When evaluating stocks, investors frequently turn to the recommendations of Wall Street analysts. These brokerage-firm-employed analysts often trigger price movements with their ratings, but how much weight should investors give these rating changes?

Before delving into the reliability of these recommendations and how investors can leverage them to their advantage, it’s essential to understand how Wall Street views The Trade Desk (TTD).

Currently, The Trade Desk boasts an average brokerage recommendation (ABR) of 1.50, falling between Strong Buy and Buy on a scale ranging from 1 to 5. Of the 28 recommendations that contribute to this ABR, 21 are Strong Buy and two are Buy, accounting for 75% and 7.1% of all recommendations, respectively.

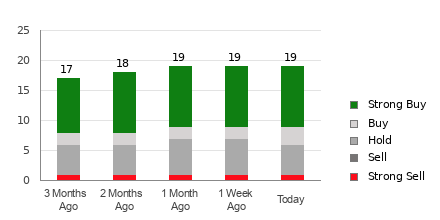

Brokerage Recommendation Trends for TTD

Check price target & stock forecast for The Trade Desk here>>>

While the ABR suggests a favorable stance on The Trade Desk, it’s important for investors to exercise caution. Numerous studies have questioned the efficacy of brokerage recommendations in predicting stock performance as analysts often carry a strong positive bias due to their firms’ vested interests.

So, how should investors use this information? Instead of relying solely on ABR, it could be beneficial to cross-reference with an established indicator, such as the Zacks Rank, which has a strong track record of predicting stock performance.

ABR Should Not Be Confused With Zacks Rank

It’s crucial to differentiate between ABR and Zacks Rank. While both are measured on a scale of 1 to 5, they serve different purposes.

Broker recommendations determine the ABR, typically depicted in decimals (e.g., 1.28). On the other hand, the Zacks Rank is a quantitative model based on earnings estimates revisions, represented by whole numbers from 1 to 5.

Historical data reveals that brokerage analysts tend to be overly optimistic in their recommendations due to their firms’ vested interests, often misleading investors. In contrast, the Zacks Rank is primarily driven by earnings estimate revisions, which have shown strong correlation with stock price movements.

Moreover, the Zacks Rank is constantly updated to reflect the latest earnings estimate revisions, providing timely insights into future price movements.

Is TTD Worth Investing In?

Considering the earnings estimate revisions for The Trade Desk, the Zacks Consensus Estimate for the current year has remained stagnant at $1.26 over the past month.

Steady consensus estimates suggest that The Trade Desk’s performance may align with the broader market in the near term, resulting in a Zacks Rank #3 (Hold). This indicates a potential need for caution despite the Buy-equivalent ABR for The Trade Desk.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Handpicked by Zacks Director of Research, Sheraz Mian, this portfolio has been consistently successful, outperforming the S&P 500. Sheraz has meticulously selected the top 10 stocks for 2024 from a pool of 4,400 companies covered by the Zacks Rank.

Get the latest recommendations from Zacks Investment Research with our free report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.