The Trade Desk Faces Challenges Amid Market Volatility

The Trade Desk (TTD) shares have declined by 18.2% over the last month amid overall market turbulence. Broader indices have been impacted by heightened tariff and trade tensions, particularly between the United States and China. Investors remain cautious as worries about supply chain disruptions, potential inflation, and an impending global recession contribute to a general market downturn. Although President Trump’s recent announcement of a 90-day pause on reciprocal tariffs caused a brief rally, markets fell again the following day.

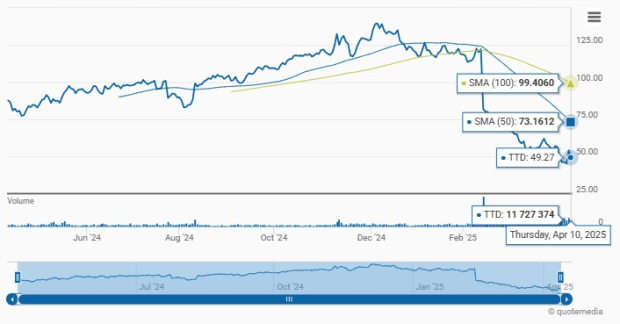

Recent Price Performance

Image Source: Zacks Investment Research

In addition to market conditions, company-specific issues have also hindered TTD’s performance. The company reported weaker-than-expected fourth-quarter 2024 results and is facing slower adoption of its next-generation platform, Kokai, contributing to investor hesitance. TTD has fallen behind the Zacks Computer & Technology sector and the Zacks Internet Services industry’s declines of 8.4% and 8.3%, respectively.

Furthermore, TTD has lagged behind its digital advertising competitors, such as Alphabet (GOOGL) and Amazon (AMZN), whose shares have decreased by 8.4% and 8.9%, respectively, during the same period. This volatility raises uncertainty about TTD’s future direction. It is crucial to weigh the Stock’s strengths and weaknesses to determine if the current dip represents a caution signal or an investment opportunity.

Connected TV: A Primary Growth Driver for TTD

TTD is experiencing positive momentum in digital spending, particularly in Connected TV (CTV) and retail media sectors. In the fourth quarter of 2024, The Trade Desk noted record spending exceeding $12 billion on its platform, reflecting sustained demand from advertisers.

Moreover, TTD has enhanced support for UID2, a privacy-focused identity solution set to replace third-party cookies, allowing for more relevant digital advertising while safeguarding user privacy. Major streaming services, including Disney, Netflix, Paramount, Peacock, Fox, and Max, are heavily investing in programmatic advertising, with many adopting UID2 to improve targeting precision for advertisers. This trend is expected to broaden CTV advertising globally.

UID2 is now operational on significant platforms, such as Spotify Technology (SPOT), SiriusXM/Pandora, and iHeartMedia, in addition to major streaming entities. Through its extended partnership with TTD, Spotify is piloting integrations with OpenPath and UID2 via the Spotify Ad Exchange. This partnership aims to enhance audience targeting and provide better insights into Spotify’s premium ad inventory, likely leading to increased adoption and revenue for TTD.

Additionally, The Trade Desk has launched its Ventura Operating System for CTV, designed to enhance efficiency and transparency in CTV advertising operations. This system enables improved data management, crucial for refining TTD’s targeting capabilities in an expanding CTV market.

Acquisition of Sincera Strengthens TTD’s Digital Advertising Framework

In January 2025, The Trade Desk finalized an agreement to acquire Sincera, a notable digital advertising data company. This acquisition aims to integrate Sincera’s actionable data insights into TTD’s programmatic advertising platform, leading to enhanced ad valuations and improved data quality, which will benefit publishers and advertisers alike.

Positive Unfolding of AI Integration for TTD

The Trade Desk is focused on streamlining its platform to enhance usability without sacrificing complexity, which should improve client onboarding and retention. Concurrently, the company is aggressively incorporating AI technology into all operations to meet the evolving demands of its clients in the current AI landscape.

Challenges Related to Kokai Rollout

While Kokai is anticipated to fully replace the current platform, Solimar, by the end of 2025, TTD is currently operating with two platforms, which complicates processes. Delays in the Kokai rollout could adversely affect TTD’s performance and limit upsell opportunities.

Additional Challenges Facing TTD

Ongoing macroeconomic instability and rising trade tensions pose challenges for TTD, as these factors may constrain advertising budgets. The highly competitive digital advertising sector, dominated by giants like Google and Amazon, places additional pressure on TTD’s market position.

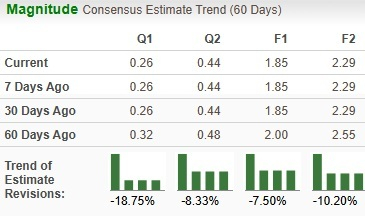

Given these numerous challenges, analysts have adopted a bearish outlook on the Stock, leading to significant downward revisions in earnings estimates.

Image Source: Zacks Investment Research

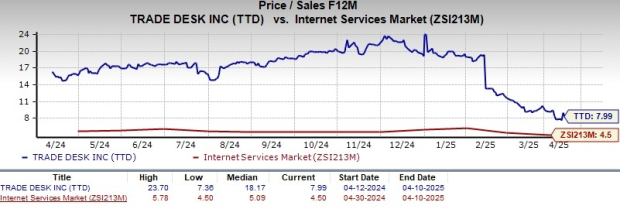

TTD’s Valuation and Market Indicators

From a valuation standpoint, TTD appears relatively expensive. The stock is currently trading at a forward 12-month Price/Sales ratio of 7.99X, substantially above the industry average of 4.5X.

Image Source: Zacks Investment Research

Additionally, TTD is trading below its 50 and 100-day moving averages, suggesting a predominantly bearish sentiment among investors.

Image Source: Zacks Investment Research

Conclusion: Maintain a Hold on TTD Stock

Despite The Trade Desk’s robust portfolio and expanding partnerships, macroeconomic uncertainty continues to pose risks. The fierce competition in the digital advertising landscape, led by dominant players like Google and Amazon, exerts additional pressure on TTD’s market presence. Given the high valuation concerns and various external challenges, maintaining a hold on TTD Stock seems prudent for the time being.

Trade Desk Shares Hold a Zacks Rank Amid Market Variability

The financial climate surrounding The Trade Desk (TTD) indicates a cautious approach, evidenced by its Zacks Rank of #3 (Hold). This ranking suggests that investors may want to wait for a more opportune moment to acquire shares of the company.

For those interested in strategic investments, Zacks also has a complete list of stocks currently holding a #1 Rank (Strong Buy). You can see the list here.

Zacks Identifies Leading Semiconductor Stock

In the semiconductor sector, Zacks highlights a new stock that is significantly smaller than NVIDIA, which has surged over 800% since Zacks’ original recommendation. While NVIDIA remains a strong player, this newly identified stock presents greater potential for growth.

Strong earnings growth coupled with a widening customer base positions this semiconductor stock to meet the soaring demand for technologies like Artificial Intelligence, Machine Learning, and the Internet of Things. Projections show that global semiconductor manufacturing could jump from $452 billion in 2021 to $803 billion by 2028.

For more insights on this promising semiconductor stock, you can see this Stock Now for Free.

If you are looking for the latest investment strategies, Zacks Investment Research is currently offering a downloadable report titled “7 Best Stocks for the Next 30 Days.” To receive your free report, click here.

Included in their free stock analysis reports are detailed assessments on:

- Amazon.com, Inc. (AMZN)

- Alphabet Inc. (GOOGL)

- The Trade Desk (TTD)

- Spotify Technology (SPOT)

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.