The Company and The Current Financial Scenario

The renowned diversified manufacturer of home, industrial, and auto-related components, Leggett & Platt, Incorporated (NYSE:LEG), has faced a challenging year, with its value plummeting by 28%, while the S&P 500 has shown returns of +23%.

In just over a week, LEG will confront a significant event, likely to act as a crucial catalyst in deciding the next step for its beleaguered shares. We are referring to the Q4-23 results, to be released on the morning of February 9th, before the market opens.

What To Anticipate from the Q4 Results

Leggett & Platt has exhibited a volatile pattern in meeting headline estimates, which should make investors wary. Over the past 9 quarters, actual EPS figures have exceeded the expected EPS by an average of 4.5%. However, this is largely influenced by the Q1 EPS beat of 50%, with only one meeting and four misses in the remaining 8 quarters.

Regarding the topline, LEG experienced a 9% decline in the first nine months, and a similar trend is expected in Q4, primarily attributed to weak volumes in the furniture, flooring, and textile segment, along with the bedding product segment.

Attention will be on LEG’s cash flow performance in Q4. Historically, this quarter has been the strongest for operating cash generation. However, with sequential declines in accounts receivables throughout 2023, Q4 is unlikely to match the extraordinary performance seen a year ago.

Currently, LEG’s FCF yield is almost twice its 5-year average. However, this is likely to decrease post Q4, with the impending challenge of meeting $300m of debt maturities due in November.

The net debt to EBITDA ratio is on the rise, not due to a growing debt component, but as a result of pressure on the operating front, with LEG’s Adjusted EBITDA base contracting on a sequential and annual basis.

Investors should also look for commentary related to progress on the integration of LEG’s specialty foam and innerspring businesses, expected to drive manufacturing savings and optimize the distribution footprint.

Investor Considerations – Is The Leg Stock Worth Buying?

The upcoming Q4 results may not present numerous positives, yet we observe several merits making LEG a potentially favorable investment proposition.

Firstly, there’s the long-standing dividend narrative. LEG stands as a dividend king, consistently increasing its dividends for 52 straight years. Furthermore, in 33 out of the last 34 years, it has not only covered dividends but also their CAPEX initiatives with ample OCF.

LEG Stock: An Attractive Investment Opportunity

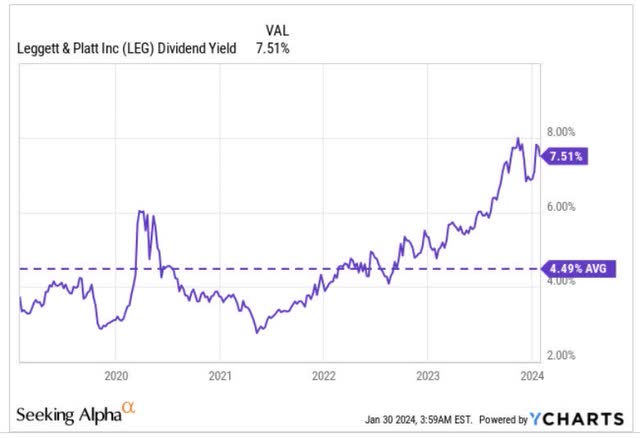

Potential investors can currently secure an enticing yield of 7.5%, a figure that overshadowed the 5-year high and is 300 basis points higher than the average of the last 5 years. This presents an appealing prospect, especially when considering that LEG management’s Target Shareholder Return (TSR) goals only target a 3% yield. Such a wide margin highlights the exceptional value of this offer—opportunities to acquire dividend kings at such compelling yields are conspicuously rare.

Despite LEG’s slowing year-over-year dividend growth trajectory over the past 6 years, predominantly influenced by the expanding base effect, the consistent annual $0.02 dividend elevation warrants recognition.

Furthermore, compared to other high-yielding dividend achievers, Leggett & Platt’s stock appears to be an ideal contender for capitalizing on the mean-reversion theme. Recent metrics indicate that LEG’s relative strength ratio compared to a high-yield dividend achievers’ portfolio currently mirrors levels last observed in 2008, a trend that could potentially stimulate interest in the stock.

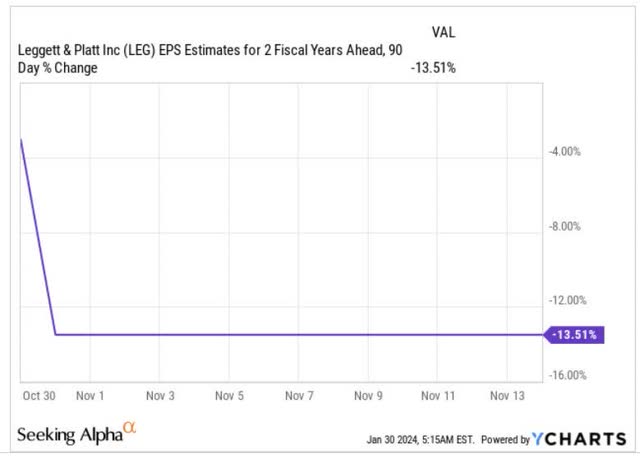

Subsequent to the underwhelming management guidance revealed at the Q3 event in late October, the sell-side community has decreased its FY25 EPS estimates by nearly -14%.

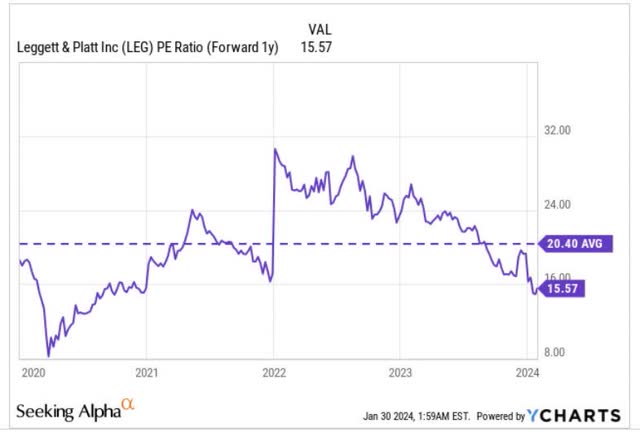

Despite the double-digit reduction in EPS forecasts, typically a factor that would inflate the forward P/E, the share price correction has rendered forward valuations exceedingly attractive. Currently, LEG is available at a 25% discount to the stock’s 5-year average of 20.4x.

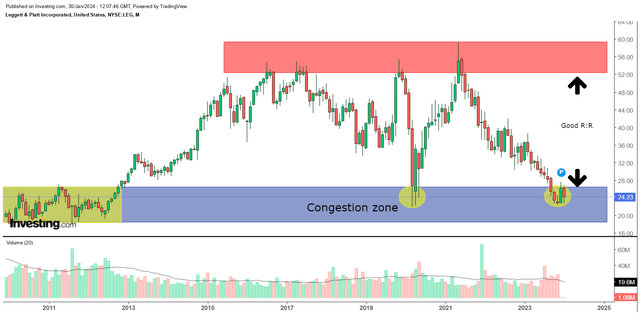

Finally, examining LEG’s long-term charts reveals a promising risk-to-reward ratio. Over the 14-year chart, it is evident that the LEG stock typically reaches its low points within the $18-$26 range and its peaks below the $60 mark. Presently, the LEG stock is trading at levels reminiscent of the lows seen during the pandemic. This range also previously functioned as a consolidation zone for the stock for a 3-year period from 2009-2012, indicating the potential for a resurgence in investor interest at these levels.