Serve Robotics Partners with Uber and Nvidia for Future of Autonomous Deliveries

Serve Robotics (NASDAQ: SERV), a leader in autonomous last-mile logistics, is preparing for a major rollout with Uber Technologies‘ (NYSE: UBER) Uber Eats delivery platform. In 2025, thousands of their self-driving robots will be deployed in cities across the U.S.

These robots utilize advanced technology from Nvidia (NASDAQ: NVDA), a renowned provider of chips essential for artificial intelligence development.

Start Your Mornings Smarter! Wake up with Breakfast News in your inbox every market day. Sign Up For Free »

Uber and Nvidia are not just partners but also major shareholders in Serve. Currently valued at approximately $700 million, Serve offers considerable growth potential if it successfully implements its business strategy. Here’s what investors should consider before following Nvidia and Uber into this stock.

Image source: Getty Images.

A $450 Billion Delivery Challenge

In a recent presentation, Serve posed an interesting question: Why do we use large vehicles for small deliveries? They argue that robots and drones are better suited for this purpose, especially as the cost of AI technology decreases.

The company projects that their robots could reduce delivery costs to just $1 per order. Operating at Level 4 autonomy allows these robots to navigate sidewalks independently without human assistance. Since 2022, Serve’s robots have successfully delivered over 50,000 orders from 400 restaurants in Los Angeles, achieving an impressive 99.94% accuracy rate—ten times more reliable than human drivers.

Serve’s new Gen3 robot, equipped with Nvidia’s Jetson Orin platform, is five times more powerful than its predecessor and can significantly cut operating costs. Its improved capabilities include a higher top speed, broader operational range, and longer duration between charges, enhancing its efficiency.

Under its agreement with Uber Eats, Serve plans to deploy 2,000 robots by the end of 2025, expanding its services to other Californian cities and Dallas and Fort Worth in Texas. Success in this venture could mean substantial savings for Uber as they transition from human delivery drivers to robotics. Serve estimates the autonomous last-mile logistics market could be worth $450 billion by 2030.

Navigating Financial Challenges

In the third quarter of 2024, Serve reported revenue of only $221,555—significantly lower than previously expected and representing a 254% growth year-over-year. However, this figure was down from $468,375 in the second quarter.

The drop is attributed to Serve’s partnership with Magna International for the production of the new robots. The agreement included a licensing deal granting Magna a $1.2 million fee for using Serve’s software in other sectors of the robotics industry, which was fully realized in the previous quarter.

Now, Serve is facing severe cash flow challenges, having burned through $25.3 million in the first three quarters of 2024, mainly in research and development. With only $50.9 million in cash remaining, the company risks running out of funds in the next 18 months unless it reduces spending or boosts revenue. To mitigate risks, Serve has initiated an at-the-market equity facility aiming to raise an additional $100 million by issuing new stock—though this will dilute current shareholders.

The Stake of Uber and Nvidia

Founded as an independent company in 2021 following Uber’s acquisition of its parent, Postmates, Serve still enjoys support from Uber, which owns roughly 12% of its shares. Nvidia recognized Serve’s potential in 2022 and currently holds 8.4% of the company.

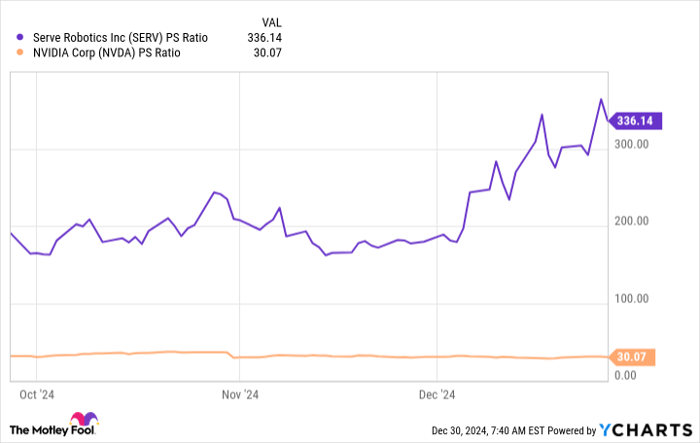

However, prospective investors should carefully evaluate Serve’s valuation. Currently trading at a price-to-sales (P/S) ratio of 336—over 11 times higher than Nvidia’s—this seems significantly inflated given Serve’s minimal revenue.

SERV PS Ratio data by YCharts.

In stark contrast, Nvidia boasts a stable financial history with over $100 billion in annual revenue and unwavering profitability. Therefore, it raises questions as to why Serve’s stock commands such a high valuation.

Market forecasts from Yahoo anticipate Serve’s revenue could climb by 598% to $13.3 million in 2025, contingent on successful deployment of its 2,000 robots. This would lower its forward P/S ratio to 54, which, while more reasonable, still presents a risk of significant stock price correction this year. As a result, investors should only invest money they are willing to lose.

Seize a New Investment Prospect

Have you ever felt like you missed out on investing in successful stocks? It’s time to reconsider.

- Nvidia: if you had invested $1,000 when we doubled down in 2009, you’d have $348,216!*

- Apple: if you had invested $1,000 when we doubled down in 2008, you’d have $47,425!*

- Netflix: if you had invested $1,000 when we doubled down in 2004, you’d have $480,681!*

Right now, our analysts are issuing “Double Down” alerts for three exceptional companies, and these opportunities may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia, Serve Robotics, and Uber Technologies. The Motley Fool recommends Magna International. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.