Unlocking the Future: The Dawn of the AI Revolution

While the race for revolutionary AI continues, a groundbreaking application may soon captivate the world…

Tim Berners-Lee changed the world in 1990 when he created the World Wide Web. Yet, the internet’s real “Day One” came five years later when Amazon.com Inc. (AMZN) completed its inaugural online sale, solidifying its place in the global marketplace.

Similarly, even though the first BlackBerry Ltd. (BB) smartphone was introduced in 1999, its true impact was felt in 2007 with Steve Jobs’s game-changing iPhone reveal, marking a new technological era.

Now, as we look toward 2025, another pivotal moment is on the brink, poised to usher in the most profound societal changes in history.

We’re calling this moment “AI Day One.”

I view the AI Revolution as unfolding in two key waves.

The first wave is the buildout phase, also known as the AI Builder boom. In this stage, companies dedicated to AI are investing billions in new data centers, AI chips, fabrication plants, and more. The stocks related to these AI Builders have seen impressive performance.

Following this is the application phase, referred to as the AI Applier boom, where companies pour resources into developing and deploying new AI applications leveraging the established infrastructure. The stocks of these AI Appliers are positioned to see significant growth.

It is only a matter of time before a “killer app” captures the world’s attention and propels these AI Applier stocks to new heights.

In this letter, I will explore what that “killer app” could be and how to position yourself now to benefit.

First, let’s examine the dynamics of the ongoing AI Revolution…

The Contrarian View on the AI Boom

The AI Builder boom originated in the 18 months following the launch of ChatGPT in late 2022.

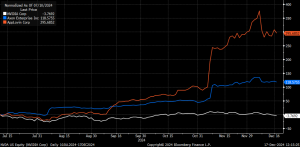

During this period, stocks from AI Builders such as Nvidia Corp. (NVDA) and Super Micro Computer Inc. (SMCI) significantly outperformed those of AI Appliers between late 2022 and summer 2024.

A recent shift has made clear that we are now in the revolution’s second wave. Since July 2024, leading AI Builder stocks such as Nvidia have faced challenges, while AI Applier stocks like Axon Enterprise Inc. (AXON) and AppLovin Corp. (APP) have surged ahead.

With this shift, AI Appliers have claimed the lead.

My premium members have greatly profited from this transition.

We anticipated the rise of the AI Applier boom and acquired stocks like AXON and APP long before their recent gains.

In one of my research services, we even recommended taking partial profits on AXON, which has increased over 350%. Likewise, APP stock is also up more than 350% since our recommendation.

However, we haven’t turned our backs on AI Builder stocks.

On the contrary, we expect AI Builders to experience a significant rebound.

Concerns about a slowdown in AI infrastructure spending have influenced recent performance, but those worries are misplaced.

Just this week…

- The world’s largest tech investor, Masayoshi Son of SoftBank Group Corp. (SFTBY), announced a $100 billion investment plan for the U.S. over the next four years, with a substantial portion directed toward AI infrastructure.

- Amazon is investing another $10 billion to expand its data center operations in Ohio.

- Meta Platforms Inc. (META) unveiled plans to construct its largest AI data center, costing $10 billion, in Louisiana. Nearby in Tennessee, Elon Musk’s xAI startup is developing a multibillion-dollar AI-focused supercomputer.

In fact, the AI infrastructure boom in the U.S. is accelerating, presenting a strong opportunity to invest in previously underperforming AI Builder stocks. As the market realizes the AI Builder boom remains robust, these stocks are likely to rebound significantly.

Our screening identified several high-potential AI stocks that have recently lagged.

Micron Technology Inc. (MU) has increased by nearly 30% in 2024 but has seen a 30% dip in the last six months.

Qualcomm Inc. (QCOM) has also fallen about 30% during that period.

Arm Holdings plc (ARM) is up almost 90% this year but has dropped about 20% in the last six months.

Nvidia and Texas Instruments Inc. (TXN) remain on my watchlist.

Investors should seriously consider these stocks for an AI Builder recovery in early 2025.

However, smart investors won’t stop there.

The AI Applier boom is still just beginning…

The New Wave of AI Is Upon Us

With less than 1,000 days remaining, we are about to experience a monumental transformation in the global economy that may outshine the internet boom.

We have named this moment “AI Day One.”

This isn’t merely another tech trend; it represents a fundamental change that could lead to significant wealth for those who recognize it early, while many are left behind.

Imagine having the foresight to pinpoint which companies will dominate the AI landscape before mainstream investors take notice.

Thanks to my InvestorPlace colleagues and myself, we have identified a unique set of “new wave” AI Applier stocks that are primed for remarkable growth in the upcoming months. These stocks are not the typical tech giants; they represent the hidden treasures of our AI-driven future.

Recently, we hosted a special free broadcast where we explored the implications of “AI Day One” and outlined how and why we selected the “new wave” AI Applier stocks for our latest portfolio.

Don’t miss out on participating in one of the greatest wealth shifts in contemporary history.

Learn how to get ahead and position yourself today, before it’s too late…

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. Stay informed with Luke’s latest market insights by checking our Daily Notes! Visit the latest updates on your Innovation Investor or Early Stage Investor subscription site.