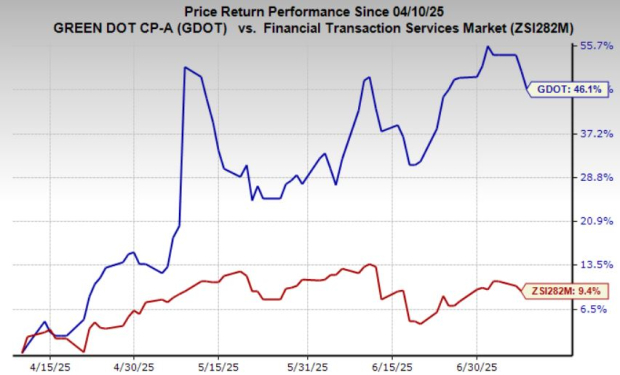

Green Dot Corporation (GDOT) has seen a 46% increase in its stock price over the past three months, outperforming the industry average growth of 9%. The company’s strong performance comes after a challenging year, as it aims to leverage partnerships with major corporations like Walmart, Uber, and Apple to drive growth.

As of Q1 2025, Green Dot reported $1.8 billion in cash and generated $108.7 million in operating cash flow, while maintaining minimal debt. However, the company has never paid dividends, prioritizing reinvestment for growth, which may deter income-focused investors. Analysts project a decline in earnings per share (EPS) of 11% year-over-year for 2025, raising concerns about the company’s vulnerability to economic downturns.

Despite its recent rally, analysts recommend a “Hold” rating on GDOT stock. With ongoing macroeconomic uncertainties and declining earnings projections, investors may benefit from a cautious approach until clearer indicators of financial recovery emerge.