“`html

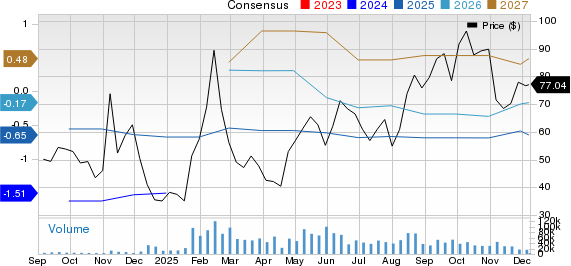

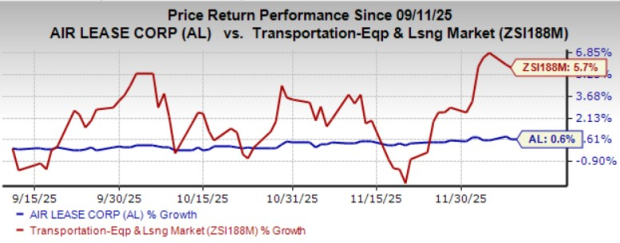

Tempus AI (TEM) has seen significant stock growth in 2025, trading around $77, up 128% year-to-date, with a 6-12 month price target of $82. The stock carries a Zacks Rank #3 (Hold) with an overall VGM score of F, indicating a cautious investment approach is warranted after its recent surge.

Tempus AI has achieved non-GAAP profitability, with positive EPS surprises, but continues to report losses on a GAAP basis due to ongoing investments and accounting adjustments. Key upcoming milestones include management-driven ADLT migrations, FDA submissions for technologies xT and xR, and potential broadening of MRD reimbursement, all of which are critical for expanding revenue and market presence.

The company’s valuation is approximately 12.2 times trailing twelve-month sales, which suggests a premium but reflects its growth potential. Investors should monitor upcoming regulatory timelines and market activities related to competitors like IQVIA (IQV) and Guardant Health (GH) for insights into the healthcare analytics and liquid biopsy sectors.

“`