Tesla Faces Challenges in Affordable EV Plans as Musk Shifts Focus

Tesla (TSLA) CEO Elon Musk has cast doubt on the company’s ambitions to produce an electric vehicle priced around $25,000.

Demand for Affordable EVs

A more affordable electric vehicle has been a top priority for analysts and investors who believe it is essential for Tesla to enhance its sales amid increasing competition from other automakers. Currently, the least expensive Model 3 retails for nearly $40,000, leading many to urge Tesla to introduce a budget-friendly option.

The anticipation for a lower-priced model reached a peak this past spring when Reuters reported that Tesla had scrapped its plans for a $25,000 electric vehicle. This news triggered a drop in the company’s stock, prompting Musk to refute the report on social media.

Shifting Gears: The Robotaxi Vision

Tesla’s recent sales performance presents a need for improvement. In the third quarter of this year, the company delivered 462,890 electric vehicles, falling short of analyst expectations and resulting in a 4% decline in stock value. Compounding these challenges is the growing competition both in the U.S. and in China, the largest automotive market globally.

During a recent discussion with investors, Musk confirmed Tesla’s pivot away from a traditional mass-market vehicle. When asked about the timeline for introducing a $25,000 non-robotaxi model, Musk stated, “We’re not making a non-robo… Basically, I think having a regular $25K model is pointless. It would be silly.”

This statement aligns with Musk’s promotion of Tesla’s self-driving robotaxis as the future of the automotive industry. In October, the company showcased plans for autonomous vehicles during a dedicated event, although reactions from analysts and investors were mixed.

So far in 2023, TSLA stock has risen by 1%.

Analyst Opinions on TSLA Stock

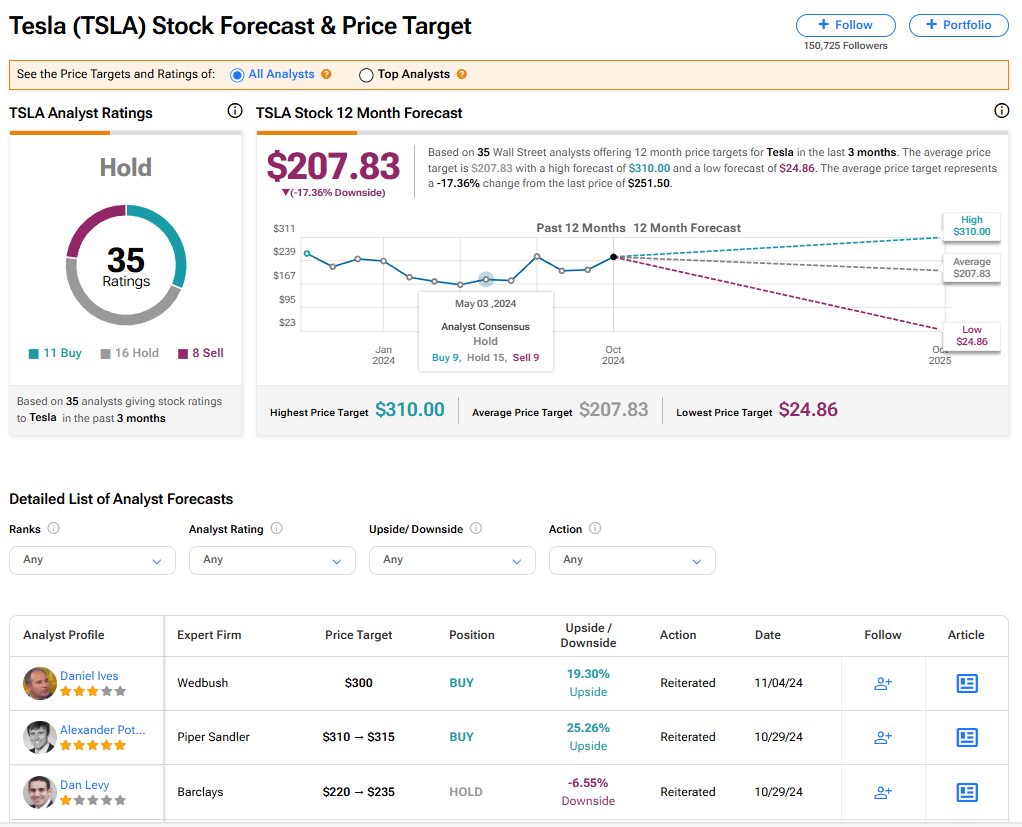

The consensus among 35 Wall Street analysts is a Hold rating for Tesla stock, based on 11 Buy, 16 Hold, and eight Sell ratings issued over the past three months. The average price target for TSLA sits at $207.83, indicating a potential downside risk of 17.36% from its current levels.

Read more analyst ratings on TSLA stock

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.