As investors eagerly anticipate the revealing of corporate performance during earnings season, the spotlight falls on Tesla TSLA, a juggernaut in the electric vehicle (EV) realm and one of the decade’s top-performing stocks.

Let’s delve into how Tesla is faring as it approaches its quarterly release.

Quarterly Expectations

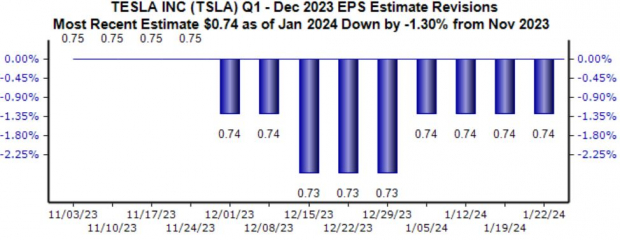

Analysts have tempered expectations for the upcoming quarter, with the estimated earnings per share at $0.74 experiencing a 1.4% downward revision since November of last year. This projection reflects a potential 38% retreat compared to the same period last year.

Image Source: Zacks Investment Research

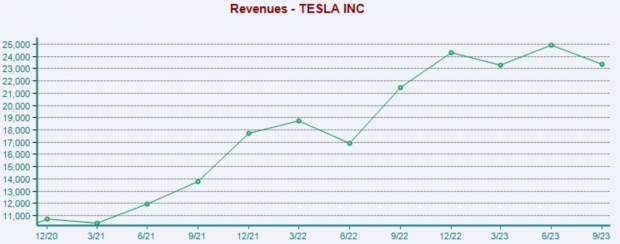

The consensus revenue estimate currently stands at $25.9 billion, showing nearly 7% growth from the year-ago sales of $24.3 billion. Despite a recent slowdown in revenue expansion, Tesla’s growth trajectory is evident.

Image Source: Zacks Investment Research

Moreover, pivotal to Tesla’s performance are its EV production and delivery figures. The company recently disclosed a quarterly record, delivering over 484,000 EVs and manufacturing nearly 495,000 units. Annually, Tesla produced over 1.85 million EVs in 2023 and delivered approximately 1.81 million, surpassing the previously set target of 1.8 million.

Quarterly Performance & Valuation

Following a long streak of positive earnings surprises, Tesla’s latest release fell 8% short of the Zacks Consensus EPS Estimate, leading to a downward stock movement.

Image Source: Zacks Investment Research

Currently, Tesla’s shares are relatively inexpensive, with a forward price-to-sales ratio of 5.7X, significantly lower than the five-year median of 8.2X and the peak of 23.9X in 2021. The stock is presently assigned a Value Style Score of ‘C’.

Image Source: Zacks Investment Research

Bottom Line

As we plunge into earnings season, all eyes are set on Tesla TSLA, scheduled to unveil its results after the market’s closure on Wednesday. There is some pessimism surrounding the release, with the Zacks Consensus EPS Estimate undergoing slight fluctuations in recent months. Additionally, Tesla’s production and delivery figures indicate continued strength, with the company set at a Zacks Rank #2 (Buy) and an Earnings ESP of -1.0%.

Whether Tesla is a buy heading into earnings remains to be seen, but its financial performance and market positioning will undoubtedly command investors’ attention.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.