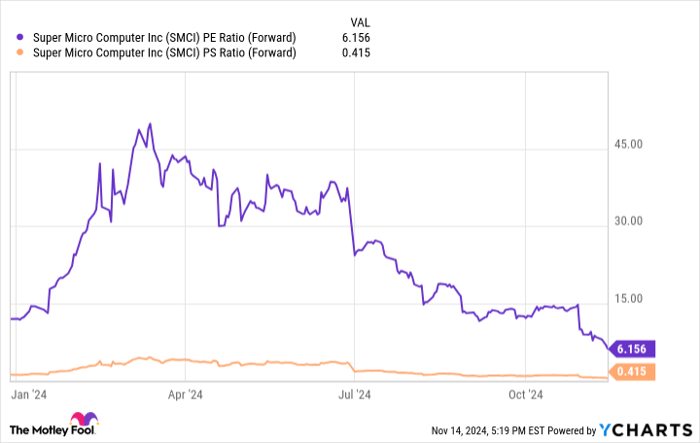

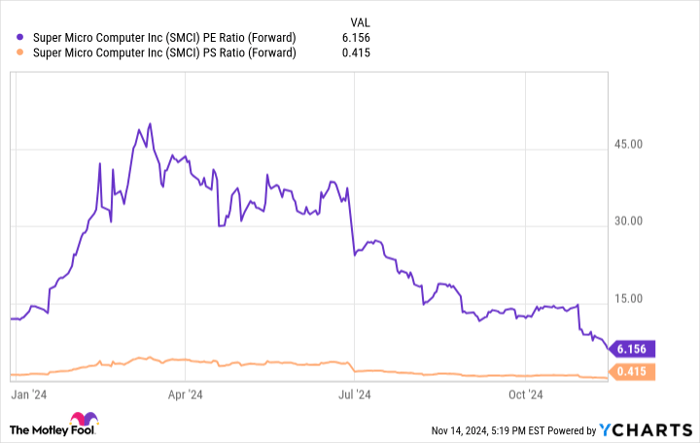

SMCI PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio. PS Ratio = price-to-sales ratio.

Currently trading at under 6.2 times its expected earnings, and less than 42% of its expected sales, Supermicro could seem appealing based on its prior momentum. However, the complexity of the company’s current situation complicates purely numerical evaluations.

The troubles for Supermicro began in August when short-seller Hindenburg Research released a report accusing the company of accounting violations. This was immediately followed by an announcement of a delay in their 10-K report filing as they reviewed their internal controls over financial accounting. The potential for delisting from the Nasdaq loomed over them due to the missed deadline.

In another setback for shareholders, October brought news that Ernst & Young (EY) resigned as the company’s financial auditor, citing issues with management’s representations that undermined their trust in the company’s financial statements.

As of now, Supermicro has yet to file its 10-K report and faces potential delays with its latest 10-Q report. Investigations by the Department of Justice are reportedly underway. Compounding difficulties, there are reports that Nvidia is reallocating GPUs initially intended for Supermicro to other competitors in the market.

Investment Options Remain Uncertain Amid Risks

Given the numerous uncertainties surrounding the company’s situation, including possible delisting and other significant risk factors, investing in Supermicro stock may not be advisable for those looking for volatile opportunities in the AI sector.

Are You Missing Out on Lucrative Stock Opportunities?

Have you ever felt you missed the chance to invest in top-performing stocks? If so, this might be the moment you’re waiting for.

On special occasions, our experienced analysts propose a “Double Down” stock recommendation for companies they believe are poised for significant gains. If you think the chance has passed, now could be a prime opportunity to act before it’s too late. Here’s a look at the returns:

- Amazon: Invested $1,000 when we doubled down in 2010 would be worth $24,113!

- Apple: Invested $1,000 when we doubled down in 2008 would be worth $42,634!

- Netflix: Invested $1,000 when we doubled down in 2004 would now be worth $447,865!

Currently, we are signaling “Double Down” alerts for three promising companies, and opportunities like this could be rare.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cisco Systems and Nvidia. The Motley Fool recommends Nasdaq and has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.