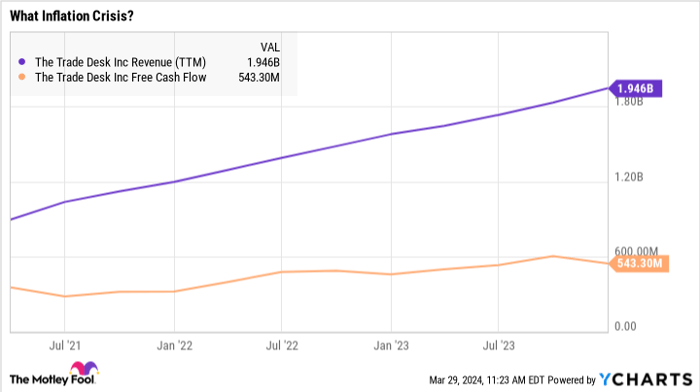

The story of The Trade Desk (NASDAQ: TTD) is one of resilience in the face of adversity. While the digital advertising industry weathered the storm that began with the 2021 inflation scare, The Trade Desk not only survived but emerged stronger, navigating through turbulent waters and coming out ahead.

The Trade Desk’s Success Playbook

Amidst the industry-wide challenges, The Trade Desk managed to achieve robust revenue growth and maintain strong profit margins. Laura Schenkein, the CFO, highlighted the company’s ability to outpace its peers consistently and deliver results even when competitors were struggling.

Through strategic initiatives like tapping into the connected TV (CTV) media, leveraging AI in the Kokai ad-buying platform, and capitalizing on the election cycle and international ad spending, The Trade Desk found growth opportunities in unexpected places.

Unleashing Growth Engines

What sets The Trade Desk apart is its commitment to delivering value and efficiency to advertisers. In a landscape where every advertising dollar counts, the company’s platform offers a promise of optimization and effectiveness, enabling clients to make the most out of their ad spend.

For potential investors eyeing The Trade Desk stock, the company’s proven track record of innovation and adaptability is a beacon of hope. It has shown a remarkable ability to not only survive but thrive in challenging conditions, much like a skilled judo master turning an opponent’s attack into a winning move.

Seizing the Opportunity

As the digital advertising landscape evolves, The Trade Desk’s resilience and growth trajectory make it a compelling investment. While the stock may not come cheap, the company’s stellar execution justifies its premium valuation.

The Trade Desk has consistently surpassed Wall Street’s sales expectations, proving naysayers wrong and showcasing its potential for high-octane growth. It may not be the right choice for every investor, but for those willing to weather some volatility, The Trade Desk offers a tantalizing opportunity for growth.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. The newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed the 10 best stocks for investors to buy right now, with The Trade Desk making the cut alongside other hidden gems.

See the 10 stocks

*Stock Advisor returns as of March 25, 2024

Anders Bylund has positions in The Trade Desk. The Motley Fool has positions in and recommends The Trade Desk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.