Target’s Q4 Results Share Insights, Stock Drops Amid Cautious Outlook

Target TGT reported solid Q4 results yesterday, but its stock fell 3% due to cautious future guidance from the retail giant.

Despite the drop, Target shares are still valued at a notable discount compared to competitors like Walmart WMT, raising questions for investors about whether this is an ideal time to purchase TGT stock.

Image Source: Zacks Investment Research

Analyzing Target’s Q4 Performance

In Q4, Target achieved sales of $30.91 billion, surpassing estimates of $30.76 billion but declining from $31.91 billion in the same timeframe last year. Comparable store sales rose 1.5%, supported by increased traffic and digital engagement. Notably, Target’s digital comparable sales climbed 8.7% during Q4, with same-day deliveries rising 25%.

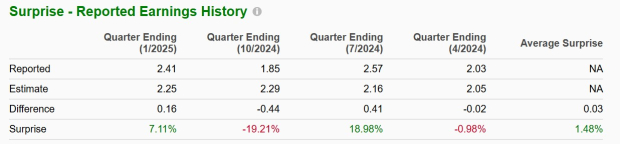

On the earnings front, the Q4 EPS reached $2.41, exceeding expectations of $2.25 by 7%. This contrasts with earnings of $2.94 per share in a more competitive previous quarter. Target has outperformed the Zacks EPS Consensus in two out of its last four quarterly reports, with an average EPS surprise of 1.48%.

Image Source: Zacks Investment Research

Full Year Overview

For fiscal 2025, Target’s total sales experienced a slight decline of approximately 1%, totaling $106.57 billion. The annual earnings also dipped by 1%, reflecting EPS of $8.86 compared to $8.94 in FY24.

Guidance & Future Outlook

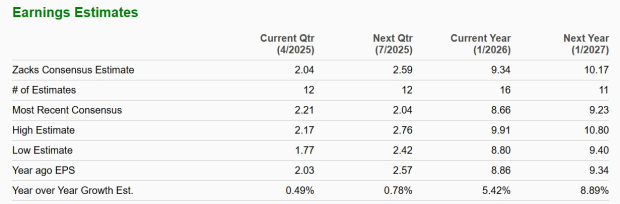

Due to continued consumer uncertainty and tariff implications, Target anticipates significant year-over-year profit pressure in Q1. The company projects full-year EPS for FY26 to fall between $8.80 and $9.80, which slightly diverges from the current Zacks Consensus of $9.34 per share, suggesting a 5% growth outlook. Additionally, Zacks estimates indicate a 9% EPS increase in FY27.

Image Source: Zacks Investment Research

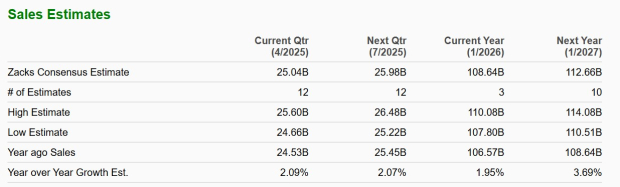

Target forecasts net sales growth of 1% in FY26, slightly below the anticipated projections of $108.64 billion, or nearly 2% growth. Projections from Zacks predict that Target’s sales will increase by over 3% in FY27, aiming for $112.66 billion.

Image Source: Zacks Investment Research

Final Thoughts

Currently holding a Zacks Rank #3 (Hold), Target’s stock could attract long-term investors at approximately $116 per share, reflecting 12.5 times forward earnings compared to Walmart’s 36 times. With promising growth in Target’s online sales, the company may enhance its competitive position against Walmart and capture a share from Amazon AMZN.

However, any potential upside for TGT may hinge on upcoming revisions of earnings estimates in the next few weeks. As it stands, investors might find future buying opportunities, particularly considering Target’s gentle warning of consumer spending pressures linked to current tariff concerns.

Zacks Identifies Top Semiconductor Stock

With a market capitalization just 1/9,000th the size of NVIDIA, which has surged more than 800% since our recommendation, this new leading semiconductor stock has substantial room for growth.

Positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and Internet of Things, this company is set to benefit from a global semiconductor manufacturing market projected to rise from $452 billion in 2021 to $803 billion by 2028.

Explore This Stock Now for Free >>

Target Corporation (TGT): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.